Add Tables To Legal Kansas Business Sale Forms For Free

How it works

-

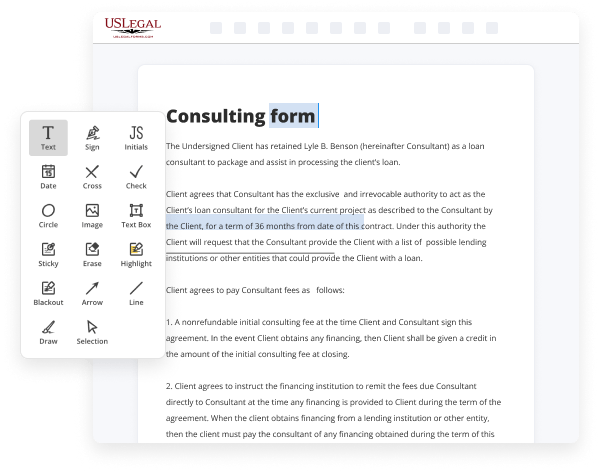

Import your Kansas Business Sale Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Kansas Business Sale Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal Kansas Business Sale Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the easiest way to Add Tables To Legal Kansas Business Sale Forms For Free and make any other essential updates to your forms is by handling them online. Select our quick and reliable online editor to complete, modify, and execute your legal paperwork with maximum effectiveness.

Here are the steps you should take to Add Tables To Legal Kansas Business Sale Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload pane, import it from the cloud, or use an alternative option (extensive PDF catalog, emails, URLs, or direct form requests).

- Provide the required information. Complete empty fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to ensure you’ve completed everything. Accentuate the most important details with the Highlight option and erase or blackout fields with no value.

- Modify and rearrange the form. Use our upper and side toolbars to update your content, drop extra fillable fields for various data types, re-order pages, add new ones, or remove unnecessary ones.

- Sign and request signatures. No matter which method you choose, your electronic signature will be legally binding and court-admissible. Send your form to others for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed paperwork to the cloud in the file format you need, print it out if you require a physical copy, and choose the most suitable file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as fast and more effectively. Try it out now!

Benefits of Editing Kansas Business Sale Forms Online

Top Questions and Answers

Sales tax 101 Kansas first adopted a general state sales tax in 1937, and since that time, the rate has risen to 6.5 percent. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0 percent and 4.1 percent.

Tips to Add Tables To Legal Kansas Business Sale Forms For Free

- Use a word processing program with table functionality such as Microsoft Word or Google Docs.

- Ensure each column in the table corresponds to a specific category or piece of information.

- Label the table clearly with a title that indicates its purpose.

- Format the table for easy readability by adjusting column widths and adding borders.

- Double-check all information in the table for accuracy before finalizing the form.

The editing feature for adding tables to legal Kansas business sale forms may be needed when organizing information in a structured and organized manner is necessary. Tables can help streamline the presentation of data and make it easier for all parties involved to understand the information being communicated.

Related Searches

Common Kansas tax forms and instructions are available at the Kansas ... Publications assist in understanding the provisions of Kansas tax laws and ... 01-Jan-2023 ? Since July 1, 2010, businesses have been required to submit Retailers' Sales Compensating Use and Withholding Tax returns electronically. Create a bill of sale for things you're selling in Kansas. Works well on any desktop, tablet, or mobile device. Share easily. Drag and drop to customize. Series Only: The resident agent and registered office named on the form RL must match identically to the name and address of the resident agent and registered ... This Asset Purchase Agreement (?Agreement?) is made and effective as of the 2nd day of April, 2009 (?Effective Date?) by and between City Juice Systems KS, LLC, ... Service taxability varies extensively by state. This white paper breaks down what services are most commonly taxed and which states tax which types of ... Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. The Missouri Department of Revenue administers Missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, ... The term surcharge refers to an additional charge, fee, or tax that is added to the cost of a good or service beyond the initially quoted price. Use any of the 200+ contract templates in our library to create your own personalized contract in just a few minutes. Save time and money with PandaDoc.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.