Add Tables To Legal New Hampshire Accounting Forms For Free

How it works

-

Import your New Hampshire Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your New Hampshire Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal New Hampshire Accounting Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Add Tables To Legal New Hampshire Accounting Forms For Free and make any other critical changes to your forms is by managing them online. Select our quick and secure online editor to complete, adjust, and execute your legal documentation with highest efficiency.

Here are the steps you should take to Add Tables To Legal New Hampshire Accounting Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

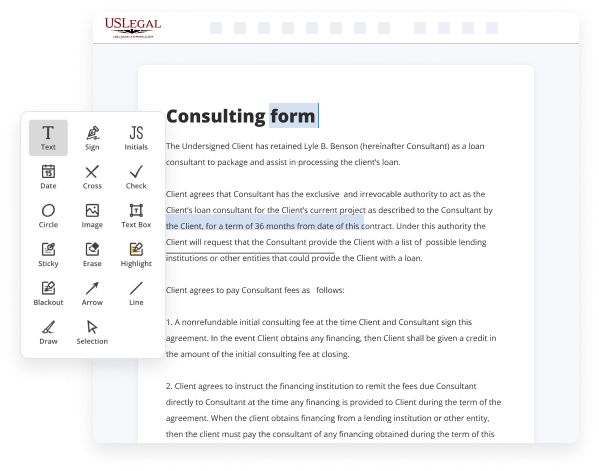

- Provide the required information. Complete empty fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make sure you’ve filled in everything. Accentuate the most important facts with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the form. Use our upper and side toolbars to change your content, place extra fillable fields for various data types, re-order sheets, add new ones, or remove redundant ones.

- Sign and request signatures. No matter which method you select, your electronic signature will be legally binding and court-admissible. Send your form to others for approval through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the format you need, print it out if you require a hard copy, and choose the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as fast and more successfully. Give it a try now!

Benefits of Editing New Hampshire Accounting Forms Online

Top Questions and Answers

Do I have to report distributions from S corporations? Yes, you must report all such distributions, including non-cash distributions, on Page 2, Line 2 of the New Hampshire I&D Tax return. If any part of a distribution is not subject to tax, you would deduct the appropriate amount on Page 2, Line 4.

Video Guide to Add Tables To Legal New Hampshire Accounting Forms For Free

Will be going over IRS form 8822b change of address or responsible party for business before we go through this one page tax form there are a couple of administrative notes that we should go over this tax form is for businesses and other entities with the employer identification number application on file so those businesses or entities we'll use

This form to notify the Internal Revenue Service if you changed your business mailing address your business location or the identity of your responsible party so this form should be filed within 60 days specifically if you are changing your responsible party so the other thing is before we get into this form if you're a tax exempt organization you

Tips to Add Tables To Legal New Hampshire Accounting Forms For Free

- Determine the layout and column headings for the table

- Use a spreadsheet program to create the table if possible

- Identify the specific data you want to include in the table

- Consider the spacing and alignment of the table within the form

- Test the table to ensure it fits the form correctly

The editing feature for adding tables to legal New Hampshire accounting forms may be needed when you need to organize and present financial data in a clear and professional manner. Tables can help summarize complex information and make it easier for others to understand the data you are presenting.

Related Searches

A separate Form NH-1040 must be filed if the spouse operates a different business. ... A separate accounting of the New Hampshire tax basis must be. Combined groups are required to file Form NH-1120-WE . ... A separate accounting of the New Hampshire tax basis must be maintained for depreciation purposes ... A formal bookkeeping system that records all receipts and expenditures in connection with the conduct of games of chance and the disbursement of net proceeds ... Transfers to internally designated funds to support research projects of new faculty members. B. DETAILED OPERATING PROCEDURES. 1. All inter- ... A collection of court forms related to wills, estates, and trusts for use in Probate and Family Court sorted by subject. SNHU offers several types of need and non-need based grants and scholarships to help you meet the cost of a college education. and clicking on Laws Rules and Guidance. ... Only upload documents relevant to the company application. Generally accepted accounting principles, or GAAP, are standards that encompass the details, complexities, and legalities of business and corporate ... GSA Blog Read the latest GSA news, updates and analysis. ... GSA1582, Revocable License for Non-Federal Use of Real Property, Legal and Investigation. GSA. You can find help for your products and accounts, discover FAQs, explore training, ... Choose Actions > Edit Payroll Tax Forms, select the client and the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.