Add Tables To Legal New York Fair Credit Reporting Forms For Free

How it works

-

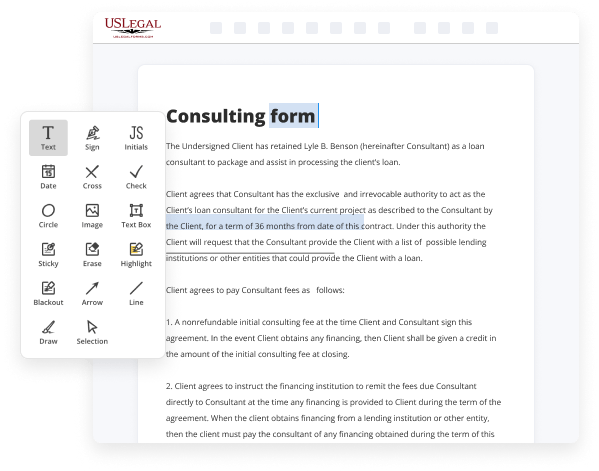

Import your New York Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your New York Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal New York Fair Credit Reporting Forms For Free

Online PDF editors have proved their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Add Tables To Legal New York Fair Credit Reporting Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

Make these simple steps to Add Tables To Legal New York Fair Credit Reporting Forms For Free online:

- Import a file to the editor. You can select from several options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted images, draw lines and symbols, highlight important elements, or erase any pointless ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if required. Use the right-side toolbar for this, place each field where you want other participants to leave their data, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need any longer or create new ones using the appropriate key, rotate them, or change their order.

- Generate eSignatures. Click on the Sign tool and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal documentation in minutes. Give it a try now!

Benefits of Editing New York Fair Credit Reporting Forms Online

Top Questions and Answers

Your Right to a Validation of the Debt After receiving your request, the debt collector must provide you with information about the debt, including the amount owed and to whom it was owed. Collection activities must stop until they provide this information.

Video Guide to Add Tables To Legal New York Fair Credit Reporting Forms For Free

This time we will discuss what is FICO the company FICO Fair Isaac and company was founded in 1956 by engineer bill fair and mathematician earl isaac nowadays it is a public company traded on the New York Stock Exchange FICO is not owned by the US government neither is it owned by any of the three credit bureaus FICO

Is a company that creates scoring models which rates consumers lending risks scores range from 350 all the way up to 850 to higher the better FICO has several scoring models actually there are over 100 FICO scoring model versions FICO 9 is the newest but all of the scoring models are used daily and lending decisions and every scoring

Tips to Add Tables To Legal New York Fair Credit Reporting Forms For Free

- Make sure the tables are relevant to the information being reported

- Include clear and accurate headings for each column in the table

- Use a consistent format for the tables throughout the form

- Ensure the tables are easy to read and understand for all users

- Double-check the accuracy of the data in the tables before submitting the form

The editing feature for adding tables to Legal New York Fair Credit Reporting Forms may be needed when you want to organize detailed information in a clear and structured manner. Tables can help present complex data in a way that is easy to comprehend for the reader.

Related Searches

Here are the steps you should take to Add Tables To Legal Fair Credit Reporting Templates easily and quickly: Upload or import a file to the service. Drag and ... As a public service, the staff of the Federal Trade Commission (FTC) has prepared the following complete text of the Fair. Credit Reporting Act (FCRA), ... The Fair Credit Reporting Act: Model Forms and Disclosures · Finance · Privacy and Security · Credit Reporting. Model forms for risk-based pricing and credit score disclosure exception notices (Appendix H to Part 1022). Download PDF ; Summary of consumer identity theft ... Pursuant to Section 611(e)(5) of the Fair Credit Reporting Act (FCRA), this report summarizes information gathered by the Consumer Financial Protection ... New York State imposes a real estate transfer tax on conveyances of real property or interests therein when the consideration exceeds $500. Using the Federal Reserve System's ?Reporting Central? electronic submission system is easy, secure, confirms receipt of your data, and performs validity checks ... To amend the Fair Credit Reporting Act to provide comprehensive reforms to the consumer credit reporting laws, and for other purposes. Although most negative information stays on your credit report for seven years, there are exceptions you should be aware of. The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers' credit information and access to their credit reports.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.