Add Tables To Legal Texas Accounts Receivables Forms For Free

How it works

-

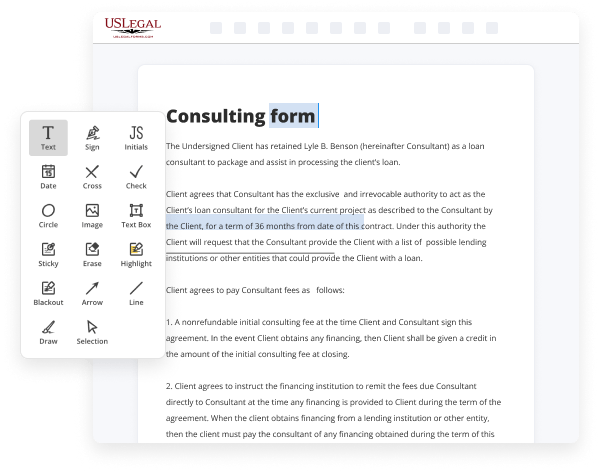

Import your Texas Accounts Receivables Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Texas Accounts Receivables Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal Texas Accounts Receivables Forms For Free

Legal documentation requires highest precision and prompt execution. While printing and completing forms usually takes plenty of time, online PDF editors demonstrate their practicality and effectiveness. Our service is at your disposal if you’re searching for a reputable and simple-to-use tool to Add Tables To Legal Texas Accounts Receivables Forms For Free quickly and securely. Once you try it, you will be surprised how simple working with official paperwork can be.

Follow the instructions below to Add Tables To Legal Texas Accounts Receivables Forms For Free:

- Upload your template via one of the available options - from your device, cloud, or PDF catalog. You can also import it from an email or direct URL or using a request from another person.

- Utilize the top toolbar to fill out your document: start typing in text areas and click on the box fields to select appropriate options.

- Make other required adjustments: insert images, lines, or icons, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, change their order, delete unnecessary ones, add page numbers if missing, etc.

- Drop extra fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if everything is true and sign your paperwork - create a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with other people or send it to them for signature via email, a signing link, SMS, or fax. Request online notarization and obtain your form promptly witnessed.

Imagine doing all of that manually in writing when even one error forces you to reprint and refill all the details from the beginning! With online services like ours, things become considerably easier. Try it now!

Benefits of Editing Texas Accounts Receivables Forms Online

Top Questions and Answers

Do you need to notarize your will in Texas? No ? in Texas, you don't need to notarize your will to make it valid. However, a notary is required if you want to make your will self-proving. When a will is self-proving, the court can accept your will without needing to contact your witnesses to prove its validity.

Video Guide to Add Tables To Legal Texas Accounts Receivables Forms For Free

Hi my name is Jaclyn and I'm going to show you how to file a statement of change of address for your business entity with the Secretary of State's office a statement of change of address should be filed with the Secretary of State if your business changes physical addresses it should be done in a timely manner to keep

Information up to date and to prevent any type of penalties from the state first to begin the process you will want to locate the correct website for your Secretary of State's office for Texas that website is .pevs.com and hover your mouse over it to produce a drop down menu about halfway down you'll see registered agents by selecting

Related Features

Tips to Add Tables To Legal Texas Accounts Receivables Forms For Free

- 1. Use a word processing program like Microsoft Word or Google Docs to create a table.

- 2. Determine the necessary columns and rows for the table based on the information you want to include in the form.

- 3. Input the data into the table, such as client names, invoice numbers, amounts owed, and payment due dates.

- 4. Format the table to make it clear and organized, using borders, shading, and font styles as needed.

- 5. Review the table for accuracy and make any necessary adjustments before finalizing the form.

The editing feature for adding tables to Legal Texas Accounts Receivables Forms may be needed when you want to present financial information, such as outstanding balances and payment histories, in a structured and easy-to-read format. Adding tables can help organize and display this data effectively for both your own records and for presenting to clients or stakeholders.

Related Searches

The following table illustrates four types of transactions that require different recognition of accounts receivable and revenues under the full accrual basis ... Two types of receivables ? taxes receivable and federal receivable ? have significant balances in the Texas ACFR and need separate disclosure of the current ... This report includes weekly status updates on items over 12 months of age and lists invoices that reach 10 months of age. If the payment issue cannot be ... 6.2.3 Adding Transactions to the Taxes Table ... Access the Tax File Revisions form. ... Enter a number that identifies an original document. This document can be a ... FMO Forms. Expand all. Access and Security ... from Texas state sales tax. Operational Accounting ... from Texas state sales tax. Sales and Receivables. Forms, discussion and expert analysis of transactions issues for your Texas trnsactions practice. 03-Sept-2020 ? Accounts receivable are cash amounts that clients owe your company. The goods or services have been delivered and the invoice sent. 20-Jan-2022 ? Some AR dashboards can be customized based on log-in permissions to deliver useful and appropriate data for different roles involved in AR. An ... Accountants use special forms called journals to keep track of their business transactions. A journal is the first place information is entered into the... The Chart of Accounts is the hierarchical numbering system used by Banner to capture financial transactions and facilitate retrieval of information and ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.