Add Tables To Legal Vermont Independent Contractors Forms For Free

How it works

-

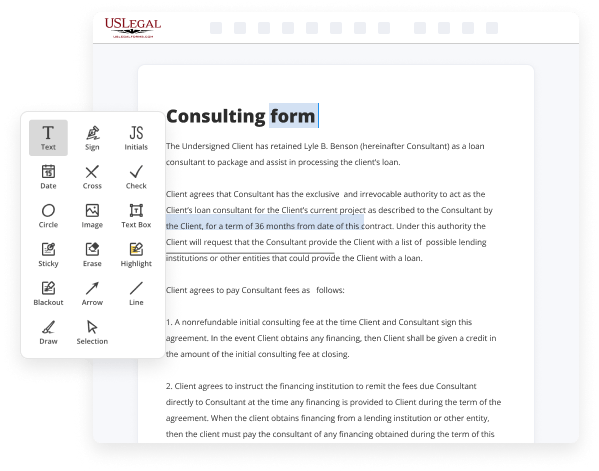

Import your Vermont Independent Contractors Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Vermont Independent Contractors Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal Vermont Independent Contractors Forms For Free

Online document editors have proved their reliability and efficiency for legal paperwork execution. Use our safe, fast, and user-friendly service to Add Tables To Legal Vermont Independent Contractors Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

Make these simple steps to Add Tables To Legal Vermont Independent Contractors Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight important elements, or erase any unnecessary ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if required. Make use of the right-side tool pane for this, drop each field where you expect others to provide their details, and make the rest of the areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones while using appropriate button, rotate them, or alter their order.

- Create electronic signatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Try it now!

Benefits of Editing Vermont Independent Contractors Forms Online

Top Questions and Answers

Answer: Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

Video Guide to Add Tables To Legal Vermont Independent Contractors Forms For Free

An independent contractor agreement is a contract that allows a client to hire a contractor for a particular job the agreement may also be known as a 1099 agreement after the number of the internal revenue service form that an independent contractor will be required to file unlike employees independent contractors do not automatically get taxes deducted from their payment

And must pay them on their own when income taxes come due the collection of taxes is just one of the many significant legal differences between independent contractors and employees in general independent contracting generally offers greater flexibility but less stability over the last decade or so independent contractor positions have grown much more quickly than the workforce at large

Related Features

Tips to Add Tables To Legal Vermont Independent Contractors Forms For Free

- Consider the purpose of the table and what information needs to be included

- Choose a table format that is easy to read and understand

- Use clear headings for each column in the table

- Ensure all information in the table is accurate and up to date

- Proofread the table for errors before finalizing it

The editing feature for adding tables to legal Vermont Independent Contractors Forms may be needed when you want to organize information in a clear and concise manner, especially when dealing with complex contract terms and conditions.

Related Searches

Yes. When hiring a Vermont resident as an employee, you are required to withhold income tax from their wages and to issue a Form W-2 to them at ... Contractors should know and understand the proper application of the Vermont Sales and Use Tax to items they purchase and sell when improving real property. The process by which an individual is classified as either an employee or an independent contractor has been revised and strengthened to reflect the ... 24-Oct-2016 ? There are four main classifications of workers: (1) a volunteer, (2) an independent contractor, (3) a non-employee intern, and (4) an employee. By KR Harned · 2010 · Cited by 40 ? To that end, this article proposes a single-factor legal test for distinguishing between an employee and an independent contractor by ... 07-Jan-2021 ? The U.S. Department of Labor (the Department) is revising its interpretation of independent contractor status under the Fair Labor Standards ... 1) Whether independent contractors (in any form or through any term) are explicitly covered by the state's antidiscrimination law;. Contract Opportunities on SAM.gov Search current federal contract ... GSA1582, Revocable License for Non-Federal Use of Real Property, Legal and ... Our independent contractor payroll services & solutions allow you to easily track contractor payments. This year, make tax time a breeze with QuickBooks. The State of Vermont's Department of Labor (DOL) provides these benefits to ... Workers who are self-employed, independent contractors and ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.