Add Tables To Legal Virginia Financial Statements Forms For Free

How it works

-

Import your Virginia Financial Statements Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Virginia Financial Statements Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Tables To Legal Virginia Financial Statements Forms For Free

Online document editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Add Tables To Legal Virginia Financial Statements Forms For Free your documents whenever you need them, with minimum effort and highest precision.

Make these simple steps to Add Tables To Legal Virginia Financial Statements Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

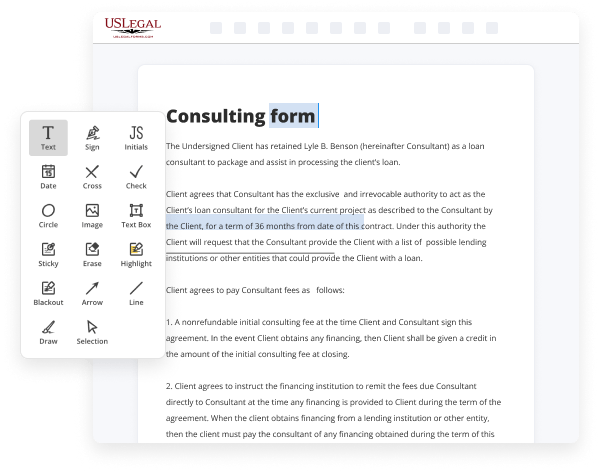

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted images, draw lines and symbols, highlight significant elements, or erase any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you expect others to provide their data, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones using the appropriate key, rotate them, or alter their order.

- Create electronic signatures. Click on the Sign option and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if necessary.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any individual or business legal documentation in minutes. Give it a try today!

Benefits of Editing Virginia Financial Statements Forms Online

Top Questions and Answers

Hear this out loud PauseYou are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

Video Guide to Add Tables To Legal Virginia Financial Statements Forms For Free

Hello and welcome... Hello and welcome back to Accounting Stuff. I'm James and today we're talking financial statements. The income statement, the balance sheet and the cash flow statement. I'm going to try and explain all the basics in under eight minutes which is going to be a challenge because we have a little puppy here who's uh trying to

Bite my finger. So let's get started! What are financial statements? Financial statements are reports that summarize the activities and financial performance of a business. They're prepared at the end of each accounting period and they're designed to give investors and lenders a feel for a business's financial health. The three main financial statements are the balance sheet, the income

Related Features

Tips to Add Tables To Legal Virginia Financial Statements Forms For Free

- Make sure to have all necessary financial information ready before adding tables to legal Virginia financial statements forms.

- Organize the data in a clear and logical manner within the tables to enhance readability.

- Double-check all calculations and figures to ensure accuracy before finalizing the tables.

- Utilize formatting options provided in the form to make the tables visually appealing and easy to understand.

- Consider seeking assistance from a financial professional or accountant if you encounter any difficulties in adding tables to the forms.

The editing feature for adding tables to legal Virginia financial statements forms may be needed when presenting complex financial data such as balance sheets, income statements, or cash flow statements in a structured and organized manner for legal or regulatory purposes.

Related Searches

613. Forms of accounts and records; audit; annual report. A. The accounts and records of the Authority showing the receipt and disbursement of funds ... Registration application; documents to file; interim financial statements. ... Total Costs and Sources of Funds for Establishing New Franchises, Form B;. The following forms can be completed online and printed for submission to the court. The forms available for completion online are those typically completed and ... Format of Forms · Supreme Court of Virginia Forms and applications used by the Supreme Court of Virginia · Court of Appeals Forms used by the Court of Appeals of ... This Annual Report on Form 10-K and other reports, statements, and information that Walmart Inc. (which individually or together with its ... We added more than 65,000 rooms ... the company achieve our record 2022 financial results. ... FORM 10-K TABLE OF CONTENTS. Employers must withhold Maryland income tax for nonresidents using the 1.75% rate. See Withholding Tables for regular and percentage method withholding amounts. You must report all income on your tax return unless excluded by law, whether you received the income electronically or not, and whether you received a Form ... ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ... Table of Contents ... the form of share repurchases in fiscal 2021. Every employer making payment of any wage or salary subject to the West Virginia personal income tax is required to deduct and withhold the tax from such wages ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.