Add Text To Legal Connecticut Sale Of Business Forms For Free

How it works

-

Import your Connecticut Sale Of Business Forms from your device or the cloud, or use other available upload options.

-

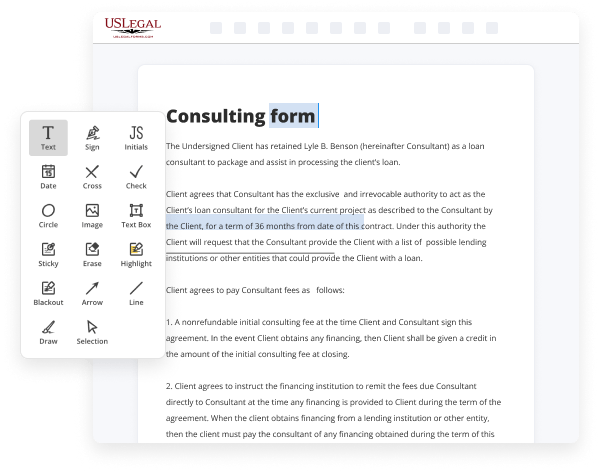

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Sale Of Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Text To Legal Connecticut Sale Of Business Forms For Free

Legal documentation requires greatest precision and prompt execution. While printing and filling forms out usually takes considerable time, online document editors prove their practicality and efficiency. Our service is at your disposal if you’re searching for a reputable and easy-to-use tool to Add Text To Legal Connecticut Sale Of Business Forms For Free rapidly and securely. Once you try it, you will be amazed at how easy dealing with formal paperwork can be.

Follow the guidelines below to Add Text To Legal Connecticut Sale Of Business Forms For Free:

- Upload your template through one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or using a request from another person.

- Use the top toolbar to fill out your document: start typing in text areas and click on the box fields to mark appropriate options.

- Make other essential adjustments: insert pictures, lines, or symbols, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, delete unnecessary ones, add page numbers if missing, etc.

- Add more fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is true and sign your paperwork - generate a legally-binding eSignature the way you prefer and place the current date next to it.

- Click Done once you are ready and choose where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with other people or send it to them for signature through email, a signing link, SMS, or fax. Request online notarization and obtain your form quickly witnessed.

Imagine doing all the above manually in writing when even a single error forces you to reprint and refill all the details from the beginning! With online solutions like ours, things become considerably easier. Try it now!

Benefits of Editing Connecticut Sale Of Business Forms Online

Top Questions and Answers

Connecticut LLC Cost. Connecticut's state fee for LLC formation is $120. Connecticut LLCs also need to file an annual report every year, which costs $80. Depending on your industry and business needs, you might have additional expenses, such as licensing fees, business insurance, and registered agent fees.

Video Guide to Add Text To Legal Connecticut Sale Of Business Forms For Free

If your business product is tangible personal property, which means physical property that you can touch, other than real estate then you must register to collect and remit the Commonwealth’s sales tax in Massachusetts. This would not include “intangible” property like patents, stocks, or copyrights. We recommend that you register with the IRS for a federal identification number. Sales tax

Is due to the state where possession of the product takes place so, in selling to a customer in Massachusetts, you would collect the Massachusetts sales tax from them. If you sell to a customer outside Massachusetts, you do not need to collect the sales tax unless your business has an actual physical presence in that customer's state. The Massachusetts

Tips to Add Text To Legal Connecticut Sale Of Business Forms For Free

- Make sure to read the instructions carefully before adding any text.

- Use a black or blue pen to fill out the form to ensure clarity.

- Fill in all required fields accurately to avoid any delays or issues.

- Double-check your spelling and grammar before finalizing the form.

- Consider seeking legal advice if you are unsure about any section of the form.

Editing feature for Add Text To Legal Connecticut Sale Of Business Forms may be needed when updating contact information, adding new terms or clauses, or making corrections to existing information. It is important to make sure that the information on the form is accurate and up-to-date to avoid any legal complications in the future.

Related Searches

The forms you see here are specific to domestic and foreign LLCs. Several can be filed directly online here at business.ct.gov. For other business forms, ... Here you will find the full suite of services available for your business, many of which you can file online. We've also included PDFs of available forms, ... Save time and effort when completing your legal paperwork. Upload and Add Watermark To Legal Connecticut Sale Of Business Forms with our reliable service, ... Add Watermark To Legal Connecticut Business Sale Forms and other necessary edits to compose your legal documents just the way you need. This disclosure form is required by sellers of previously occupied single family residences and is to be used in conjunction with a contract for the sale of ... The customer may present a Bill of Sale - State Form 44237 or similar ... of title for a vehicle that is not required to be titled under Indiana law. Are registering for sales and use taxes. Other Connecticut Licensing Requirements. The Connecticut Business Helpline can provide you with information about ... A private seller is any person who is not a dealer who sells or offers to sell a used motor vehicle to a consumer. Under Massachusetts law, anyone who sells ... Text for H.R.5376 - 117th Congress (2021-2022): Inflation Reduction Act of ... of internal revenue laws and other financial crimes, to purchase and hire ... Chestnut is not in the trade or business of selling cars, he would not be required to report the receipt of cash exceeding $10,000 from the sale of the car.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.