Add Value Choice Online Fair Debt Credit Templates For Free

How it works

-

Import your Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

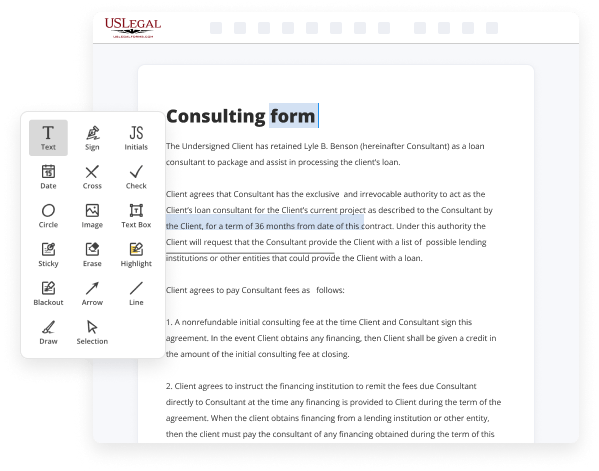

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

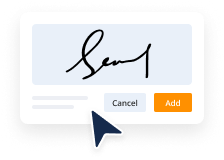

Sign your Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Value Choice Online Fair Debt Credit Templates For Free

Legal documentation requires highest accuracy and prompt execution. While printing and completing forms usually takes plenty of time, online document editors prove their practicality and effectiveness. Our service is at your disposal if you’re looking for a reputable and easy-to-use tool to Add Value Choice Online Fair Debt Credit Templates For Free quickly and securely. Once you try it, you will be amazed at how simple working with official paperwork can be.

Follow the guidelines below to Add Value Choice Online Fair Debt Credit Templates For Free:

- Upload your template via one of the available options - from your device, cloud, or PDF library. You can also obtain it from an email or direct URL or using a request from another person.

- Make use of the upper toolbar to fill out your document: start typing in text areas and click on the box fields to select appropriate options.

- Make other essential modifications: insert pictures, lines, or signs, highlight or remove some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, remove unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is true and sign your paperwork - create a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done when you are ready and choose where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with others or send it to them for approval via email, a signing link, SMS, or fax. Request online notarization and obtain your form quickly witnessed.

Imagine doing all the above manually in writing when even one error forces you to reprint and refill all the details from the beginning! With online solutions like ours, things become much more manageable. Try it now!

Benefits of Editing Fair Debt Credit Forms Online

Top Questions and Answers

One of the most rigorous rules in their favor is the 7-in-7 rule. This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period. Also, they must not contact the individual within seven days after engaging in a phone conversation about a particular debt.

Video Guide to Add Value Choice Online Fair Debt Credit Templates For Free

Hey folks Bill O'Leary here coming to you in this video uh and I'm going to be addressing the question what assets should be kept out of your trust so quick introduction again my name is Bill O'Leary I'm an estate planning attorney and I do elder law in Probate and deal with trust as well and my firm is

Legacy planning Law Group located in Jacksonville Florida so let's talk about a trust and the assets that should be kept out of a trust so what trust is a great way to make things go smoothly and easily to your loved ones when you pass away because they will not be stuck in the court system what we call

Related Searches

Use our Debt Validation Letter Template to ensure you receive all the information you need while disputing a debt. This guide will cover: - Understanding Collections - Understanding your rights - Negotiating Collections - Disputing Collections (with template letters) The CFPB complaint database, credit card plan survey and agreement database are good places to start if you are shopping for a credit card. The questions and answers below pertain to compliance with the Debt Collection Rule. Debt collectors contact one billion consumers every year. The Fair Credit Reporting Act does not require that a furnisher (whether creditor or collection agency) prove the consumer owes the debt. Fair Debt Collection. Chapter 10 FDCPA §§ 1692h, 1692i, 1692j: Applying Payments; Distant Forum Abuse; False Impression of Debt Collector Involvement. Demand letters are essentially a cease and desist letter, formally requesting that the creditor or debt collector stop contacting you. The Fair Credit Reporting Act does not require that a furnisher (whether creditor or collection agency) prove the consumer owes the debt.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.