Add Video To Legal Connecticut Sale Of Business Forms For Free

How it works

-

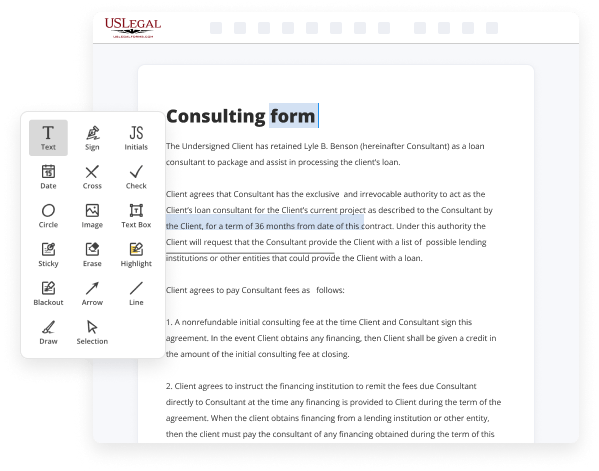

Import your Connecticut Sale Of Business Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Sale Of Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Video To Legal Connecticut Sale Of Business Forms For Free

Legal documentation requires maximum accuracy and timely execution. While printing and filling forms out often takes considerable time, online PDF editors prove their practicality and effectiveness. Our service is at your disposal if you’re searching for a reputable and simple-to-use tool to Add Video To Legal Connecticut Sale Of Business Forms For Free rapidly and securely. Once you try it, you will be surprised how simple dealing with formal paperwork can be.

Follow the instructions below to Add Video To Legal Connecticut Sale Of Business Forms For Free:

- Upload your template through one of the available options - from your device, cloud, or PDF library. You can also import it from an email or direct URL or through a request from another person.

- Utilize the top toolbar to fill out your document: start typing in text fields and click on the box fields to select appropriate options.

- Make other necessary adjustments: insert images, lines, or icons, highlight or remove some details, etc.

- Use our side tools to make page arrangements - insert new sheets, change their order, remove unnecessary ones, add page numbers if missing, etc.

- Add more fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is true and sign your paperwork - generate a legally-binding eSignature in your preferred way and place the current date next to it.

- Click Done once you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with other people or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and obtain your form promptly witnessed.

Imagine doing all the above manually in writing when even one error forces you to reprint and refill all the data from the beginning! With online solutions like ours, things become much more manageable. Give it a try now!

Benefits of Editing Connecticut Sale Of Business Forms Online

Top Questions and Answers

Contents Decide on a name for your business. Assign an agent for service of process (also referred to as the resident agent). Get an Employer Identification Number (EIN) from the IRS. Create an operating agreement. Register with the Department of Revenue Services for the Connecticut Business Entity Tax (BET).

Video Guide to Add Video To Legal Connecticut Sale Of Business Forms For Free

If you are a real estate agent or you're interested in becoming a real estate agent then you have probably heard these two terms title indeed used interchangeably but I'm going to explain today what is the difference in the fact that they are not exactly the same thing I'm Tiffany Weber I'm a real estate attorney in Mooresville North

Carolina at Thomas and Weber let's get right into it all right first we're going to start with title because this is the foundational concept so title refers to ownership your ownership of the property so title is comprised of a lot of different things if you're sitting in a law school property class right now your professor might describe

Tips to Add Video To Legal Connecticut Sale Of Business Forms For Free

- Ensure the video content aligns with the information provided in the forms

- Keep the video concise and informative, highlighting key points

- Use a clear and professional video quality for better presentation

- Include visuals or graphics to enhance understanding

- Provide clear instructions on how to access or view the video

The editing feature for adding a video to Legal Connecticut Sale Of Business Forms may be needed when you want to provide a more interactive and engaging way to convey important information to clients or stakeholders. It can help clarify complex details and make the process more user-friendly.

Related Searches

Here you will find the full suite of services available for your business, many of which you can file online. We've also included PDFs of available forms, ... DRS will mail you a permanent Sales and Use Tax Permit. Permits are valid for two years. You must furnish a general description of your business activities on ... Use Form REG-1, Business Taxes Registration Application, to obtain a Connecticut tax registration number or to register for additional. Expert & error-free preparation and filing of all legal documents and Articles of Incorporation with the state. three people small large group team editors ... CT Corporation is the leader in registered agent, incorporation, corporate business compliance services and offers solutions for managing transactions, ... Thinking about starting a business in Connecticut? Our guide will have your new venture up and running in the Constitution State in 8 steps. Our free online guide for business owners covers Connecticut sales tax registration, collecting, filing, due dates, nexus obligations, and more. Form NumberForm NameCategoryB 105Involuntary Petition Against an IndividualIndividual DebtorsB 106 DeclarationDeclaration About an Individual Debtor's SchedulesIndividual DebtorsB 106A/BSchedule A/B: Property (individuals)Individual Debtors If your corporation reasonably expects to owe more than $1,000 in franchise tax after credits, you must file estimated tax forms (Form CT-400, ... Register your business online with MassTaxConnect to file and pay taxes to the Massachusetts Department of Revenue (DOR).

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.