Add Watermark To Legal Fair Credit Reporting Templates For Free

How it works

-

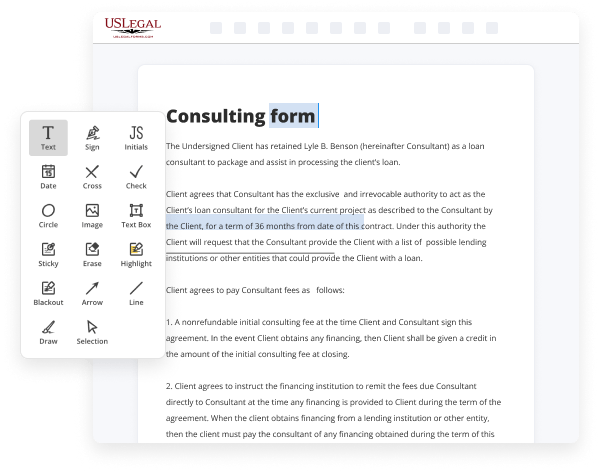

Import your Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Watermark To Legal Fair Credit Reporting Templates For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our secure, fast, and straightforward service to Add Watermark To Legal Fair Credit Reporting Templates For Free your documents whenever you need them, with minimum effort and greatest accuracy.

Make these simple steps to Add Watermark To Legal Fair Credit Reporting Templates For Free online:

- Upload a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted images, draw lines and icons, highlight important parts, or remove any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if neccessary. Use the right-side toolbar for this, drop each field where you want others to leave their details, and make the remaining areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones while using appropriate key, rotate them, or change their order.

- Generate electronic signatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any personal or business legal paperwork in minutes. Try it today!

Benefits of Editing Fair Credit Reporting Forms Online

Top Questions and Answers

The FCRA requires accurate credit reporting The law prohibits credit bureaus from reporting false information on a consumer's credit because doing so can adversely affect their financial health. However, your responsibility as the consumer is to ensure that your file contains up-to-date and accurate information.

Video Guide to Add Watermark To Legal Fair Credit Reporting Templates For Free

Credit guide 360 build better credit what is Fair Credit Reporting Act background check the Fair Credit Reporting Act FC is a US federal law enacted to promote accuracy fairness and privacy in consumer reporting it governs how consumer credit information is collected used and shared when an employer conducts a background check under the FC they must follow specific

Guidelines to ensure compliance first they need to inform the applicant or employee that a background check will be performed this disclosure must be in writing and in a standalone document it cannot be included in an employment application or other paperwork the person must also provide written consent for the background check if the background check includes credit information

Tips to Add Watermark To Legal Fair Credit Reporting Templates For Free

- Use a transparent image or text for the watermark to ensure it does not interfere with the content of the template.

- Place the watermark strategically in a corner or along the edges of the template to avoid covering important information.

- Adjust the opacity of the watermark to make it visible but not distracting from the content.

- Consider using a subtle color for the watermark that complements the overall design of the template.

- Save the template with the watermark as a separate file to preserve the original version without the watermark.

Adding a watermark to legal fair credit reporting templates can help protect the confidentiality and integrity of the information contained in the documents. This editing feature may be needed when sharing sensitive financial information with third parties or uploading documents to online platforms to prevent unauthorized use or distribution.

Related Searches

Sample form to disclose to an applicant or employee that a background check will be conducted as required by the FCRA. A checklist of steps to comply with the federal Fair Credit Reporting Act when conducting employment background checks. This single credit bureau dispute letter has helped delete thousands of negative accounts & increase credit scores. Get your free copy here! Fill Credit Dispute Letter, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ? Instantly. Try Now! This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act ... Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable ... The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, ... Under section 609 of the FCRA, a consumer reporting agency must, ... The Regulatory Flexibility Act (RFA) does not apply to a rulemaking ... The Fair Credit Reporting Act (FCRA), enacted in 1970, sets standards for the collection, communication, and use of information bearing on a ... The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.