Add Watermark To Legal Indiana Accounts Receivables Forms For Free

How it works

-

Import your Indiana Accounts Receivables Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Indiana Accounts Receivables Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Watermark To Legal Indiana Accounts Receivables Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Add Watermark To Legal Indiana Accounts Receivables Forms For Free and make any other essential changes to your forms is by handling them online. Choose our quick and trustworthy online editor to fill out, modify, and execute your legal paperwork with highest productivity.

Here are the steps you should take to Add Watermark To Legal Indiana Accounts Receivables Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

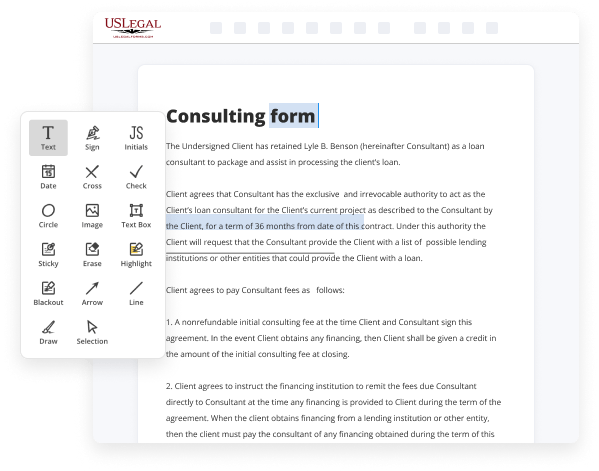

- Provide details you need. Fill out blank fields using the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to ensure you’ve filled in everything. Point out the most significant details with the Highlight option and erase or blackout fields with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to change your content, drop additional fillable fields for various data types, re-order pages, add new ones, or delete unnecessary ones.

- Sign and request signatures. No matter which method you choose, your electronic signature will be legally binding and court-admissible. Send your form to others for approval through email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed paperwork to the cloud in the file format you need, print it out if you prefer a hard copy, and select the most appropriate file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as quickly and more successfully. Give it a try now!

Benefits of Editing Indiana Accounts Receivables Forms Online

Top Questions and Answers

The required addback is the amount of the state income tax deduction claimed on the taxpayer's federal return or the amount by which a taxpayer's total itemized deductions exceed the standard deduction otherwise allowable to the taxpayer, whichever is less.

Video Guide to Add Watermark To Legal Indiana Accounts Receivables Forms For Free

In this video I'll be talking about how to use the dynamic text feature caseguard has available for documents once your project is added into caseguard you can pin the pages panel in order to load pages below you can use the watermark icon to select to add new watermark you're able to give it a name and a short

Description select continue under Source you're able to select the watermark type we'll go ahead and use Dynamic text external input file for this demonstration I'm able to shift the alignment rotation and Scale based on my needs you're able to layer your watermarks by selecting add Watermark choosing a different type of Watermark type this time I'll select Dynamic

Tips to Add Watermark To Legal Indiana Accounts Receivables Forms For Free

- Use a watermark with transparency to avoid obstructing text on the form

- Choose a watermark that is relevant to the content of the form, such as 'Confidential' or 'Draft'

- Place the watermark strategically on the form to prevent tampering or alteration

- Test the appearance of the watermark on the form before finalizing it

- Consider creating a custom watermark for a professional touch

Adding a watermark to legal Indiana accounts receivables forms can help to protect the document's integrity and confidentiality. This editing feature may be needed when sharing sensitive information with external parties or when sending out draft versions of the form for review.

Related Searches

Rate and Form Submission Requirements. Under IC 27-1-3-15, the following fees apply to all rate and form product filings in all classes of business:. Accounting is responsible for accounts payable, fiscal analysis and reporting and coordinates with various staff for records and forms management. Add or replace a watermark, with no document open (Windows only) · Choose Tools > Edit PDF > Watermark > Add. · In the dialog box, click Add Files ... First, create your custom watermark. On the Design tab, select Watermark > Custom Watermark. Choose Picture Watermark and select a picture, or choose Text ... Consent forms, sometimes called release forms, are legal documents that serve as written permission to send or receive information among participating ... Forms Search the database of GSA forms, standard (SF) and optional (OF) ... GSA1582, Revocable License for Non-Federal Use of Real Property, Legal and ... Does Michigan issue tax exempt numbers? If not, how do I claim an exemption from sales or use tax? · Michigan Sales and Use Tax Certificate of Exemption (Form ... Use Dropbox to add photography watermarks and logos to your photos and ... Legal materials: Contracts, financial records, documents requiring eSignature. Understanding your rights to take legal action for non-payment of invoices is an important part of ensuring the viability of your business. The primary letter we use to request information about a return is Form DTF-948 or DTF-948-O, Request for Information (RFI). If your refund ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.