Annotate Legal Connecticut Fair Debt Credit Forms For Free

How it works

-

Import your Connecticut Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Annotate Legal Connecticut Fair Debt Credit Forms For Free

Legal paperwork requires highest accuracy and prompt execution. While printing and filling forms out normally takes plenty of time, online document editors prove their practicality and effectiveness. Our service is at your disposal if you’re looking for a trustworthy and simple-to-use tool to Annotate Legal Connecticut Fair Debt Credit Forms For Free rapidly and securely. Once you try it, you will be surprised how easy dealing with formal paperwork can be.

Follow the guidelines below to Annotate Legal Connecticut Fair Debt Credit Forms For Free:

- Upload your template via one of the available options - from your device, cloud, or PDF catalog. You can also import it from an email or direct URL or using a request from another person.

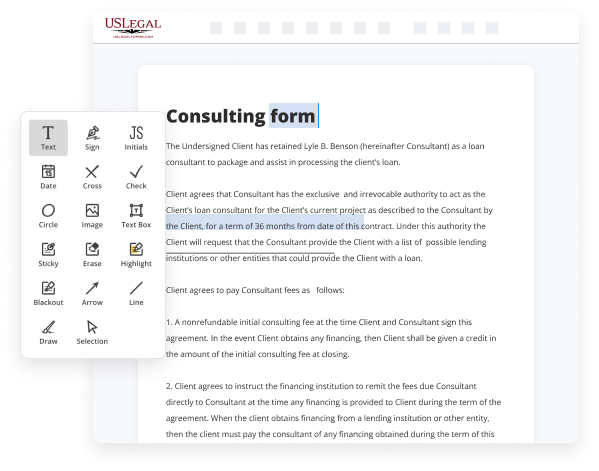

- Make use of the top toolbar to fill out your document: start typing in text fields and click on the box fields to choose appropriate options.

- Make other necessary adjustments: insert images, lines, or symbols, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, change their order, delete unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if all information is true and sign your paperwork - create a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done when you are ready and choose where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with others or send it to them for approval via email, a signing link, SMS, or fax. Request online notarization and get your form rapidly witnessed.

Imagine doing all the above manually in writing when even a single error forces you to reprint and refill all the data from the beginning! With online services like ours, things become much more manageable. Give it a try now!

Benefits of Editing Connecticut Fair Debt Credit Forms Online

Top Questions and Answers

You have the right to send what's referred to as a ?drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

Video Guide to Annotate Legal Connecticut Fair Debt Credit Forms For Free

The Fair Debt Collection Practices back is a federal law we also have a Florida counterpart that's very similar to that called the FCC PA and it protects against harassing creditors that are trying to collect debts using illegal means there's a lot of things they can't do they can't call you before 8:00 a.m. or after 9:00 p.m. they

Can't call you at work after you tell them not to they can't call relatives and discuss the debt with them there's a lot of things they can't do and one of the important virtues of this law is it allows you to hire an attorney where the attorney is actually paid by the other side out of the recovery

Tips to Annotate Legal Connecticut Fair Debt Credit Forms For Free

- Read the entire document carefully before adding annotations.

- Highlight or underline important terms and conditions related to debts.

- Use clear and concise comments to explain any legal jargon or complex sections.

- Cross-reference any related documents that may provide additional context.

- Note any deadlines or important dates that require attention.

- Ensure your annotations do not obscure the original text.

You may need this editing feature for Annotate Legal Connecticut Fair Debt Credit Forms when preparing for a legal dispute or seeking clarification on your rights and obligations.

Related Searches

Connecticut Law About Debt Collection: useful links to research guides, statutes, regulations, and pamphlets concerning debt collection. (1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the ... Abusive debt collection practices contribute to the number of personal bankruptcies, to marital instability, to the loss of jobs, and to ... The primary federal law that governs the conduct of debt collectors is the FDCPA,6 which establishes consumer protections in the debt collection process, ... Regulations. Section 36a-648 - Abusive, harassing, fraudulent, deceptive or misleading debt collection practices. Liability. Exemptions. Limitations on actions. Debt Collection model forms and samples. Download English and translated versions of Debt Collection Rule model form. Editable versions of the forms are ... Specifically, this report examines (1) the protections provided consumers under federal and state laws related to credit card debt collection, ... Redlining is a form of illegal disparate treatment in which a lender provides unequal access to credit, or unequal terms of credit, because of the race, color, ... The Bulletin summarizes CFPB staff's conclusion that, under section 808(1), debt collectors may collect such pay-to-pay fees only if the ... The Fair Debt Collection Practices Act (FDCPA) is a federal law that limits the actions of debt collectors, including how they can contact the debtor.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.