Annotate Legal Delaware Satisfaction Of Mortgage Forms For Free

How it works

-

Import your Delaware Satisfaction Of Mortgage Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Delaware Satisfaction Of Mortgage Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Annotate Legal Delaware Satisfaction Of Mortgage Forms For Free

Online document editors have demonstrated their reliability and effectiveness for legal paperwork execution. Use our secure, fast, and intuitive service to Annotate Legal Delaware Satisfaction Of Mortgage Forms For Free your documents any time you need them, with minimum effort and maximum precision.

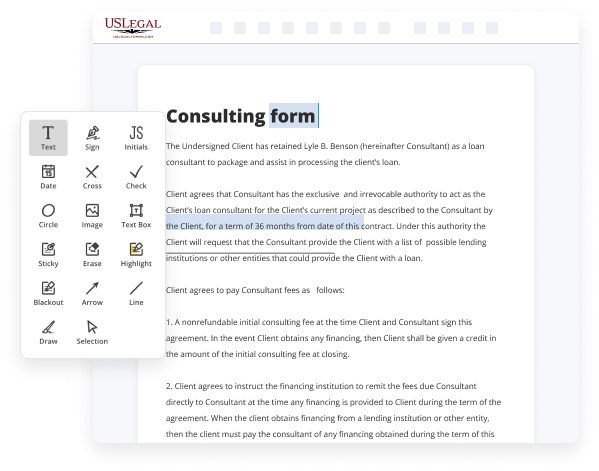

Make these simple steps to Annotate Legal Delaware Satisfaction Of Mortgage Forms For Free online:

- Upload a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and icons, highlight important elements, or remove any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if required. Make use of the right-side toolbar for this, drop each field where you expect others to leave their data, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones utilizing the appropriate button, rotate them, or alter their order.

- Generate electronic signatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal paperwork in clicks. Give it a try now!

Benefits of Editing Delaware Satisfaction Of Mortgage Forms Online

Top Questions and Answers

A promissory note is a documented promise to repay borrowed money. Promissory notes are binding legal documents used to protect both the lender and the borrower. The promissory note is paper evidence of the debt that the borrower has incurred.

Video Guide to Annotate Legal Delaware Satisfaction Of Mortgage Forms For Free

Module two mortgage execution recording requirements documentation and closing procedures buying a home using a mortgage is complex and time-consuming several documents must be executed to effectuate the transfer ranging from financial documents to consumer protection disclosures and contracts this module explains how and when real estate finance documents must be recorded as well as the documentation and closing procedures

Required to support real estate finance agreements mortgage documentation required prior to closing when buying a home the purchaser executes several critical documents at various times in the process understanding the intent and legal function of these documents is critical to effectively navigating the mortgage process the following discussion goes over the standard documents that one can expect to execute

Related Features

Tips to Annotate Legal Delaware Satisfaction Of Mortgage Forms For Free

- Read the entire Satisfaction of Mortgage form carefully before adding comments.

- Highlight key sections that explain the total amount paid and the mortgage release.

- Use simple language to summarize complex legal terms in the margins.

- Note any specific dates or events that are crucial to understanding the document.

- If there are any potential questions about the form, list them clearly for future reference.

- Keep your annotations organized and neat to ensure that they are easy to follow.

- Review the document again after making your annotations to ensure accuracy.

This editing feature for Annotate Legal Delaware Satisfaction Of Mortgage Forms may be needed when you want to clarify specific terms, prepare for a legal discussion, or ensure that all parties involved fully understand the document.

Related Searches

The best way to modify Satisfaction, Release or Cancellation of Mortgage by Individual - Delaware in PDF format online. Form edit decoration. 9.5. Ease of Setup. Satisfaction of mortgage after lapse of time. (a) Any mortgage or deed of trust having the effect of a mortgage (hereinafter ?mortgage?) that is unsatisfied ... (1) A satisfaction of a mortgage or conveyance shall be made by recordation of either a satisfaction piece, if the instrument is presented in substantially the ... MSOJ - Compel Satisfaction of Judgment. MSAM - Compel Satisfaction of Mortgage. MCTO - Consent Order. MIND - Destruction of Indicia of Arrest *. MESP - Excess ... ... form of mortgage satisfaction affidavit pursuant to this section: AFFIDAVIT CERTIFYING MORTGAGE PAYOFF AND REQUEST FOR MORTGAGE SATISFACTION PURSUANT TO 25. ... mortgage and seller for satisfaction of mortgage. (c) Survey charges ... Any material, forms, documents, policies, endorsements, annotations, notations ... This document is an acknowledgement, that states, that the (previous) borrower has completed a payment agreement and therefore the mortgage is recognized by all ... Any material, forms, documents, policies, endorsements, annotations, notations, interpretations, or constructions included in Virtual Underwriter® are made ... Documents affecting real property (including deeds, easements, right-of-way, deed restrictions, satisfaction pieces, mortgages, maps and plot ... If a loan originator issues a revised GFE based on information previously collected in issuing the original GFE and ?changed circumstances,? it must document ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.