Annotate Legal Kentucky Loans Lending Forms For Free

How it works

-

Import your Kentucky Loans Lending Forms from your device or the cloud, or use other available upload options.

-

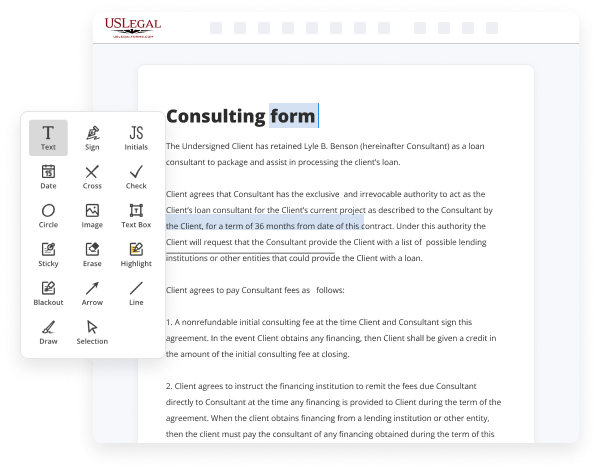

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Kentucky Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Annotate Legal Kentucky Loans Lending Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the simplest way to Annotate Legal Kentucky Loans Lending Forms For Free and make any other critical changes to your forms is by handling them online. Select our quick and secure online editor to complete, modify, and execute your legal documentation with greatest productivity.

Here are the steps you should take to Annotate Legal Kentucky Loans Lending Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF catalog, emails, URLs, or direct form requests).

- Provide the required information. Fill out empty fields using the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make sure you’ve filled in everything. Point out the most significant facts with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the form. Use our upper and side toolbars to update your content, drop additional fillable fields for different data types, re-order pages, add new ones, or delete unnecessary ones.

- Sign and request signatures. No matter which method you select, your electronic signature will be legally binding and court-admissible. Send your form to others for approval through email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the file format you need, print it out if you prefer a physical copy, and choose the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as quickly and more properly. Give it a try now!

Benefits of Editing Kentucky Loans Lending Forms Online

Top Questions and Answers

At a minimum, creditors generally must consider eight underwriting factors: (1) current or reasonably expected income or assets; (2) current employment status; (3) the monthly payment on the covered transaction; (4) the monthly payment on any simultaneous loan; (5) the monthly payment for mortgage-related obligations; ...

Video Guide to Annotate Legal Kentucky Loans Lending Forms For Free

We have prepared for you 100 more real estate questions that will help you study and prepare for your real estate exam please like this video as it helps our Channel now let's get started question one which two documents are necessary to establish a legally binding mortgage loan a promisory note and deed of trust B Sales contract and

Mortgage agreement C title insurance and appraisal report D warranty deed and lease agreement the correct answer is a promisory note and deed of trust the promisory note outlines the borrower's promise to repay the loan while the deed of trust secures the property as collateral for the loan question two if a buyer defaults on a sales contract after

Tips to Annotate Legal Kentucky Loans Lending Forms For Free

- Read the entire form carefully before making any annotations.

- Highlight key terms and conditions, such as interest rates and fees.

- Use clear, simple language when adding notes or comments.

- Ensure your annotations are directly relevant to the information on the form.

- Use bullet points for clarity when adding comments for easier understanding.

- Double-check your annotations for accuracy and completeness.

- Avoid cluttering the form with too many annotations; keep it clean and focused.

- Make sure that any abbreviations you use are clearly defined within the annotations.

This editing feature for Annotate Legal Kentucky Loans Lending Forms may be needed when you want to clarify specific points or highlight important information before submitting the forms.

Related Searches

AN ACT relating to the regulation of the mortgage loan industry. 1. Be it enacted by the General Assembly of the Commonwealth of Kentucky: 2. *Section 1. Document Type: Forms | Location: 24 States. ALTA Short Form Commitment (for an ALTA Short Form Residential Loan Policy Schedule A, BI, BII) (7-1-21). Document ... Document Type: Bulletins | Location: Kentucky. MU2017003 - RATES AND/OR FORMS UPDATE - ALTA Short Form Residential Loan Policy (12-03-12) and ALTA Short Form ... By KH Barnett · Cited by 3 ? in-depth analysis of Kentucky's new predatory lending law by examining the ... [to] income verification forms, and even entire loan files."21 6 Kentucky's ... The Act requires lenders, mortgage brokers, or servicers of home loans to provide borrowers with pertinent and timely disclosures regarding the nature and costs ... No person shall, without first obtaining a license from the commissioner, engage in the business of making loans in the amount or of the value of fifteen ... The proper use and handling of these legal forms is important. Improper use of a form, or alteration of a form (beyond mere completion) without removal of the ... Fill out the METCO Pre-Screen Inquiry Form · Already have a loan? Make a loan payment online ... Kentucky Economic Development Finance Authority (the Authority). Instructions and forms for lenders to perform loan closing. Content. Closing documents; Loan modification instructions. Closing documents ... State Directors who have counties they believe merit loan limits exceeding the standard, may submit a request to the National Office by completing Form RD 2006- ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.