Annotate Legal Minnesota Startup For S-Corporation Forms For Free

How it works

-

Import your Minnesota Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Minnesota Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Annotate Legal Minnesota Startup For S-Corporation Forms For Free

Online document editors have proved their reliability and effectiveness for legal paperwork execution. Use our secure, fast, and user-friendly service to Annotate Legal Minnesota Startup For S-Corporation Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

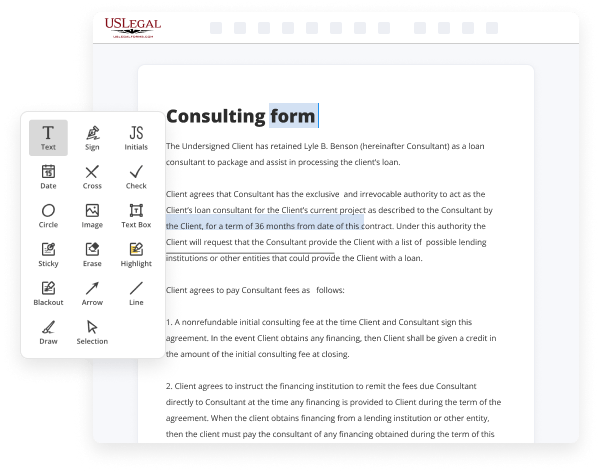

Make these simple steps to Annotate Legal Minnesota Startup For S-Corporation Forms For Free online:

- Import a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted images, draw lines and symbols, highlight significant components, or erase any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Use the right-side toolbar for this, drop each field where you want others to leave their data, and make the remaining areas required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need any longer or create new ones while using appropriate button, rotate them, or change their order.

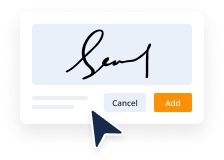

- Generate electronic signatures. Click on the Sign option and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Minnesota Startup For S-Corporation Forms Online

Top Questions and Answers

Follow these five steps to filing taxes as an S corporation. Prepare your financial statements. One of the first things your tax professional will ask for are financial statements. ... Issue Forms W-2. ... Prepare information return Form 1120-S. ... Distribute Schedules K-1. ... File Form 1040.

Video Guide to Annotate Legal Minnesota Startup For S-Corporation Forms For Free

Okay for this video i wanted to go over the newly added irs form 7203 which is used to report the s corporation shareholders stock and debt basis so why has the irs added this form well if you're a shareholder in an s corporation you have always been required to adequately track your stock and debt basis because when

You prepare your 1040 if you have allocations of losses or if you have cash distributions and you don't have sufficient amount of basis then you can't take the losses on your tax return right you can only take losses to the extent you have basis well they've added this form because they found that taxpayers have done a really

Related Features

Tips to Annotate Legal Minnesota Startup For S-Corporation Forms For Free

- Read the form carefully before you start annotating.

- Highlight key terms and important information that stands out.

- Use clear and concise language when adding notes or comments.

- Ensure that your annotations do not obscure any essential information on the form.

- Make sure to check for any updates or specific requirements for the S-Corporation forms in Minnesota.

- Organize your thoughts logically – group related annotations together.

This editing feature for Annotate Legal Minnesota Startup For S-Corporation Forms may be needed when you are preparing your documents for submission or when seeking feedback from partners or legal advisors.

Related Searches

The way you form a corporation in Minnesota is dictated by state law and the process is pretty straightforward. Start by filing articles of incorporation with ... The S corporation files Form 1120S and supporting forms and schedules, including Schedules K and K-1 (Form 1120S). Individual shareholders report their share of ... Minnesota automatically accepts your S corporation status once approved by the IRS. Before doing so, complete federal Form 1120-S and supporting schedules. The ... Filing Requirements?? Corporations doing business in Minnesota that have elected to be taxed as S corporations under IRC section 1362 must file Form M8. Generally, an S corporation must file Form 1120-S by the 15th day of the 3rd month ... The corporation generally elects to deduct start-up or ... Types of corporations and how to incorporate your startup · 1. Sole proprietorship · 2. Limited Liability Company (LLC) · 3. S Corporations (S corps) · 4. C ... This page contains summaries of significant recent court opinions and IRS developments involving taxation, with a particular focus on tax issues that could ... The following Minnesota Business Corporations forms are available in pdf: Use the following form to register a Minnesota Business Corporation. To create an S corp, you'll need to file form 2553 with the IRS . ... A registered agent receives official papers and legal documents on behalf of ... Articles of incorporation are essential to legally incorporate your business. Here's what you need to know about obtaining and filing them.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.