Autofill Legal Indiana Personal Loans Forms For Free

How it works

-

Import your Indiana Personal Loans Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Indiana Personal Loans Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Autofill Legal Indiana Personal Loans Forms For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our safe, fast, and user-friendly service to Autofill Legal Indiana Personal Loans Forms For Free your documents any time you need them, with minimum effort and greatest precision.

Make these quick steps to Autofill Legal Indiana Personal Loans Forms For Free online:

- Import a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

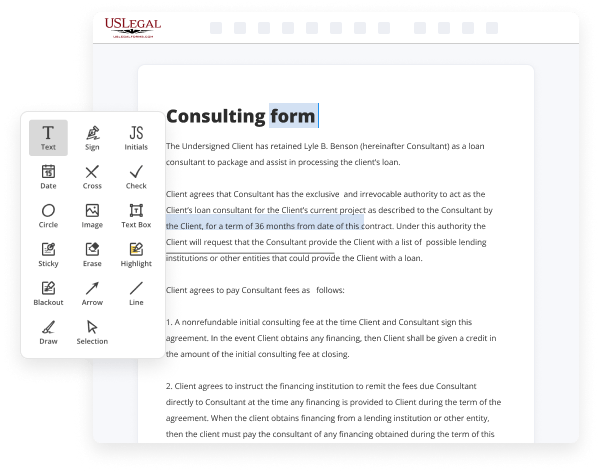

- Complete the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted images, draw lines and signs, highlight significant parts, or remove any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if neccessary. Use the right-side tool pane for this, place each field where you want others to leave their details, and make the rest of the fields required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones while using appropriate key, rotate them, or alter their order.

- Generate electronic signatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any individual or business legal documentation in clicks. Give it a try today!

Benefits of Editing Indiana Personal Loans Forms Online

Top Questions and Answers

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Video Guide to Autofill Legal Indiana Personal Loans Forms For Free

These are the top five Credit Unions for personal loans that anyone can join credit card debt has passed over1 trillion dollar in America and the interest rates are at an all-time high and this is crippling the everyday working American so on today's video I'm going to talk about a massive option that a lot of people do not

Think about credit unions that offer personal loans so you can consolidate that debt and lower your interest rate to get you back on track financially and save you thousands of dollars in interest fees or you don't have any credit card debt maybe you want to consolidate some student loans or try to get some type of major home

Tips to Autofill Legal Indiana Personal Loans Forms For Free

- Gather all necessary documents such as identification, proof of income, and credit history before starting.

- Use a straightforward and organized format for your personal information to make entry easier.

- Double-check the accuracy of all details before finalizing to avoid any errors in your submission.

- Familiarize yourself with common terms and conditions related to Indiana personal loans to understand what you are signing up for.

- Utilize autofill software or browser features, if available, to speed up the process of filling out forms.

- Take advantage of any guides or templates provided by the lender to simplify the form completion.

- Keep a copy of any forms you submit for your records and future reference.

This editing feature may be needed when you want to update your personal information or make adjustments based on new financial situations or changes in your employment.

Related Searches

Loan Application Forms · Common Application Form · Cent Buy · Cent Computer · Cent Liquid · Cent Mortgage · Cent Trade · Cent Vyapari · Housing Loan Application ... 19-Apr-2023 — Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Here is the complete list of all the documents required for a personal loan and the eligibility criteria to apply for a Bajaj Finserv Personal Loan. 14-Sept-2023 — Select a student loan to help pay for college · Undergraduate · Graduate · Health Professions · MBA · Law · Residency · Bar Exam · Consolidation. Indian Bank is offering Vehicle Loan for purchase of New Car, New Two Wheeler and Used Car at a competitive… Read More. Ind Mortgage. Eligibility Who can apply ... PNC Bank offers a wide range of personal banking services including checking and savings accounts, credit cards, mortgage loans, auto loans and much more. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating ... People choose online installment loans because their application process is simple and easy and can have fewer fees and expenses than some credit cards and ... Step-by-step guide to apply for a personal loan. Click on 'APPLY' at the top of this page to open our online personal loan application form. Enter your 10 ... 01-Dec-2022 — Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you won't have ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.