Combine Legal Wisconsin Accounting Forms For Free

How it works

-

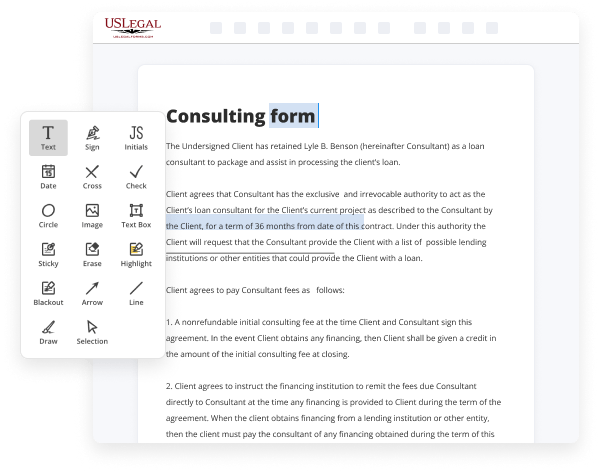

Import your Wisconsin Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Wisconsin Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Combine Legal Wisconsin Accounting Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the simplest way to Combine Legal Wisconsin Accounting Forms For Free and make any other essential adjustments to your forms is by managing them online. Take advantage of our quick and secure online editor to fill out, edit, and execute your legal paperwork with highest effectiveness.

Here are the steps you should take to Combine Legal Wisconsin Accounting Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF catalog, emails, URLs, or direct form requests).

- Provide details you need. Complete blank fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make sure you’ve filled in everything. Point out the most significant facts with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to update your content, drop additional fillable fields for different data types, re-order sheets, add new ones, or delete redundant ones.

- Sign and collect signatures. Whatever method you choose, your eSignature will be legally binding and court-admissible. Send your form to others for approval using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished paperwork to the cloud in the format you need, print it out if you prefer a physical copy, and select the most suitable file-sharing method (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as fast and more successfully. Give it a try now!

Benefits of Editing Wisconsin Accounting Forms Online

Top Questions and Answers

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

Video Guide to Combine Legal Wisconsin Accounting Forms For Free

If you are a real estate agent or you're interested in becoming a real estate agent then you have probably heard these two terms title indeed used interchangeably but I'm going to explain today what is the difference in the fact that they are not exactly the same thing I'm Tiffany Weber I'm a real estate attorney in Mooresville North

Carolina at Thomas and Weber let's get right into it all right first we're going to start with title because this is the foundational concept so title refers to ownership your ownership of the property so title is comprised of a lot of different things if you're sitting in a law school property class right now your professor might describe

Tips to Combine Legal Wisconsin Accounting Forms For Free

- Ensure all forms are current and up-to-date

- Review the instructions for each form to understand how they should be completed

- Organize forms in a logical order before combining them

- Double check calculations and data entry to avoid errors

- Consider seeking assistance from a professional accountant or legal advisor if needed

The editing feature for Combine Legal Wisconsin Accounting Forms may be needed when you have multiple forms that need to be consolidated and submitted together for legal or accounting purposes.

Related Searches

If you are com- pleting Form C for a member of a combined group, include only that corporation's amounts, determined on a separate entity basis. Line-by-Line ... Purpose of Form 1CNS. A tax-option (S) corporation having two or more qualifying nonresident shareholders uses Form 1CNS to report and pay the Wisconsin ... (1) A person licensed to practice as a certified public accountant shall comply with all of the following general standards as interpreted by bodies designated ... Accy 1.405(1) (1) An individual or firm may practice as a certified public accountant in any form of business organization permitted by state law. No person ... A merger is the combination of two firms, which subsequently form a new legal entity under the banner of one corporate name. A company can be objectively ... Forensic accountants are CPAs that look for evidence of crimes and commonly work for insurance companies, financial institutions, and law enforcement agencies. For over 88 years, Wipfli has provided private and publicly held companies with industry-focused assurance, accounting, tax and consulting services. We combine a deep understanding of our client's business operations with ... Complete the form below to receive relevant legal updates, exclusive event ... Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. We are grateful to the Legislative Reference Bureau for hosting these forms. View Town Law Forms. Each sample ordinance, resolution or form is listed in ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.