Compress Legal Nebraska Startup For S-Corporation Forms For Free

How it works

-

Import your Nebraska Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Nebraska Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Compress Legal Nebraska Startup For S-Corporation Forms For Free

Online document editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our secure, fast, and user-friendly service to Compress Legal Nebraska Startup For S-Corporation Forms For Free your documents whenever you need them, with minimum effort and maximum precision.

Make these quick steps to Compress Legal Nebraska Startup For S-Corporation Forms For Free online:

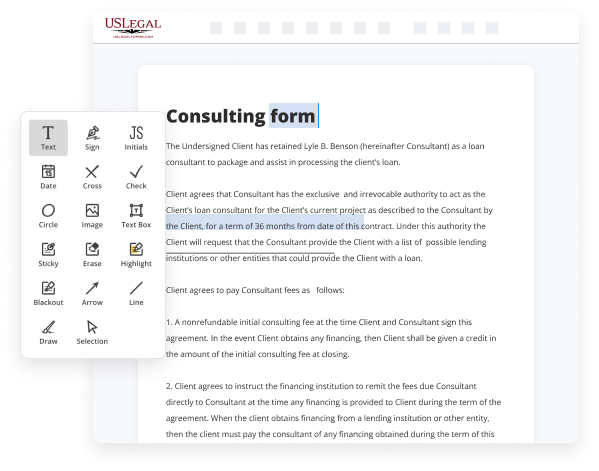

- Import a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty field and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted images, draw lines and symbols, highlight important parts, or erase any unnecessary ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if neccessary. Utilize the right-side toolbar for this, place each field where you expect other participants to leave their data, and make the remaining fields required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need any longer or create new ones while using appropriate key, rotate them, or change their order.

- Create electronic signatures. Click on the Sign tool and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any personal or business legal paperwork in minutes. Give it a try now!

Benefits of Editing Nebraska Startup For S-Corporation Forms Online

Top Questions and Answers

Any year you have minimal or no income, you may be able to skip filing your tax return and the related paperwork. However, it's perfectly legal to file a tax return showing zero income, and this might be a good idea for a number of reasons.

Video Guide to Compress Legal Nebraska Startup For S-Corporation Forms For Free

Rock rigor CPA in Hollywood Florida no video of me today because I don't have a camera on my new computer hopefully I have one soon but this video is going to show you how to file an extension for an S corporation return so the deadline to file is March 15 and if you need a little extra time

This will give you until September so I'm gonna walk you through line by line how to fill out the form seven zero zero four application for automatic extension of time to file so we're gonna start with our name something really goofy this is just an example and you're gonna fill out all your ID basic identifying information so

Tips to Compress Legal Nebraska Startup For S-Corporation Forms For Free

- Use online tools to compress PDF files containing legal forms

- Remove any unnecessary images or graphics from the forms

- Minimize the use of color and background elements to reduce file size

- Consider converting the forms into a more efficient file format, such as Word or Excel

- Use compression software specifically designed for legal documents

Editing feature for Compress Legal Nebraska Startup For S-Corporation Forms may be needed when you need to send the forms electronically, or if you have limited storage space on your device.

Related Searches

We encourage the preparer of any Nebraska S Corporation Income Tax Return, Form 1120-SN, to review applicable Nebraska law regarding any issue that may have a ... Here are the steps you should take to Add Checkmark To Legal Nebraska Startup For S-Corporation Forms quickly and effortlessly: Upload or import a file to the ... S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. Go to for instructions ... FROM THE COMMISSIONER. This booklet is designed to provide information and assist. S Corporations in filing their Georgia corporate tax returns. Corporations which have elected to file under Subchapter S of the Internal Revenue Code must file a Nebraska S Corporation Income Tax Return, Form 1120-SN,. Nebraska Business Tax: 5 Types of Corporations · A legal entity that is separate and distinct from its owners · Pay federal and state corporate income taxes · Must ... S corporations doing business in Oregon or receiv- ing income from Oregon ... Enter the corporation's current legal name as set forth in the articles of ... This information is for guidance only and does not state the complete law. Who Must File Form MO-1120S. S Corporation Income Tax: Every S corporation must file ... How competitive is your state's business tax system? Which states are best to start and grow a business? See 2023 state business tax rankings!

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.