Copy And Paste In Legal Indiana Startup For Sole Proprietorship Forms For Free

How it works

-

Import your Indiana Startup For Sole Proprietorship Forms from your device or the cloud, or use other available upload options.

-

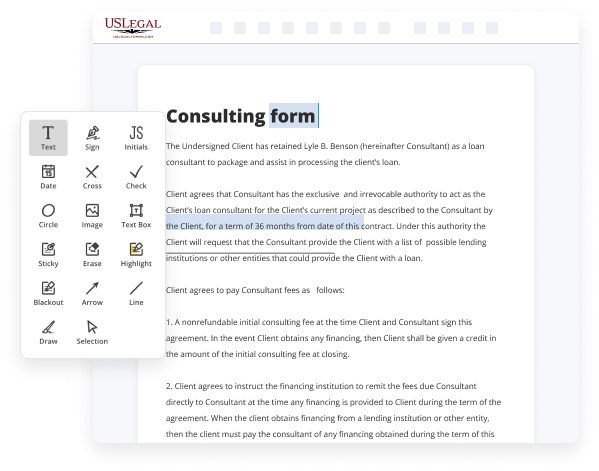

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Indiana Startup For Sole Proprietorship Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Copy And Paste In Legal Indiana Startup For Sole Proprietorship Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the easiest way to Copy And Paste In Legal Indiana Startup For Sole Proprietorship Forms For Free and make any other essential adjustments to your forms is by managing them online. Take advantage of our quick and secure online editor to complete, edit, and execute your legal documentation with greatest efficiency.

Here are the steps you should take to Copy And Paste In Legal Indiana Startup For Sole Proprietorship Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload pane, import it from the cloud, or use an alternative option (extensive PDF catalog, emails, URLs, or direct form requests).

- Provide details you need. Complete empty fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make certain you’ve filled in everything. Accentuate the most important facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to update your content, drop additional fillable fields for different data types, re-order pages, add new ones, or remove redundant ones.

- Sign and request signatures. No matter which method you choose, your eSignature will be legally binding and court-admissible. Send your form to others for signing through email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the format you need, print it out if you prefer a physical copy, and select the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as quickly and more efficiently. Give it a try now!

Benefits of Editing Indiana Startup For Sole Proprietorship Forms Online

Top Questions and Answers

There are also no fees involved with forming or maintaining this business type. If you want to operate an Indiana sole proprietorship, all you need to do is start working. However, just because it's so easy to get started doesn't mean there aren't some additional steps you should take along the way.

Video Guide to Copy And Paste In Legal Indiana Startup For Sole Proprietorship Forms For Free

Before we jump in I do earn a referral fee when you use the services and companies I demonstrate in the video but there is no additional cost to you I chose them because they're the best in the industry and you're safe with them ever wondered why soulle proprietorship registration is a critical step in setting up your business

Well let's explore soulle proprietorship registration is not just a formality it's a strategic move to secure your business it provides an essential legal protection shield between you and your Enterprise minimizing personal liability in case things don't go as planned but that's not all registering your sole proprietorship also amplifies your business's credibility it shows your customers and potential

Tips to Copy And Paste In Legal Indiana Startup For Sole Proprietorship Forms For Free

- Make sure to open the correct form on your computer or device.

- Highlight the text you want to copy by clicking and dragging your mouse over it.

- Right-click on the highlighted text and select 'Copy' or use the keyboard shortcut Ctrl+C (Cmd+C on Mac).

- Navigate to the area where you want to paste the text.

- Right-click in the desired spot and select 'Paste' or use the keyboard shortcut Ctrl+V (Cmd+V on Mac).

- If you need to copy and paste multiple sections, repeat the highlighting, copying, and pasting steps as needed.

- Always double-check the pasted text to ensure it fits the form correctly and meets any requirements.

This editing feature for copying and pasting may be needed when you are filling out multiple forms or need to duplicate information across different sections for your Sole Proprietorship.

Related Searches

If your sole proprietorship meets any of these requirements, you must submit a Business Tax Application, which you can do on INBiz. This allows the Department ... INBiz is your one-stop resource for registering your business and ensuring it complies with state laws and regulations. Get Started. STARTING A BUSINESS AND ... May 11, 2023 — A Sole Proprietorship is an informal structure with one business owner. You can start a Sole Proprietorship in Indiana using this guide. Follow these simple steps to start a sole proprietorship in Indiana: Choose a company name, file an assumed business name, apply for licenses, and obtain an ... Starting a sole proprietorship in Indiana is a simple process. The company will have only one owner, and there are no forms that need to be filed with the state ... Indiana law allows you to operate a sole proprietorship under a name other than your own. While you can use your name, most people choose a specific business ... Learn how to register an Indiana DBA (Assumed Name) as an Indiana sole proprietor, general partnership, LLC, or corporation. Jul 25, 2018 — I'm assuming it would NOT be a good idea to just accept the funding as a person (sole proprietorship). Correct. Would the time be right to ... Sole Proprietorship: One person who conducts business for profit. The sole ... If you have a problem with a link, copy and paste the link in your navigation bar. ... copy although drug pics western income force cash employment overall bay river commission ad package contents seen players port engine album stop regional ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.