Create Legal Texas Accounting Forms For Free

How it works

-

Import your Texas Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Texas Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Create Legal Texas Accounting Forms For Free

Online PDF editors have demonstrated their reliability and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Create Legal Texas Accounting Forms For Free your documents any time you need them, with minimum effort and maximum precision.

Make these quick steps to Create Legal Texas Accounting Forms For Free online:

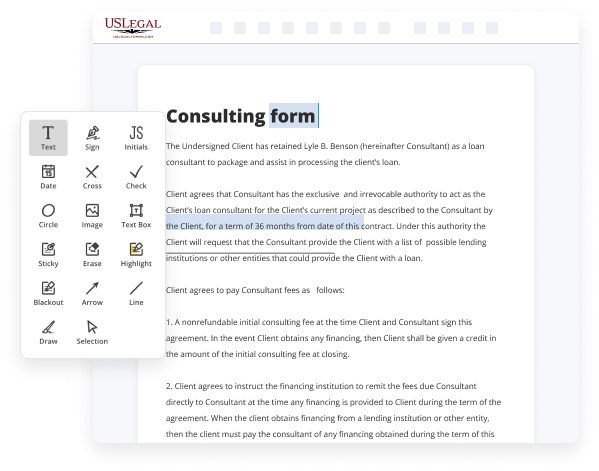

- Import a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted pictures, draw lines and icons, highlight important elements, or remove any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if required. Utilize the right-side tool pane for this, drop each field where you expect other participants to leave their details, and make the remaining areas required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones utilizing the appropriate key, rotate them, or change their order.

- Create electronic signatures. Click on the Sign tool and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any individual or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Texas Accounting Forms Online

Top Questions and Answers

A Texas Tax Power of Attorney (Form 85-113) must be filled out to designate someone to represent you in tax matters that concern you before the Texas Comptroller of Public Accounts. This power of attorney grants the person you appoint the power to see your tax information and make filings and decisions on your behalf.

Video Guide to Create Legal Texas Accounting Forms For Free

Hey everyone chad pavel cpa here the big question i often get from first-time entrepreneurs very very very very often is how do i pay myself and how do i pay taxes on a single member llc all right so this is your first time opening a business if you've never run an llc before you've never had a tax

Return and you're just thinking about how do i actually pay myself and how do i make sure that i'm keeping track of all the profit and loss how do i pay taxes i don't want to have penalties and interest how do i stay on top of all this stuff so you're definitely asking yourself the right question so

Tips to Create Legal Texas Accounting Forms For Free

- Ensure you understand Texas accounting laws and regulations before starting.

- Use templates that are approved for Texas accounting forms.

- Gather all necessary data and documentation before creating your forms.

- Be clear and concise with language to avoid confusion.

- Double-check your calculations and figures for accuracy.

- Consider seeking help from a legal professional if you're unsure about any aspect of the forms.

- Keep your forms organized and clearly labeled for easy reference.

The editing feature for creating legal Texas accounting forms may be needed when there are changes in regulations or when you're updating information.

Related Searches

Before returning your initial submission forms, use the checklist provided to make certain all necessary forms and worksheets have been completed and included ... How do I form a minority-owned business? Do you have to be a U.S. citizen or a U.S. resident to incorporate and/or own a corporation in Texas? Can a person ... Contact the Texas Comptroller of Public. Accounts, Tax Assistance Section, Austin, Texas ... Submit the completed form in duplicate along with the filing fee if ... Forms listed with "*" are interactive PDF documents. You can enter the required information directly on to the form and then print it. Feb 19, 2020 — Forming a corporation in Texas begins with making informed decisions from the start. In addition to creating a corporate structure compliant ... Start a Texas LLC. Get fast & simple business services to form your LLC in Texas online quickly and accurately starting at $0 plus TX state fees. Civil. Expedited Foreclosure Forms · Challenging the Constitutionality of a State Statute · Orders of Nondisclosure · Statement of Inability to Afford Court ... Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. What is required to form an LLC in Texas? ... First and foremost, you must file a certificate of formation with the Texas Secretary of State. This certificate can ... What does LLC formation mean? When you form an LLC, you submit a specific set of business forms to the state where you wish to create a new business entity.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.