Define Fillable Fields In Legal Minnesota Gifts Forms For Free

How it works

-

Import your Minnesota Gifts Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Minnesota Gifts Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Define Fillable Fields In Legal Minnesota Gifts Forms For Free

Online PDF editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Define Fillable Fields In Legal Minnesota Gifts Forms For Free your documents whenever you need them, with minimum effort and maximum accuracy.

Make these simple steps to Define Fillable Fields In Legal Minnesota Gifts Forms For Free online:

- Upload a file to the editor. You can select from several options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

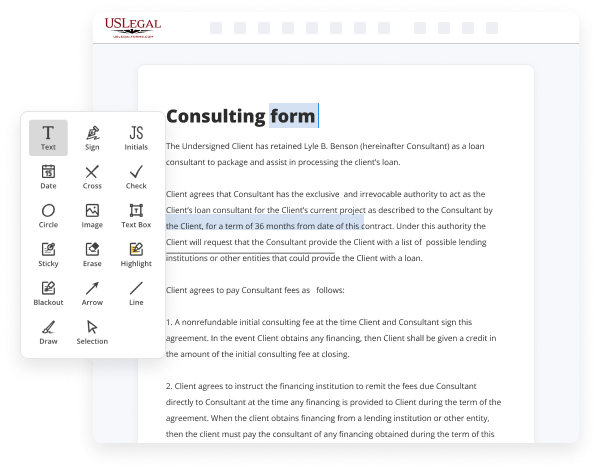

- Fill out the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and icons, highlight important components, or erase any pointless ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if neccessary. Use the right-side toolbar for this, place each field where you expect others to provide their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones utilizing the appropriate key, rotate them, or alter their order.

- Generate electronic signatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or utilizing a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal documentation in minutes. Give it a try now!

Benefits of Editing Minnesota Gifts Forms Online

Top Questions and Answers

In Minnesota, there is no gift tax - however, if you give a gift that exceeds $17,000 in value then this gift may be included in your estate if you die within three year of making the gift.

Related Searches

15-May-2014 — Gifts received pursuant to. Minnesota Statutes 16A.013 must be approved by the agency head or designee and by Minnesota. Management & Budget ( ... Any federal adjusted taxable gifts made within three years of the decedent's death must be added to the federal gross estate when determining if the estate ... Gifts of assets can help you reduce your taxable estate. In Minnesota, gifts might help you make a small estate smaller and avoid the probate process. by JB Baron · 2011 · Cited by 136 — It is a truism of Anglo-American law that there is a difference between gifts and bargains, between donative transfers and contractual exchanges ... Before acting on behalf of the principal, the attorney(s)-in-fact must sign this form acknowledging having read and understood the IMPORTANT NOTICE TO ATTORNEY ... 2.6 Summary ; donatio mortis causa and gifts ; inter vivos, the term “gift/ ; don” in common law covers all transactions that are designed to transfer property to ... In the Income Tax Act, 1961 gifts in any form cash or movable or immovable property including gold, jewelry or anything can be given or received. For Cash: If ... The unified tax provides a set amount you can gift to family and friends during your lifetime and upon death before gift and estate taxes apply. This new Sixth Edition starts a second century for Black's Law. Dictionary-the standard authority for legal definitions since 1891. Nearly every area of the law ... "Estate Tax." Internal Revenue Service. "Instructions for Form 709," Pages 2-3. Internal Revenue Service. "Instructions for Form 709: United States Gift (and ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.