Define Fillable Fields In Legal New Hampshire Satisfaction Of Mortgage Forms For Free

How it works

-

Import your New Hampshire Satisfaction Of Mortgage Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your New Hampshire Satisfaction Of Mortgage Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

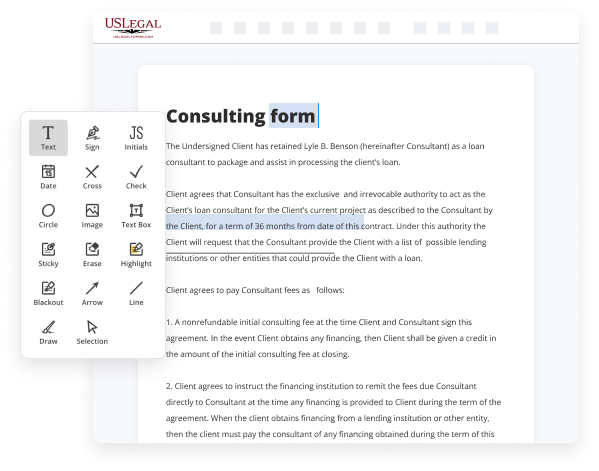

How to Define Fillable Fields In Legal New Hampshire Satisfaction Of Mortgage Forms For Free

Legal paperwork requires highest accuracy and prompt execution. While printing and completing forms usually takes plenty of time, online document editors demonstrate their practicality and efficiency. Our service is at your disposal if you’re looking for a trustworthy and straightforward-to-use tool to Define Fillable Fields In Legal New Hampshire Satisfaction Of Mortgage Forms For Free rapidly and securely. Once you try it, you will be surprised how simple working with formal paperwork can be.

Follow the guidelines below to Define Fillable Fields In Legal New Hampshire Satisfaction Of Mortgage Forms For Free:

- Add your template through one of the available options - from your device, cloud, or PDF catalog. You can also get it from an email or direct URL or using a request from another person.

- Utilize the upper toolbar to fill out your document: start typing in text areas and click on the box fields to select appropriate options.

- Make other necessary modifications: add images, lines, or icons, highlight or remove some details, etc.

- Use our side tools to make page arrangements - add new sheets, alter their order, remove unnecessary ones, add page numbers if missing, etc.

- Drop extra fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if everything is true and sign your paperwork - generate a legally-binding eSignature in your preferred way and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with other people or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and get your form promptly witnessed.

Imagine doing all of that manually in writing when even one error forces you to reprint and refill all the details from the beginning! With online solutions like ours, things become considerably easier. Try it now!

Benefits of Editing New Hampshire Satisfaction Of Mortgage Forms Online

Top Questions and Answers

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

Video Guide to Define Fillable Fields In Legal New Hampshire Satisfaction Of Mortgage Forms For Free

A satisfaction of mortgage form is a document made by the owner of the mortgage or Mortgagey to acknowledge that the obligation regarding the mortgage between the parties has received full satisfaction or has been fully paid by the mortgager or debtor. Once the satisfaction of mortgage form is signed by the mortgage. The satisfaction of mortgage form is usually

Accompanied by the original mortgage instrument or a certified copy when presented for recording at the land registry or Country registry. A satisfaction of mortgage form will generally include the name of the mortgager and the mortgagey, the docket and page number, or the recording number of the mortgage, the total amount of the mortgage. Acknowledgment of the satisfaction and

Tips to Define Fillable Fields In Legal New Hampshire Satisfaction Of Mortgage Forms For Free

- Identify the key fields that need to be filled out, such as borrower information, property details, and mortgage satisfaction date.

- Use clear and concise labels for each fillable field to avoid confusion.

- Ensure that the fillable fields are large enough for users to input all necessary information comfortably.

- Include instructions or examples in the form to guide the user on what information is required.

- Make sure the fillable fields are easily accessible and logically arranged to facilitate a smooth completion process.

- Test the fillable fields for functionality to ensure they work properly before finalizing the form.

The editing feature for defining fillable fields in legal New Hampshire Satisfaction of Mortgage forms may be needed when making updates to the document or tailoring it for specific situations.

Related Searches

The easiest way to modify Satisfaction, Release or Cancellation of Mortgage by Individual - New Hampshire in PDF format online. Form edit decoration. 9.5. Ease ... This document is an acknowledgement, that states, that the (previous) borrower has completed a payment agreement and therefore the mortgage is recognized by ... Update the form with inserted pictures, draw lines and symbols, highlight significant elements, or remove any pointless ones. Drop more fillable fields. When a mortgage upon real estate is satisfied, the mortgagee shall give the mortgagor a discharge thereof. Said discharge shall be in the form of a written ... The Short Form contains the loan-specific information (e.g., borrower name, lender name, loan amount, description of property, etc.) and identifies the ... If the manufactured housing is relocated into NH from another state, the tax is to be paid only by the buyer to the register of deeds of the county to which ... BUYER hereby authorizes, directs and instructs its lender to communicate the status of BUYER'S financing and the satisfaction of lender's specified conditions ... Discrepancies between a form reproduction and a court-furnished original may subject the Party who signs/or files the reproduction to court-imposed sanctions or ... 12-Oct-2016 — A Loan policy expires with the payment or satisfaction of the mortgage described in the policy, except when satisfied by foreclosure or ... The Short Form contains the loan-specific information (e.g., borrower name, lender name, loan amount, description of property, etc.) and identifies the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.