Delete Pages From Legal Arkansas Startup For S-Corporation Forms For Free

How it works

-

Import your Arkansas Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

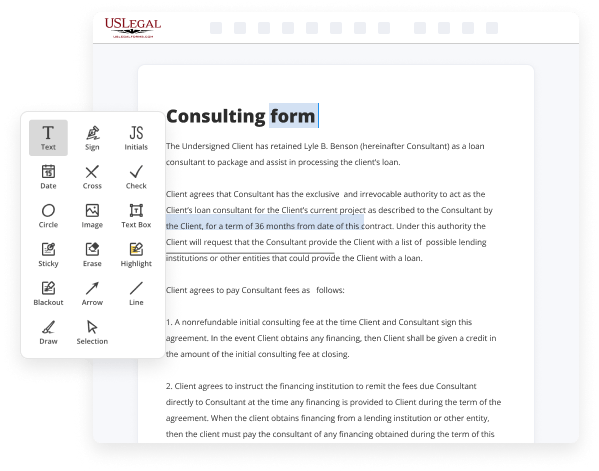

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Arkansas Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Delete Pages From Legal Arkansas Startup For S-Corporation Forms For Free

Online PDF editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our safe, fast, and straightforward service to Delete Pages From Legal Arkansas Startup For S-Corporation Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these quick steps to Delete Pages From Legal Arkansas Startup For S-Corporation Forms For Free online:

- Upload a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight significant parts, or erase any pointless ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if required. Make use of the right-side toolbar for this, drop each field where you want others to provide their data, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones while using appropriate button, rotate them, or change their order.

- Generate eSignatures. Click on the Sign option and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Give it a try today!

Benefits of Editing Arkansas Startup For S-Corporation Forms Online

Top Questions and Answers

The Articles of Incorporation Arkansas must be filed with the Secretary of State in order to start a corporation. The Articles of Incorporation do not have to be a complex document.

Video Guide to Delete Pages From Legal Arkansas Startup For S-Corporation Forms For Free

Welcome back to my channel thank you for being here today we're going to talk about as Corporation taxes I have seen this question frequently in the comments to my videos so I thought it would take some time to upload a quick video to hopefully help you out if you haven't already subscribe to my channel by the way

Please take a moment to subscribe now and make sure that you ring the bell to turn on video notifications an S corporation is technically a hybrid business structure that has characteristics of both a corporation and a partnership technically it operates as a corporation but unlike a true C corporation it is not subject to double taxation since it

Tips to Delete Pages From Legal Arkansas Startup For S-Corporation Forms For Free

- Make sure you are logged into the legal Arkansas startup platform.

- Locate the S-Corporation forms section in your account settings.

- Select the specific page or pages you want to delete from the forms.

- Look for the delete option or trash icon to remove the selected pages.

- Confirm the deletion to permanently remove the pages from your S-Corporation forms.

You may need to use the editing feature to delete pages from Legal Arkansas Startup For S-Corporation Forms when you accidentally added incorrect information, updated details need to be reflected, or if certain pages are no longer required for your business filings.

Related Searches

US Legal Forms. Add Textbox To Legal Arkansas Startup For S-Corporation Forms ... delete unnecessary ones, add page numbers if missing, etc. Add more fields ... 2015 ; AR1100S Subchapter S Corporation Income Tax Return, 01/15/2016 ; AR1103 Application to be a Small Business Corporation, 09/27/2016 ; AR1103 Supplemental, 01 ... Domestic Limited Liability Company ; Application for Fictitious Name Dom. Limited Liability Co. DN-18, $22.50 ; Cancellation of Fictitious Name Dom. Liability Co. Here are the steps you should take to Add Required Fields To Legal Arkansas Startup For S-Corporation Forms easily and quickly: · Upload or import a file to the ... Form an S Corp today in less than 10 minutes. Starting an S Corporation provides limited liability protection to owners, offers special IRS ... Create an Arkansas LLC in five easy steps. From naming an LLC in Arkansas to applying for an EIN. Start an LLC online today with ZenBusiness Inc. This act amends Hawaii income tax law under chapter 235, Hawaii Revised Statutes (HRS), to conform to certain provisions of the IRC, as amended as of December ... Articles of incorporation are essential to legally incorporate your business. Here's what you need to know about obtaining and filing them. S Corporation Expenses. ? Line 19: Other Deductions. ? Pub 535. ? Startup and organizational. ? Meals and entertainment. ? Gifts / Awards. ? Director fees. 15 ... Incorporation/Qualification number in the proper fields on page. 1 of form TC-20S. These numbers are used for identification of the corporate tax return.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.