Draw On Legal Montana Startup For Sole Proprietorship Forms For Free

How it works

-

Import your Montana Startup For Sole Proprietorship Forms from your device or the cloud, or use other available upload options.

-

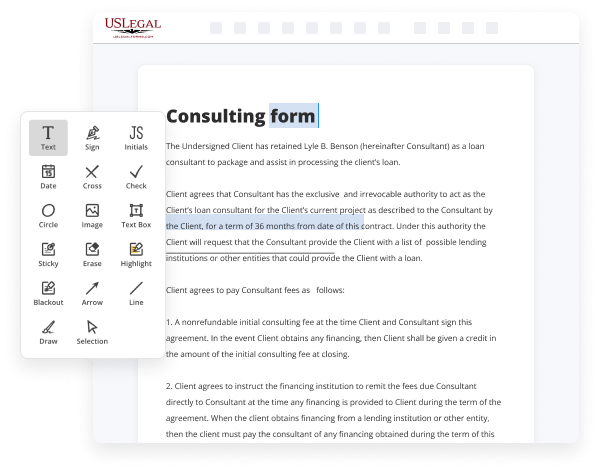

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

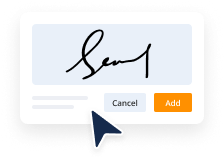

Sign your Montana Startup For Sole Proprietorship Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Draw On Legal Montana Startup For Sole Proprietorship Forms For Free

Legal paperwork requires highest precision and prompt execution. While printing and completing forms usually takes plenty of time, online PDF editors prove their practicality and efficiency. Our service is at your disposal if you’re looking for a reputable and easy-to-use tool to Draw On Legal Montana Startup For Sole Proprietorship Forms For Free quickly and securely. Once you try it, you will be amazed at how easy working with formal paperwork can be.

Follow the instructions below to Draw On Legal Montana Startup For Sole Proprietorship Forms For Free:

- Add your template via one of the available options - from your device, cloud, or PDF library. You can also obtain it from an email or direct URL or through a request from another person.

- Use the upper toolbar to fill out your document: start typing in text areas and click on the box fields to mark appropriate options.

- Make other necessary adjustments: insert pictures, lines, or signs, highlight or remove some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, remove unnecessary ones, add page numbers if missing, etc.

- Drop more fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is true and sign your paperwork - create a legally-binding electronic signature in your preferred way and place the current date next to it.

- Click Done when you are ready and choose where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with other people or send it to them for approval via email, a signing link, SMS, or fax. Request online notarization and obtain your form promptly witnessed.

Imagine doing all of that manually in writing when even a single error forces you to reprint and refill all the details from the beginning! With online services like ours, things become considerably easier. Give it a try now!

Benefits of Editing Montana Startup For Sole Proprietorship Forms Online

Top Questions and Answers

How to start a sole proprietorship: 7 steps to take Choose a business name. ... Register your business name. ... Purchase a website domain name. ... Obtain a business license and other permits. ... File for an employer identification number (EIN) ... Open a business bank account. ... Get insurance coverage.

Video Guide to Draw On Legal Montana Startup For Sole Proprietorship Forms For Free

Chris is with us cleveland ohio hi chris what's up hi dave thanks for taking my call i'll try to be as brief as possible um my question is my wife and i over the last two and a half years have really focused in on the steps and have been in the situation where now we financially were able

To pay off the house last fall we have no credit card debt and it seems to me at this point where our income levels are she had recently gotten promoted about two years ago that now we're getting just absolutely at the end of the year crushed and having to write big checks for taxes and i guess my

Tips to Draw On Legal Montana Startup For Sole Proprietorship Forms For Free

- Understand the legal requirements for a sole proprietorship in Montana.

- Gather all necessary personal information and documents before starting the form.

- Use clear and simple language when filling out the forms.

- Double-check spelling of names and addresses to avoid mistakes.

- Consult a legal professional if you're unsure about any part of the form.

- Keep a copy of the completed forms for your records.

- Be aware of any deadlines for filing forms related to your business.

You may need this editing feature for Draw On Legal Montana Startup For Sole Proprietorship Forms if you make mistakes or if your business details change after submitting the initial forms.

Related Searches

The filing fee is $20, and you can fill out this form and submit it to the Secretary of State in Montana. Thinking about starting a business in Montana? Our guide will help you set up shop in Big Sky Country in eight easy steps. To start an LLC in Montana, you must file the Articles of Organization with the Secretary of State and pay a $35 filing fee. LLCs must also pay ... 1. Choose a Business Name. In Montana, a sole proprietor can use their own legal name or a trade name?also sometimes known as an "assumed business name" or " ... Sole Proprietors are paid by withdrawing funds (taking owner's draws) out of their businesses for personal use. It's common for entrepreneurs to start as Sole ... When it comes to being a sole proprietor in the state of Montana, there is no formal setup process. There are also no fees involved with forming or ... Existing corporations can file the LLC without a registered agent by downloading the application for submitting Articles of Organization at the Montana SOS.mt ... You may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole ... Form, Use this form to -. W-2, Wage and Tax Statement and W-3, Transmittal of Wage and Tax Statements, Report wages, tips, ... If you plan to start a sole proprietorship and you are not planning to do ... Due to the 2020 Montana Business Corporate Act, here are the laws pertaining to:.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.