Edit Legal Pennsylvania Sale Of Business Forms For Free

How it works

-

Import your Pennsylvania Sale Of Business Forms from your device or the cloud, or use other available upload options.

-

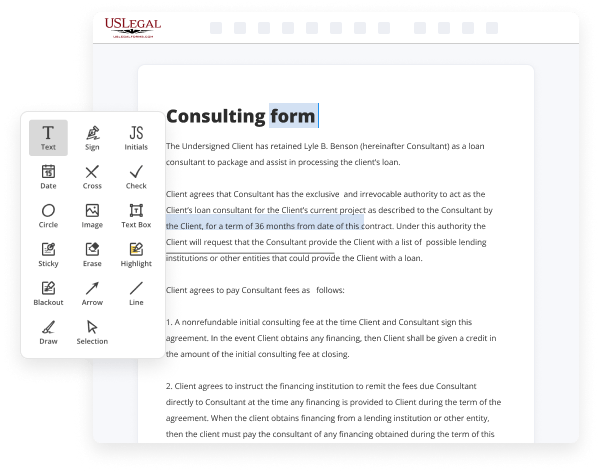

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Pennsylvania Sale Of Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Edit Legal Pennsylvania Sale Of Business Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the simplest way to Edit Legal Pennsylvania Sale Of Business Forms For Free and make any other critical updates to your forms is by managing them online. Select our quick and trustworthy online editor to fill out, edit, and execute your legal documentation with highest productivity.

Here are the steps you should take to Edit Legal Pennsylvania Sale Of Business Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Fill out blank fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to ensure you’ve completed everything. Accentuate the most important details with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to update your content, drop extra fillable fields for various data types, re-order pages, add new ones, or delete redundant ones.

- Sign and request signatures. No matter which method you select, your eSignature will be legally binding and court-admissible. Send your form to others for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the format you need, print it out if you prefer a hard copy, and choose the most suitable file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as quickly and more effectively. Try it out now!

Benefits of Editing Pennsylvania Sale Of Business Forms Online

Top Questions and Answers

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

Video Guide to Edit Legal Pennsylvania Sale Of Business Forms For Free

A lot of States impose an inheritance tax in Pennsylvania is one of them the inheritance tax is a tax that is imposed on beneficiaries on their right to inherit certain property from a person who died the inheritance tax is also imposed on both residents and non-residents so if you live in New Jersey or New York or Florida

But you own property in Pennsylvania it does not matter that you are not a resident of the state as long as you died owning something here within the state that property will be taxed upon the person who you bequeathed it to in your will the Pennsylvania tax rates are set forth by Statute not everyone will will have

Related Features

Tips to Edit Legal Pennsylvania Sale Of Business Forms For Free

- Understand the purpose of the Sale of Business forms to ensure accurate edits.

- Gather all necessary business information prior to editing the forms.

- Review the current legal requirements for business sales in Pennsylvania.

- Make sure to use clear and concise language throughout the forms.

- Double-check for any specific terms or clauses needed for your type of business.

- Consider consulting a legal professional if you're unsure about any edits.

- Save a copy of the original form before making changes for your records.

Editing the Pennsylvania Sale Of Business forms might be needed when you're finalizing the sale details or when there are changes in ownership or terms of the sale.

Related Searches

This form is to be used to report Entity ID (federal EIN/SSN), business name, address corrections, a change to a more frequent filing status and/or to ... The forms may be used to file new entities or to request changes to existing entities. The Bureau highly encourages online filing as the easiest and fastest way ... Make these quick steps to Convert To Text Legal Pennsylvania Sale Of Business Forms online: Import a file to the editor. You can select from several options - ... There are two ways to update/correct your business name, address, identification number or filing frequency: Log in to myPATH , available at mypath.pa.gov , and ... Corporate taxpayers may report a change in corporate officers in one of two ways: By logging in to myPATH , available at mypath.pa.gov , and selecting the ... The Change in Terms Addendum to Agreement of Sale (Form CTA) is for making common changes to an agreement of sale after it has been executed. Using the Change ... A business bill of sale is a legal document that recognizes the sale and change of ownership of a business and all its assets. ... Pennsylvania, Rhode Island ... To establish an LLC in Pennsylvania, a Certificate of Organization is required to be filed with the. Corporation Bureau on form DSCB: 15-8913, accompanied by a ... Once a deed is recorded it cannot be changed. We recommend you consult a real estate attorney or title company to prepare a new deed. If a married couple held ... Use Form 8822-B to notify the Internal. Revenue Service if you changed your business mailing address, your business location, or the identity of your.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.