Edit Pages Legal California Independent Contractors Forms For Free

How it works

-

Import your California Independent Contractors Forms from your device or the cloud, or use other available upload options.

-

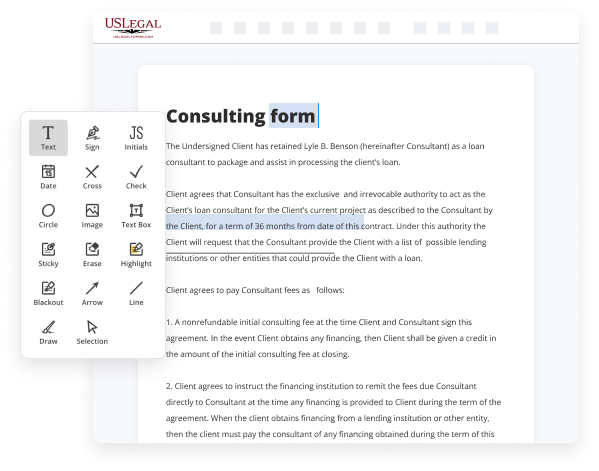

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your California Independent Contractors Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Edit Pages Legal California Independent Contractors Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the easiest way to Edit Pages Legal California Independent Contractors Forms For Free and make any other essential adjustments to your forms is by handling them online. Take advantage of our quick and secure online editor to complete, modify, and execute your legal paperwork with maximum productivity.

Here are the steps you should take to Edit Pages Legal California Independent Contractors Forms For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide the required information. Complete empty fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to ensure you’ve filled in everything. Accentuate the most important facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the template. Use our upper and side toolbars to update your content, place additional fillable fields for various data types, re-order pages, add new ones, or remove unnecessary ones.

- Sign and collect signatures. Whatever method you select, your eSignature will be legally binding and court-admissible. Send your form to others for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished paperwork to the cloud in the file format you need, print it out if you prefer a physical copy, and choose the most appropriate file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as quickly and more successfully. Try it out now!

Benefits of Editing California Independent Contractors Forms Online

Top Questions and Answers

Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

Video Guide to Edit Pages Legal California Independent Contractors Forms For Free

If you are a $199 earner or independent contractor then you have one of the greatest opportunities to reduce your taxes we already know that the tax law heavily favors business owners and the good news is that when you earn $10.99 income the IRS considers you to be self-employed this key characteristic opens the doors for you to take

Advantage of over 100 tax deductions in strategies that you can use to pay less taxes as a licensed CPA I have helped independent contractors reduce their taxes by thousands at my CPAC coach.com and today I want to share the most valuable strategies with you all right so first of all what exactly is 1099 income 1099 income is

Related Features

Tips to Edit Pages Legal California Independent Contractors Forms For Free

- Read the form carefully to understand what information is required.

- Ensure that all the details you provide are accurate and up to date.

- Use clear and simple language when filling out the forms.

- Double-check for any spelling or grammatical errors.

- Keep a copy of the filled-out form for your records.

- If you're uncertain about any section, consider seeking advice from a professional.

Editing your California Independent Contractors Forms may be needed when you have changes in personal information or when updating the terms of your contract.

Our CA employment lawyers will explain what you should know about California misclassification and independent contractor law. USC must prove the worker is customarily and currently engaged in an independently-established trade, occupation, or business. This worksheet asks questions and seeks evidence supporting responses to the questions to help determine whether a service provider should be classified as an. A new study finds that due to California's AB5 law, independent contractors were not converted to fulltime employees and instead lost work opportunities. In California, a worker is presumptively an employee unless the employer demonstrates otherwise. This new law aims to provide greater protections to freelance workers (e.g. , "independent contractors"). The California legislature today approved a controversial new law that will reshape the way businesses across the state classify workers. You must make sure that your hire is properly classified using the legal tests. California's DIR starts with the presumption that a worker is an employee.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.