Erase In Legal Minnesota Independent Contractors Forms For Free

How it works

-

Import your Minnesota Independent Contractors Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Minnesota Independent Contractors Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Erase In Legal Minnesota Independent Contractors Forms For Free

Online PDF editors have proved their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Erase In Legal Minnesota Independent Contractors Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these quick steps to Erase In Legal Minnesota Independent Contractors Forms For Free online:

- Import a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

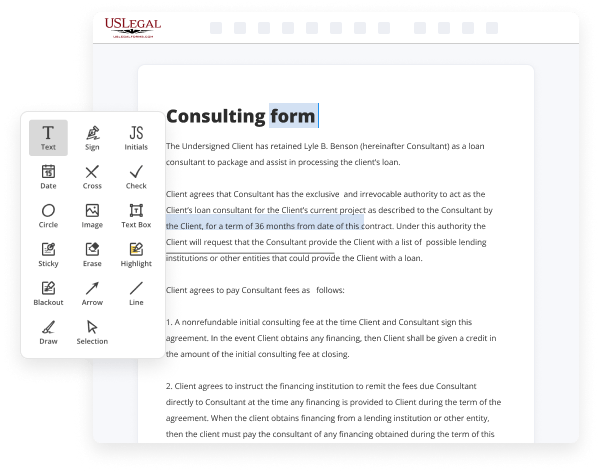

- Complete the blank fields. Put the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and icons, highlight significant parts, or remove any pointless ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, place each field where you expect other participants to leave their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need any longer or create new ones using the appropriate button, rotate them, or alter their order.

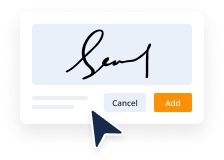

- Create eSignatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can complete and share any individual or business legal documentation in clicks. Give it a try today!

Benefits of Editing Minnesota Independent Contractors Forms Online

Top Questions and Answers

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Video Guide to Erase In Legal Minnesota Independent Contractors Forms For Free

The reason you want to make sure that you're not accidentally calling someone an independent contractor if they're truly an employee is that it can actually get you into trouble if you're trying to classify someone as an independent contractor in a way just to get out of paying them benefits or give them vacation time that you normally would

Do if somebody was actually an employee so you're going to want to make sure that the independent contractor agreement and what the independent contractor does clearly is an independent contract position and not a case of somebody that should be classified as an employee that you're trying to kind of get around the edges and not have to pay

Related Features

Tips to Erase In Legal Minnesota Independent Contractors Forms For Free

- Carefully review each section of the form to identify information that needs to be erased.

- Use a black ink pen to clearly cross out any incorrect information without obscuring the original text too much.

- Consider using correction tape for a cleaner look if you want to completely hide the unwanted text.

- Always date and initial any corrections made on the form to maintain a clear record.

- If the form allows, make a photocopy before erasing in case you need to reference the original information later.

- Consult a legal professional if you are unsure about the proper methods for modifying the document.

The editing feature for Erase In Legal Minnesota Independent Contractors Forms may be needed when an error has been discovered after the form has been submitted or if there are changes that need to be made to the terms of the contract.

Related Searches

"Employee" as used in this chapter means a worker who is not an independent contractor. The employee safe harbor criteria are not intended to define "employee" ... When workers perform services for your business, they may be classified as independent contractors or employees. Information to determine if an independent contractor could be considered an employee and how to keep independent contractors independent. Under Minnesota law, employers are not obligated to pay unemployment taxes for independent contractors. ... form. Rather, the primary concern is how the contract ... The following table summarizes the key elements involved in determining whether a worker is an employee or an independent contractor. Common law factors. Minnesota has enacted one of the strictest state non-compete laws in the US, banning almost all post- termination non-competes between employers ... A new law went into effect in Minnesota that prohibits almost all post-employment non-compete agreements entered into between employers and employees. Forms and Instructions for Registration and Reporting ... Minnesota's wage and hour laws do not apply if the worker is considered to be an independent contractor ... In short, the new law makes clear that employees and independent contractors get to work when and where they want, and any agreements that ... ... independent contractors are not protected from non-harassment forms of discrimination. Thus, while independent contractors can bring actions ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.