Erase In Legal Pennsylvania Fair Credit Reporting Forms For Free

How it works

-

Import your Pennsylvania Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Pennsylvania Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Erase In Legal Pennsylvania Fair Credit Reporting Forms For Free

Online PDF editors have proved their reliability and efficiency for legal paperwork execution. Use our secure, fast, and user-friendly service to Erase In Legal Pennsylvania Fair Credit Reporting Forms For Free your documents any time you need them, with minimum effort and highest accuracy.

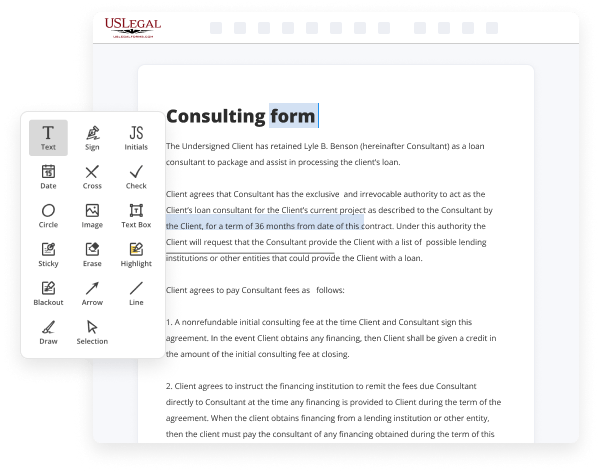

Make these quick steps to Erase In Legal Pennsylvania Fair Credit Reporting Forms For Free online:

- Upload a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty area and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight significant parts, or remove any unnecessary ones.

- Drop more fillable fields. Adjust the template with a new area for fill-out if required. Make use of the right-side toolbar for this, place each field where you expect others to provide their data, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones making use of the appropriate key, rotate them, or change their order.

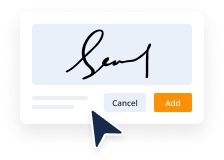

- Create eSignatures. Click on the Sign option and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. Finish your editing using the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or transform it as you need.

And that’s how you can complete and share any individual or business legal documentation in clicks. Give it a try now!

Benefits of Editing Pennsylvania Fair Credit Reporting Forms Online

Top Questions and Answers

Dispute the old debt with the credit reporting agencies. Outline your dispute in writing and send it to the three major CRAs. They are required under the FCRA to investigate your dispute and remove the negative information from your credit report.

Video Guide to Erase In Legal Pennsylvania Fair Credit Reporting Forms For Free

FAIR CREDIT REPORTING ACT – CREDIT REPORTING AGENCIES AND CONSUMER RIGHTS There are many consumer reporting agencies, including credit bureaus and specialty agencies, that are allowed to store and sell information about you. This can include things like your check writing history, medical records, and rental records. These companies must abide by the Fair Credit Reporting Act (FCRA), which ensures

That the data they hold is accurate, secure and that it is used fairly. Here’s what you should know about your rights in relation to credit reporting agencies: SHARING OF INFORMATION Firstly, you must be told if any information in your file has been used against you. If anyone has used a credit or consumer report to deny an application

Tips to Erase In Legal Pennsylvania Fair Credit Reporting Forms For Free

- Gather all necessary documents and information before starting.

- Make sure you understand the specific regulations related to Fair Credit Reporting in Pennsylvania.

- Identify the inaccuracies or items you wish to erase on your credit report.

- Contact the credit reporting agency and request the erasure, providing supporting evidence.

- Be clear and concise in your communication, explaining why the items should be removed.

- Follow up with the agency to ensure your request has been processed.

- Keep copies of all correspondence for your records.

- Be patient, as this process can take time.

This editing feature for Erase In Legal Pennsylvania Fair Credit Reporting Forms may be needed when you find errors on your credit report that could impact your credit score or ability to obtain loans.

Related Searches

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable information must ... 08-Sept-2023 ? This process is meant to remove negative items that are correctly reported, such as missed credit card payments or loan defaults. The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers' credit information and access to their credit reports. Remove negative information seven years after the date of first delinquency (except for bankruptcies (10 years) and tax liens (seven years from the time they ... Background checks of an applicant or employee's financial condition, credit history, driving history, employment history, criminal record, ... Don't report credit errors on your own! Call Pennsylvania debt collection abuse attorney Michael P. Forbes to file a credit report error lawsuit! ... Fair Credit Reporting Act creates interrelated legal standards and requirements to support the policy goal of accurate credit reporting. These requirements ... 21-Dec-2011 ? The version of this form developed by the Federal Trade Commission, available on the FTC's Web site ( ftc.gov/idtheft), remains valid and ... Consumers also have a right to see their own credit reports. By law, they are entitled to at least one free credit report every 12 months from each of the three ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.