Extract Data From Legal California Mortgage Satisfaction Forms For Free

How it works

-

Import your California Mortgage Satisfaction Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your California Mortgage Satisfaction Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Extract Data From Legal California Mortgage Satisfaction Forms For Free

Online PDF editors have demonstrated their reliability and effectiveness for legal paperwork execution. Use our safe, fast, and user-friendly service to Extract Data From Legal California Mortgage Satisfaction Forms For Free your documents whenever you need them, with minimum effort and greatest accuracy.

Make these quick steps to Extract Data From Legal California Mortgage Satisfaction Forms For Free online:

- Import a file to the editor. You can select from a couple of options - add it from your device or the cloud or import it from a form library, external URL, or email attachment.

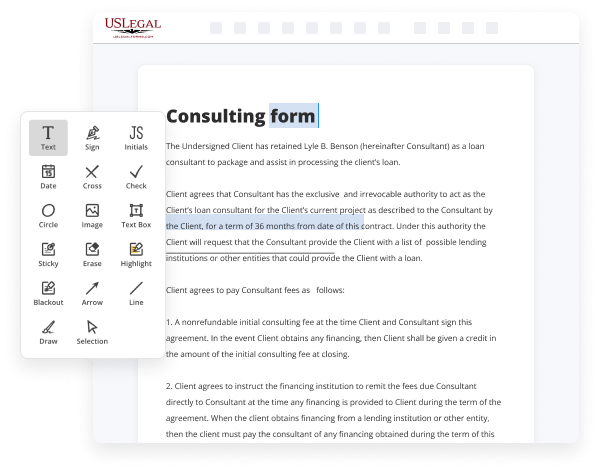

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and signs, highlight important parts, or remove any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Utilize the right-side tool pane for this, place each field where you want other participants to leave their details, and make the remaining areas required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need anymore or create new ones using the appropriate key, rotate them, or change their order.

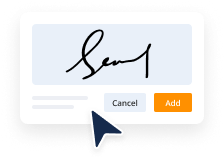

- Create eSignatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or convert it as you need.

And that’s how you can complete and share any individual or business legal paperwork in minutes. Try it now!

Benefits of Editing California Mortgage Satisfaction Forms Online

Top Questions and Answers

A promissory note is a written agreement between one party (you, the borrower) to pay back the loan issued by another party (often a bank or other financial institution). Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note.

Video Guide to Extract Data From Legal California Mortgage Satisfaction Forms For Free

This is a tutorial on the also known as the tds recently revised 1221 this form is required on most transactions residential transactions between one and four units now there are rare exceptions notably when the home is held in a trust and the trustee does not live on premises or and hasn't lived on premises in the last five

Years so let's jump right into it so we start by putting the city the property is located in the county and the address of the property we put a date here which effectively time stamps this document since there's going to be other disclosures like the natural hazard disclosure for example that will be in the transaction usually you'll

Related Features

Tips to Extract Data From Legal California Mortgage Satisfaction Forms For Free

- Read the entire Mortgage Satisfaction Form carefully to understand its structure.

- Look for key sections such as borrower information, lender details, and property address.

- Identify the dates mentioned, especially the date of satisfaction, as it is crucial for record keeping.

- Note any signatures or stamps, as these can indicate the validity of the document.

- Use a highlighter or digital tool to mark important sections for easy reference.

- If using software to extract data, make sure it can handle scanned documents and has OCR capabilities.

- Save the extracted data in a secure location, such as a cloud storage or an encrypted file.

- Double-check for accuracy to ensure no important details are missed.

This editing feature for extracting data from Legal California Mortgage Satisfaction Forms may be needed when you are managing a large volume of documents or preparing records for audits.

Related Searches

This will acknowledge and document, that the previously obtained mortgage has been paid in full and there is no longer a lien on the property. Required ... Recording Satisfaction: A certificate of the discharge of a mortgage, and the proof or acknowledgment thereof, must be recorded in the office of the county ... A Satisfaction of Mortgage form provides confirmation that the borrower has paid back the lender and satisfied the terms of the mortgage ... 2941. (a) Within 30 days after any mortgage has been satisfied, the mortgagee or the assignee of the mortgagee shall execute a certificate of the discharge ... Find information about the property document recording process including important paperwork and essential forms. Proof a lien was released. Contact the county where the lien was recorded, removed, or released to get a copy of the recorded release. The Short Form contains the loan-specific information (e.g., borrower name, lender name, loan amount, description of property, etc.) and identifies the ... The lender will record the Deed of Trust or Mortgage document in the public records with the appropriate agency in the county where the property is located. The quickest way we will release a Notice of State Tax Lien is for you to pay 7 your liened tax debt in full (including interest, penalties, and fees). We will ... A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.