Extract Data From Legal Massachusetts Startup For S-Corporation Forms For Free

How it works

-

Import your Massachusetts Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Massachusetts Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Extract Data From Legal Massachusetts Startup For S-Corporation Forms For Free

Online document editors have proved their reliability and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Extract Data From Legal Massachusetts Startup For S-Corporation Forms For Free your documents any time you need them, with minimum effort and greatest accuracy.

Make these simple steps to Extract Data From Legal Massachusetts Startup For S-Corporation Forms For Free online:

- Import a file to the editor. You can choose from several options - upload it from your device or the cloud or import it from a form library, external URL, or email attachment.

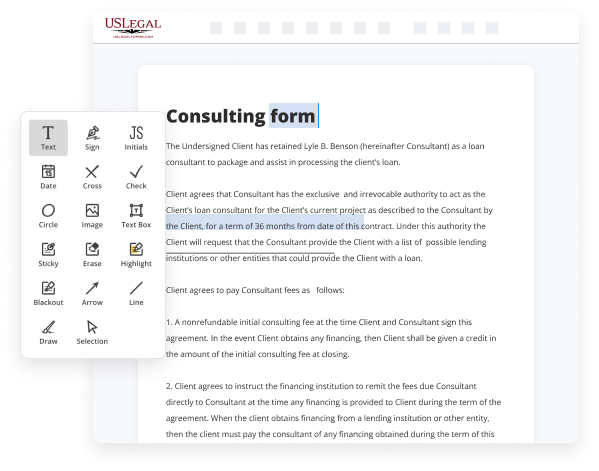

- Complete the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and symbols, highlight significant components, or remove any unnecessary ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if neccessary. Utilize the right-side toolbar for this, drop each field where you expect others to provide their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Remove sheets you don’t need any longer or create new ones making use of the appropriate key, rotate them, or change their order.

- Create electronic signatures. Click on the Sign tool and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any individual or business legal documentation in minutes. Give it a try today!

Benefits of Editing Massachusetts Startup For S-Corporation Forms Online

Top Questions and Answers

A business corporation will only file a separate Form 355 or 355S to calculate its non-income measure of excise tax, if its year ends at a different time than the common year used to determine the combined group's income.

Video Guide to Extract Data From Legal Massachusetts Startup For S-Corporation Forms For Free

How to file your taxes as an S corporation let's talk about it because becoming Wayne can be an excellent way to avoid some self-employment taxes and even bring on some investors however when you become a corporation then you're stepping into more Advanced Tax territory if you will and too many business owners are electing for S Corp status

Without knowing what to do or how it will impact them so in this video what I want to do is talk about how s corporations actually work how to elect to become an S corporation how to file your tax return as an S corporation owner and much more like how to stay compliant some important tax deadlines and

Related Features

Tips to Extract Data From Legal Massachusetts Startup For S-Corporation Forms For Free

- Gather all relevant documents related to your startup, including articles of incorporation and operating agreements.

- Ensure you have the latest version of the S-Corporation Form (1120S) to avoid any discrepancies.

- Review state-specific guidelines for Massachusetts regarding S-Corporations to ensure compliance.

- Consult with a legal professional who specializes in corporate law to assist with any complex issues.

- Utilize data extraction tools or software to streamline the extraction of information from your documents.

- Double-check all extracted data for accuracy to prevent mistakes in your filing.

- Keep records organized and easily accessible for future reference or audits.

You may need this editing feature when preparing to submit S-Corporation Forms to ensure all data is correct and compliant with both state and federal regulations.

Related Searches

4 days ago ? Learn about resources, funding opportunities, tax obligations, and the required steps for starting your business. Learn which taxpayers are eligible and ineligible to own shares in an S corporation. Filing requirement and Financial Institution ... To request a direct deposit of the corporation's income tax refund into an account at a U.S. bank or other financial institution, attach Form ... See the instructions for line 35 for details on how to pay any tax the corporation owes. Contributions to reduce debt held by the public are ... Types of corporations and how to incorporate your startup · 1. Sole proprietorship · 2. Limited Liability Company (LLC) · 3. S Corporations (S corps) · 4. C ... If your business is an LLC, corporation, partnership, or nonprofit corporation, you'll need a registered agent in your state before you file. A ... Legal forms · Legal form-building software · Legal data & document management · Data management · Data-driven insights · Document management · Document storage ... Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. The S corporation is a corporation that has elected a special tax status with the IRS and therefore has some tax advantages. Both business structures get their ... All forms will also be unavailable during this time to allow for the fees to be updated. Washington Secretary of State. Search. Search. Menu. Corporations ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.