Fill Out Legal New Mexico Independent Contractors Forms For Free

How it works

-

Import your New Mexico Independent Contractors Forms from your device or the cloud, or use other available upload options.

-

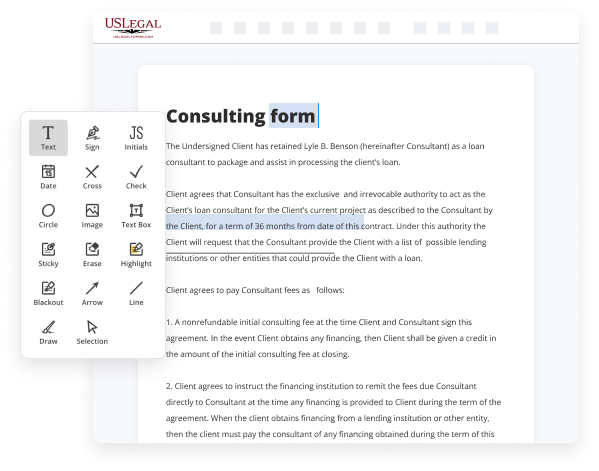

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your New Mexico Independent Contractors Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Fill Out Legal New Mexico Independent Contractors Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the simplest way to Fill Out Legal New Mexico Independent Contractors Forms For Free and make any other critical changes to your forms is by handling them online. Take advantage of our quick and secure online editor to fill out, modify, and execute your legal paperwork with highest effectiveness.

Here are the steps you should take to Fill Out Legal New Mexico Independent Contractors Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Fill out empty fields utilizing the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make sure you’ve filled in everything. Accentuate the most significant facts with the Highlight option and erase or blackout fields with no value.

- Modify and rearrange the template. Use our upper and side toolbars to change your content, drop extra fillable fields for different data types, re-order pages, add new ones, or delete unnecessary ones.

- Sign and request signatures. No matter which method you select, your eSignature will be legally binding and court-admissible. Send your form to others for approval using email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed paperwork to the cloud in the file format you need, print it out if you prefer a physical copy, and select the most suitable file-sharing method (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as fast and more successfully. Try it out now!

Benefits of Editing New Mexico Independent Contractors Forms Online

Top Questions and Answers

Becoming an Independent Contractor Working as an Independent Contractor. Decide on Your Business Structure. Apply for a Tax ID Number and Other Tax Registrations. Register Your Business Name. Open Your Business Checking Account. Set up Your Business Record Keeping System. Frequently Asked Questions.

Video Guide to Fill Out Legal New Mexico Independent Contractors Forms For Free

Hey everyone chad pavel cpa here the big question i often get from first-time entrepreneurs very very very very often is how do i pay myself and how do i pay taxes on a single member llc all right so this is your first time opening a business if you've never run an llc before you've never had a tax

Return and you're just thinking about how do i actually pay myself and how do i make sure that i'm keeping track of all the profit and loss how do i pay taxes i don't want to have penalties and interest how do i stay on top of all this stuff so you're definitely asking yourself the right question so

Tips to Fill Out Legal New Mexico Independent Contractors Forms For Free

- Read the instructions carefully before starting to fill out the forms.

- Ensure you have all necessary information such as names, addresses, and tax identification numbers.

- Double-check that the classification of independent contractor is appropriate for your situation.

- Provide a clear description of the services to be performed by the contractor.

- Include payment details, such as rate and method of payment.

- Review the form for any errors or missing information before submitting it.

- Keep a copy of the completed form for your records.

You may need this editing feature for filling out the Legal New Mexico Independent Contractors Forms if you realize there are mistakes or missing information after you have initially submitted the forms.

Related Searches

Oct 3, 2023 — Download our New Mexico independent contractor agreement so you can define the relationship between a client and a contractor. In New Mexico, pay received by independent contractors is subject to gross receipts tax unless a statutory exemption or deduction applies to a transaction. New Mexico Self-Employed Independent Contractor Agreement US Legal Forms provides access to the biggest catalogue of fillable templates in Word and PDF ... Comply with all legal and tax requirements, including filing necessary tax forms (e.g., IRS Form 1099-NEC in the United States) and adhering to employment ... A Q&A guide to state law on independent contractor status for private employers in New Mexico. This Q&A addresses how independent contractors are classified ... The agreement provides a written record for financial and legal purposes, and ensures that both parties will uphold their agreed commitments. FREE INDEPENDENT ... Nov 15, 2021 — Fill & Sign Click to fill, edit and sign this form now! ... A New Mexico independent contractor agreement is a legal document used to outline the ... Jul 13, 2016 — For example, in New Mexico, pay received by independent contractors is subject to gross receipts tax unless a statutory exemption or deduction ... The New Hire Directory welcomes Independent Contractor reports, however, employers are not required by law to submit them. The IRS provides strict guidelines on ... You can register LLCs online, but partnerships and corporations registration forms must be completed and submitted via mail or in person. Please visit the pages ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.