Highlight In Legal Indiana Loans Lending Forms For Free

How it works

-

Import your Indiana Loans Lending Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

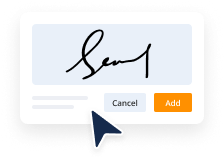

Sign your Indiana Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Highlight In Legal Indiana Loans Lending Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the simplest way to Highlight In Legal Indiana Loans Lending Forms For Free and make any other critical changes to your forms is by managing them online. Take advantage of our quick and trustworthy online editor to fill out, modify, and execute your legal documentation with greatest productivity.

Here are the steps you should take to Highlight In Legal Indiana Loans Lending Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

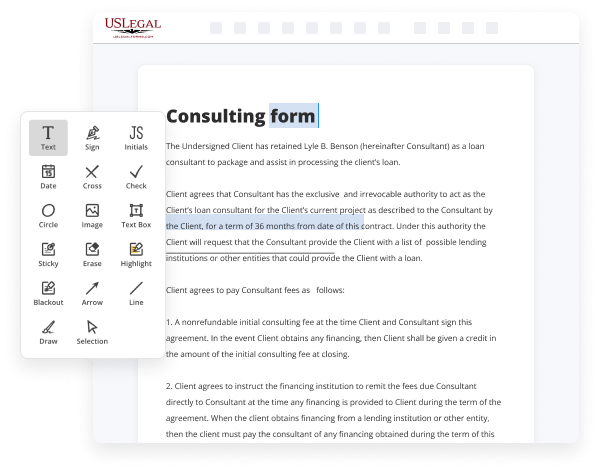

- Provide the required information. Complete blank fields utilizing the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make certain you’ve completed everything. Point out the most important details with the Highlight option and erase or blackout fields with no value.

- Modify and rearrange the form. Use our upper and side toolbars to change your content, place additional fillable fields for various data types, re-order sheets, add new ones, or delete redundant ones.

- Sign and collect signatures. Whatever method you choose, your eSignature will be legally binding and court-admissible. Send your form to others for approval using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the file format you need, print it out if you prefer a physical copy, and choose the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more successfully. Try it out now!

Benefits of Editing Indiana Loans Lending Forms Online

Top Questions and Answers

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Video Guide to Highlight In Legal Indiana Loans Lending Forms For Free

It was a perfect storm that would rob millions of Americans of jobs and homes and savings that they had worked a lifetime to build in fact most Americans who've known economic hardship these past several years they don't think about the collapse of Lehman Brothers when they think about the recession instead they recall the day they got the

Pink slip economic empowerment in our community can mean a lot of things one of the areas in the focused on bankruptcies is primarily to consumer a chapter a chapter 7 is what they call like a new start people who also qualify chapter 13s or when they make too much money to do a chapter 7 but they want

Related Features

Tips to Highlight In Legal Indiana Loans Lending Forms For Free

- Read through the entire form carefully before highlighting.

- Use a bright, contrasting highlighter color to make important sections stand out.

- Highlight key terms such as interest rates, loan amounts, and fees.

- Focus on sections that require your attention or signature.

- Avoid highlighting too much text; stick to vital information.

- Use symbols or shorthand notes in the margins to remind you of important points.

- Consider using sticky notes for additional comments without marking the form directly.

This editing feature for highlighting in Legal Indiana Loans Lending Forms may be needed when you are preparing for a meeting with your lender or when you need to review the document thoroughly before signing.

Related Searches

Are you looking for a loan agreement form in Indiana? Download our free Indiana Loan Agreement Form which is available as PDF or Word documents. The NMLS checklists for principal manager and mortgage loan originator licenses provide an overview of the filing requirements. All required forms and items ... Access to consumer credit applications, registration form and information for the following activities: Loan Licenses; Civil Proceeding Advance Payments; Small ... A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be ... What are Loan Documents? Loan documents are documents provided and requested by lenders for the purpose of providing a loan. They are typically statements ... Document Type: Forms | Location: 16 States. ALTA Short Form Commitment (for an ALTA Short Form Residential Loan Policy Schedule A, BI, BII) (7-1-21). Document ... This program assists low- and very-low-income applicants obtain decent, safe and sanitary housing in eligible rural areas by providing payment assistance to ... The core business of a banking company is to lend money in the form of loans and advances. Lending may be for short term or medium term or long term ... MU2016006 - RATES AND/OR FORMS UPDATE - ALTA Expanded Coverage Residential Loan ... ALTA Endorsement 45-06 (Pari Passu Mortgage - Loan Policy). Document Type ... Students are encouraged to apply for these funding opportunities through the IU McKinney School of Law. For more information on types of awards available and ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.