Make Legal Connecticut Startup For Sole Proprietorship Forms For Free

How it works

-

Import your Connecticut Startup For Sole Proprietorship Forms from your device or the cloud, or use other available upload options.

-

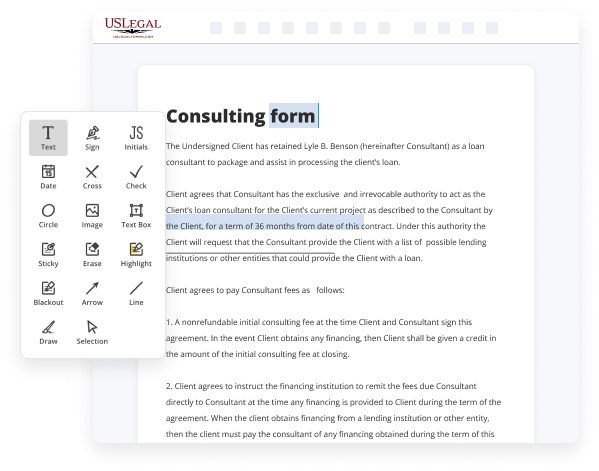

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Connecticut Startup For Sole Proprietorship Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Make Legal Connecticut Startup For Sole Proprietorship Forms For Free

Legal paperwork requires maximum precision and timely execution. While printing and completing forms often takes considerable time, online PDF editors demonstrate their practicality and effectiveness. Our service is at your disposal if you’re searching for a reputable and straightforward-to-use tool to Make Legal Connecticut Startup For Sole Proprietorship Forms For Free rapidly and securely. Once you try it, you will be surprised how effortless working with official paperwork can be.

Follow the instructions below to Make Legal Connecticut Startup For Sole Proprietorship Forms For Free:

- Upload your template via one of the available options - from your device, cloud, or PDF catalog. You can also obtain it from an email or direct URL or through a request from another person.

- Use the top toolbar to fill out your document: start typing in text fields and click on the box fields to mark appropriate options.

- Make other essential adjustments: add images, lines, or symbols, highlight or delete some details, etc.

- Use our side tools to make page arrangements - add new sheets, alter their order, delete unnecessary ones, add page numbers if missing, etc.

- Add more fields to your document requesting different types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if things are true and sign your paperwork - create a legally-binding eSignature the way you prefer and place the current date next to it.

- Click Done once you are ready and choose where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with other people or send it to them for signature via email, a signing link, SMS, or fax. Request online notarization and obtain your form promptly witnessed.

Imagine doing all the above manually on paper when even one error forces you to reprint and refill all the details from the beginning! With online services like ours, things become considerably easier. Give it a try now!

Benefits of Editing Connecticut Startup For Sole Proprietorship Forms Online

Top Questions and Answers

Yes, correct. They are a non-citizen doing their best to survive the draconian process of immigration in this country. They fly under the radar until one day they can obtain their green card. If you are a legal permanent resident(green card holder), you may operate a sole proprietorship just like any citizen.

Video Guide to Make Legal Connecticut Startup For Sole Proprietorship Forms For Free

Hi everyone I'm attorney Aiden Durham with 180 Loco in Colorado welcome back to all up in your business where today I'm going to tell you about six pretty common mistakes that you're going to want to avoid if you are forming or already operating as a single member LLC but first of course please do subscribe if you haven't

Already be sure to click that little bell so you get notified anytime I post a new video and you can check the description for links to some additional information and resources and while I am a lawyer I am not your lawyer the stuff I talk about in my videos isn't a substitute for actual legal advice if you

Tips to Make Legal Connecticut Startup For Sole Proprietorship Forms For Free

- Choose a suitable business name that complies with Connecticut's naming rules.

- Register your business name with the appropriate state agencies if it's different from your legal name.

- Obtain any necessary permits or licenses for your business type.

- Open a separate business bank account to keep your personal and business finances separate.

- Keep accurate records of all business transactions and expenses.

- Consider getting liability insurance to protect your business and personal assets.

You may need to edit your Make Legal Connecticut Startup For Sole Proprietorship Forms when you change your business name, add new services, or if your business location changes.

Related Searches

There is no form to file to start a Sole Proprietorship. Simply by engaging in activities with the goal of making money, you are operating as a Sole Proprietor. However, if you'd like to do business under a name besides your first and last name, you'll need to register a DBA (Doing Business As) Name.Dec 1, 2022 In Connecticut, you can establish a sole proprietorship without filing any legal documents with the Connecticut state government. Though no action is required ... How to set up a sole proprietorship in Connecticut. 1. Choose your business name. Connecticut law allows you to operate a sole proprietorship ... forms. There is ... Sep 14, 2022 — Thinking about starting a business in Connecticut? Our guide will have your new venture up and running in the Constitution State in 8 steps. Feb 8, 2020 — Least Costly to Form. Because of its simplicity, there is no need to create and file the legal documents generally recommended for partnerships ... Connecticut law requires annual report filings for all corporations, nonstock corporations, limited liability companies, limited liability partnerships and ... In just a few short steps the tool will generate a personalized checklist that will guide you through the entire startup process - from registration to taxes to ... Protect your profession and assets as a Sole Proprietor in Connecticut. Navigating legal compliance and trade name registration can be complex and risky. If your company is a nonprofit, you'll need to submit a Certificate of Incorporation, but your filing fee is only $50. All of the above filings can be completed ... The vast majority of small businesses start out as sole proprietorships. One ... Federal Tax Forms for Sole Proprietorship. (only a partial list and some may ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.