Make Notes On Legal Oregon Accounting Forms For Free

How it works

-

Import your Oregon Accounting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Oregon Accounting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Make Notes On Legal Oregon Accounting Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Make Notes On Legal Oregon Accounting Forms For Free and make any other essential changes to your forms is by handling them online. Select our quick and secure online editor to complete, adjust, and execute your legal paperwork with highest efficiency.

Here are the steps you should take to Make Notes On Legal Oregon Accounting Forms For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload pane, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

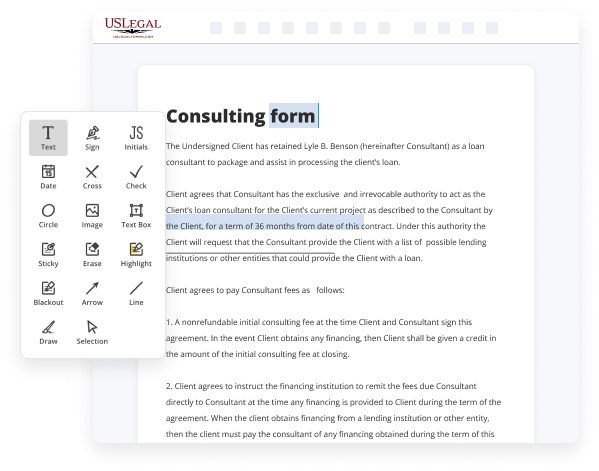

- Provide details you need. Complete empty fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to ensure you’ve filled in everything. Point out the most important facts with the Highlight option and erase or blackout areas with no value.

- Modify and rearrange the form. Use our upper and side toolbars to change your content, place additional fillable fields for various data types, re-order sheets, add new ones, or delete unnecessary ones.

- Sign and request signatures. No matter which method you select, your electronic signature will be legally binding and court-admissible. Send your form to other people for signing through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed paperwork to the cloud in the format you need, print it out if you require a hard copy, and choose the most appropriate file-sharing method (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as fast and more properly. Give it a try now!

Benefits of Editing Oregon Accounting Forms Online

Top Questions and Answers

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

Video Guide to Make Notes On Legal Oregon Accounting Forms For Free

Laws dot-com legal forms guide form 20i Oregon corporation income tax return corporations which derive Oregon income without technically doing business in the state filed their state income tax return owed with a form xx I this document can be obtained from the website of the state of Oregon step 1 the top of the form requires you to give

Your business name address and tax identification numbers step 2 if filing under a new name or from a new address indicate this with a check mark step 3 enter your phone number step 4 indicated with a check mark the type of return being filed step 5 questions a through D should only be completed by corporations filing with

Tips to Make Notes On Legal Oregon Accounting Forms For Free

- Understand the purpose of each form before making notes.

- Use clear and concise language for easy reference later.

- Highlight important sections to draw attention.

- Use bullet points for clarity and organization.

- Make notes in the margins or use sticky notes for flexibility.

- Regularly review and update notes as needed to keep them relevant.

- Consider using symbols or codes to quickly convey ideas.

This editing feature for making notes on Legal Oregon Accounting Forms may be needed when you are preparing for audits, organizing your financial records, or discussing your accounts with a professional.

Related Searches

Forms · Licensees. License Application Requirements · Licensing Forms · Licensee Information · Exam and Candidates. CPA Exam Information · Firms. Firm Registration ... [NOTE: This form illustrates the accounting format required by UTCR 9.160. Each accounting must also comply with all other applicable statutes and court ... A landlord may note the imposition of a late charge on a nonpayment of rent termination notice under ORS 90.394, so long as the notice states or otherwise makes ... All forms of accounts which may be prescribed by the commission shall conform as ... Note: Section 9, chapter 807, Oregon Laws 2007, provides: Sec. 9. (1) ... Interest on Lawyer Trust Accounts (IOLTA) Reporting FAQ · 1. Why do I need to complete an Annual IOLTA Reporting Form? · 2. Who needs to complete this form? · 3. View requirements for completing an undergraduate accounting degree at the UO Lundquist College of Business. Example Oregon Court Forms · Answer to a Residential Eviction · Answer and Affidavit of Mailing (Deschutes) · Defendant's Answer - Complaint for Return of Personal ... [86] Providing nonexempt public records under the Oregon Public Records Law is a governmental activity covered by the ADA. Thus, when making public records ... I. GENERAL. A. Accounts must be filed with the Commissioner of Accounts. Ask the Commissioner how many copies are required to be filed. The notice must be in writing in a special legal form. The notice must explain the reason for termination, and it must be delivered personally to the tenant ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.