Mark Required Fields In Legal Assignment Mortgage Templates For Free

How it works

-

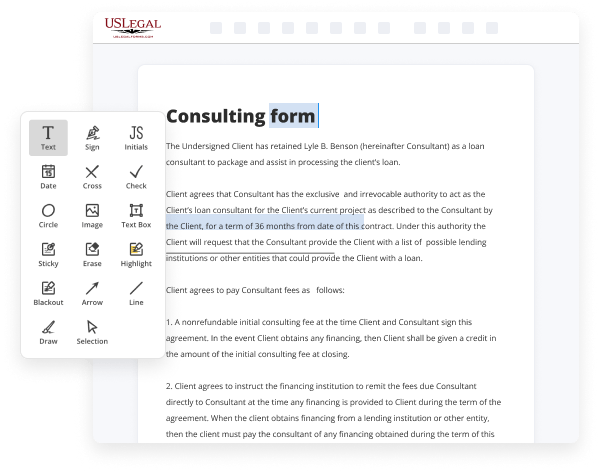

Import your Assignment Mortgage Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Assignment Mortgage Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Mark Required Fields In Legal Assignment Mortgage Templates For Free

Online document editors have demonstrated their reliability and effectiveness for legal paperwork execution. Use our safe, fast, and straightforward service to Mark Required Fields In Legal Assignment Mortgage Templates For Free your documents any time you need them, with minimum effort and highest precision.

Make these quick steps to Mark Required Fields In Legal Assignment Mortgage Templates For Free online:

- Upload a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Place the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted images, draw lines and icons, highlight significant parts, or erase any pointless ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if required. Utilize the right-side toolbar for this, place each field where you expect others to provide their details, and make the rest of the fields required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones while using appropriate button, rotate them, or change their order.

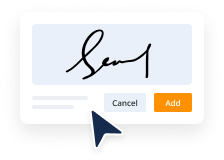

- Generate eSignatures. Click on the Sign option and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or convert it as you need.

And that’s how you can prepare and share any individual or business legal documentation in minutes. Give it a try today!

Benefits of Editing Assignment Mortgage Forms Online

Top Questions and Answers

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

Video Guide to Mark Required Fields In Legal Assignment Mortgage Templates For Free

Welcome to county office your ultimate guide to local government services and public records let's get started can I assume someone else's mortgage assuming a mortgage means taking over the payments and obligations of an existing loan this can be an appealing option for buyers however not all mortgages are assumable lenders typically include a do on sale clause in

Mortgage agreements this Clause allows them to demand full repayment if the property is sold or transferred it is essential to check the mortgage documents for such Clauses some government-backed loans like FHA and VA loans may allow for assumption these loans often have specific guidelines that facilitate the process always verify the terms directly with the lender the creditworthiness

Tips to Mark Required Fields In Legal Assignment Mortgage Templates For Free

- Use asterisks (*) next to required fields to clearly indicate them.

- Include a legend or key at the beginning of the template to explain what the asterisks mean.

- Highlight required fields in a different color or font style to make them stand out.

- Consider using a bold font for required fields to increase visibility.

- Ensure that the instructions or guidelines on how to fill out the template include information about the required fields.

Editing the template to mark required fields in a mortgage assignment document is important to ensure that all necessary information is provided by the parties involved. This feature may be needed when creating standardized templates for legal assignments to streamline the process and reduce errors in documentation.

Related Searches

5 days ago ? Insert Mandatory Field into the Assignment Of Mortgage and eSign it in minutes ... Create reusable templates for commonly used documents. Insert Mandatory Field from the Assignment Of Mortgage and eSign it in minutes ... Generate reusable templates for commonly used files. Provide the legal description of the property being assigned, including the address and any relevant parcel or lot numbers. 03. Include the original mortgage ... A mortgage deed template is a standardized legal document that outlines the terms and conditions of a mortgage agreement between a lender and a borrower. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the ... A collateral assignment of project documents for a construction loan. This Standard Document assigns to the construction lender as additional security the ... These documents are used by the lenders to evaluate whether or not they will provide you with a loan. Loan documents are necessary to initiate a loan approval ... Federally related mortgage loans? are also defined to include installment sales contracts, land contracts, or contracts for deeds on otherwise qualifying ... Document warranties relate to legal documents used for a mortgage, such as security instruments, notes, and assignments. Documents required to certify a Mortgage originated with a NY CEMA include a new original Consolidated Note and the NY CEMA with all Exhibits and assignments:

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.