Prepare Legal Fair Credit Reporting Templates For Free

How it works

-

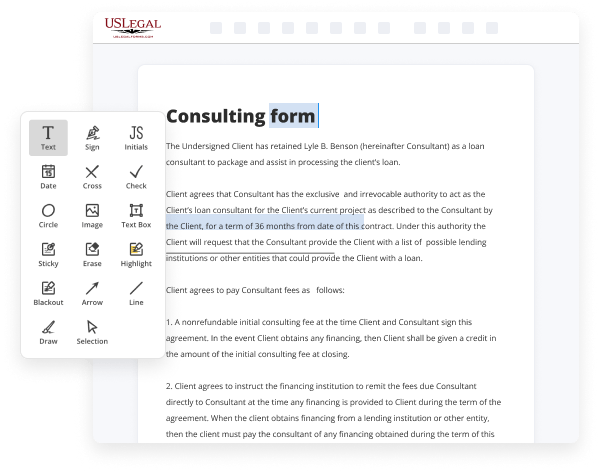

Import your Fair Credit Reporting Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Fair Credit Reporting Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Prepare Legal Fair Credit Reporting Templates For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the easiest way to Prepare Legal Fair Credit Reporting Templates For Free and make any other critical adjustments to your forms is by managing them online. Choose our quick and trustworthy online editor to fill out, edit, and execute your legal documentation with maximum efficiency.

Here are the steps you should take to Prepare Legal Fair Credit Reporting Templates For Free quickly and effortlessly:

- Upload or import a file to the editor. Drag and drop the template to the upload pane, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide the required information. Complete empty fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make certain you’ve filled in everything. Accentuate the most important details with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to change your content, place extra fillable fields for various data types, re-order pages, add new ones, or remove unnecessary ones.

- Sign and request signatures. No matter which method you choose, your eSignature will be legally binding and court-admissible. Send your form to others for signing through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the file format you need, print it out if you require a hard copy, and select the most suitable file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to prepare legal documents manually. Save time and effort executing them online twice as quickly and more effectively. Try it out now!

Benefits of Editing Fair Credit Reporting Forms Online

Top Questions and Answers

Examples of permissible purposes include subpoenas or court orders, written instructions from the consumer, credit transactions with a consumer, employment purposes with written authorization from a consumer, insurance underwriting purposes, tenant screening, and national security investigations.

Video Guide to Prepare Legal Fair Credit Reporting Templates For Free

All right listen let's talk about consumer law i want to talk about the fbcpa the fair debt collection practice is at which is 15 usc 1692 specifically we're talking about the harassment section harassment or abuse i want to talk about 1692 p number one it says the use or threat of use of violence or other criminal means

To harm the physical person reputation or property of any person so when it comes to harassment or abuse section you got to understand that if a debt collector is basically using any threat against you which is dependent upon you the consumer because to me if you're saying i owe with debt that's technically um that's technically a threat

Related Features

Tips to Prepare Legal Fair Credit Reporting Templates For Free

- Review the Fair Credit Reporting Act (FCRA) regulations and guidelines to understand the requirements for reporting credit information

- Include all necessary information in the template such as consumer information, creditor information, credit history, and any disputes

- Ensure the template is clear, concise, and easy to understand for both consumers and creditors

- Consult with legal professionals to ensure the template complies with all relevant laws and regulations

- Regularly update the template to reflect any changes in laws or regulations regarding credit reporting

Editing features for Prepare Legal Fair Credit Reporting Templates may be needed when updating information or making changes to comply with new regulations or guidelines.

Related Searches

This guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete, and you ... Sample letters to dispute information on a credit report · Key terms · Learn more about credit reports and scores · Submit a complaint · Real stories about credit ... The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting ... The Fair Credit Reporting Act: Model Forms and Disclosures · Finance · Privacy and Security · Credit Reporting. FCRA Release Form Template ... The Fair Credit Reporting Act (FCRA) is a federal law that helps make sure information in consumer credit bureau ... Sample form to disclose to an applicant or employee that a background check will be conducted as required by the FCRA. A checklist of steps to comply with the federal Fair Credit Reporting Act when conducting employment background checks. This single credit bureau dispute letter has helped delete thousands of negative accounts & increase credit scores. Get your free copy here! Please consider this a formal request to investigate and correct the following inaccurate items on my credit report issued by your agency. These items must be ... The Fair Credit Reporting Act (FCRA) deals with the rights of consumers in relation to their credit reports and the obligations of credit reporting agencies.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.