Rearrange Pages In Legal Nebraska Startup For S-Corporation Forms For Free

How it works

-

Import your Nebraska Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Nebraska Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Rearrange Pages In Legal Nebraska Startup For S-Corporation Forms For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our safe, fast, and straightforward service to Rearrange Pages In Legal Nebraska Startup For S-Corporation Forms For Free your documents any time you need them, with minimum effort and greatest accuracy.

Make these simple steps to Rearrange Pages In Legal Nebraska Startup For S-Corporation Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a template catalog, external URL, or email attachment.

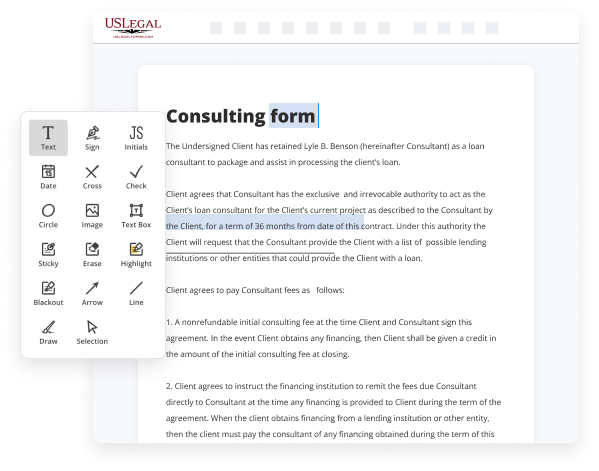

- Fill out the blank fields. Place the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted pictures, draw lines and signs, highlight significant components, or remove any pointless ones.

- Create additional fillable fields. Modify the template with a new area for fill-out if required. Utilize the right-side toolbar for this, place each field where you expect other participants to provide their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones utilizing the appropriate button, rotate them, or alter their order.

- Generate eSignatures. Click on the Sign tool and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other people for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any individual or business legal documentation in minutes. Try it now!

Benefits of Editing Nebraska Startup For S-Corporation Forms Online

Top Questions and Answers

What is the Nebraska nexus standard? Nebraska's income tax nexus standard is based on a taxpayer's economic presence in the state. Every corporate taxpayer, other than a financial institution, that is doing business in the state is subject to Nebraska corporate income tax.

Video Guide to Rearrange Pages In Legal Nebraska Startup For S-Corporation Forms For Free

Hi everyone thanks for tuning back into the simplify llc channel in this video we're going to discuss changing an llc to an s corp and give you the step-by-step instructions of how to get that done please make sure to hit that like button and press that bell icon to subscribe so that you can be notified when we

Push out more llc content like this one all right here we go so electing an s-corp status for your llc can mean federal tax advantages it's possible just make sure you follow the internal revenue service requirements don't worry this doesn't create a new business entity or change the legal structure of your business your business is still an

Tips to Rearrange Pages In Legal Nebraska Startup For S-Corporation Forms For Free

- Review the current order of the pages to understand the logical flow.

- Group related forms together to maintain consistency.

- Ensure that all required forms are included and in the correct order.

- Use tabs or markers to easily identify different sections.

- Double-check that the rearranged pages still adhere to legal requirements.

- Consider the sequence that best reflects the business's structure and operations.

- Test print the rearranged pages to ensure clarity and readability.

You may need to use this editing feature when you realize that the order of the forms doesn't make sense or if you're preparing for a submission and want to ensure everything is presented in the best way possible.

Related Searches

Use Form 22A for individual income tax name/address changes. Nebraska Change Request. You may fax this request to 402-471-5927, or mail it to: Nebraska ... We encourage the preparer of any Nebraska S Corporation Income Tax Return, Form 1120?SN, to review applicable Nebraska law regarding any issue that may have a ... Modify and rearrange the form. Use our upper and side toolbars to change your content, drop extra fillable fields for different data types, re-order sheets ... Our service is at your disposal if you're looking for a reliable and easy-to-use tool to Convert To Word Legal Nebraska Startup For S-Corporation Forms quickly ... Form an S Corp in Nebraska with this step-by-step guide. Name your business and start a NE S Corp today with ZenBusiness. Form an S Corp today providing limited liability protection to owners, offering special IRS tax status and more. Nebraska Forms and Instructions Individual Corporation S Corporation Partnership Fiduciary. E-file Info ? General Tax Return Info ? Filing ... Each trade or business the S corporation owns directly or indirectly. Use the QBI flowchart above to determine if an item is reportable as a QBI item or ... Generally, an S corporation must file Form 1120-S by the 15th day of the 3rd month after the end of its tax year. For calendar year corporations ... Forming an LLC and Electing Nebraska S Corp Tax Status · Step 1: Name Your Nebraska LLC · Step 2: Choose a Registered Agent · Step 3: File the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.