Reorder Legal Alabama Mortgage Satisfaction Forms For Free

How it works

-

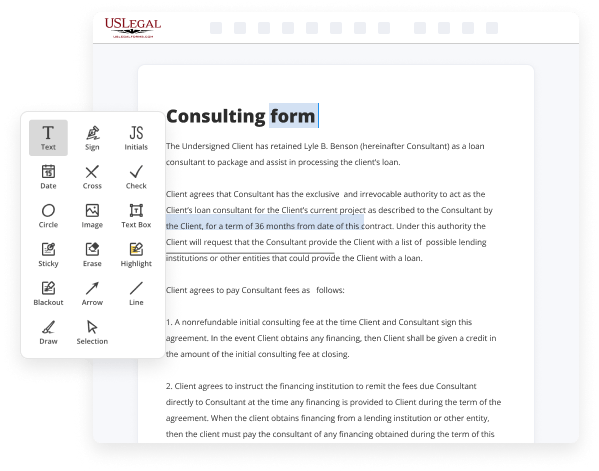

Import your Alabama Mortgage Satisfaction Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Alabama Mortgage Satisfaction Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Reorder Legal Alabama Mortgage Satisfaction Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the best way to Reorder Legal Alabama Mortgage Satisfaction Forms For Free and make any other essential updates to your forms is by managing them online. Take advantage of our quick and secure online editor to complete, adjust, and execute your legal documentation with maximum productivity.

Here are the steps you should take to Reorder Legal Alabama Mortgage Satisfaction Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use an alternative option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Fill out empty fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make certain you’ve completed everything. Accentuate the most significant facts with the Highlight option and erase or blackout fields with no value.

- Modify and rearrange the form. Use our upper and side toolbars to update your content, place additional fillable fields for different data types, re-order pages, add new ones, or remove redundant ones.

- Sign and request signatures. No matter which method you choose, your eSignature will be legally binding and court-admissible. Send your form to others for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished documentation to the cloud in the file format you need, print it out if you prefer a physical copy, and choose the most suitable file-sharing option (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more efficiently. Try it out now!

Benefits of Editing Alabama Mortgage Satisfaction Forms Online

Top Questions and Answers

You need to obtain a NOC from the registrar's office if the mortgage has already been recorded in order to have the lien released. Both the debtor and the bank representative must be present for this, therefore both parties must be present.

Video Guide to Reorder Legal Alabama Mortgage Satisfaction Forms For Free

A satisfaction of mortgage form is a document made by the owner of the mortgage or Mortgagey to acknowledge that the obligation regarding the mortgage between the parties has received full satisfaction or has been fully paid by the mortgager or debtor. Once the satisfaction of mortgage form is signed by the mortgage. The satisfaction of mortgage form is usually

Accompanied by the original mortgage instrument or a certified copy when presented for recording at the land registry or Country registry. A satisfaction of mortgage form will generally include the name of the mortgager and the mortgagey, the docket and page number, or the recording number of the mortgage, the total amount of the mortgage. Acknowledgment of the satisfaction and

Tips to Reorder Legal Alabama Mortgage Satisfaction Forms For Free

- Compile all necessary forms and documents in one place.

- Review the forms to determine the proper order for submission.

- Organize the forms according to their required sequence.

- Check for any missing or duplicate forms to avoid delays.

- Securely fasten the forms together to ensure they stay in order.

Editing the order of Legal Alabama Mortgage Satisfaction Forms may be needed when preparing documents for the closure of a mortgage loan or refinancing a property. It is important to reorder the forms accurately to ensure a smooth and efficient process.

Related Searches

Utilizing Alabama Satisfaction, Release or Cancellation of Mortgage by Corporation samples created by professional attorneys gives you the opportunity to avoid ... A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the ... THE STATE OF ALABAMA. COUNTY OF. Known All Men by These Presents, That, the undersigned acknowledges full payment of the indebtedness secured by that certain ... Using Alabama Satisfaction, Cancellation or Release of Mortgage Package templates made by skilled attorneys gives you the ability to prevent headaches when ... How to edit Satisfaction, Release or Cancellation of Mortgage by Individual - Alabama in PDF format online ... Working on paperwork with our extensive and ... Lender may require that Borrower pay such reinstatement sums and expenses in one or more of the following forms, as selected by Lender: (a) cash; (b) money ... Use these forms to finance residential property, condominiums, planned unit developments, vacant land, small commercial and rental property up to 4 units (more ... Download Mobile County Alabama Full Release of Mortgage Forms | Available for Immediate Download From Deeds.com. Mortgagee and the Lenders shall have all rights, remedies and recourses granted in the Credit Agreement and the other Credit Documents and available at law or ... Assignment: An assignment of mortgage must be in writing and recorded. 35-4-51. Demand to Satisfy: The Mortgagee (holder of the mortgage) must satisfy the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.