Reorder Legal North Dakota Loans Lending Forms For Free

How it works

-

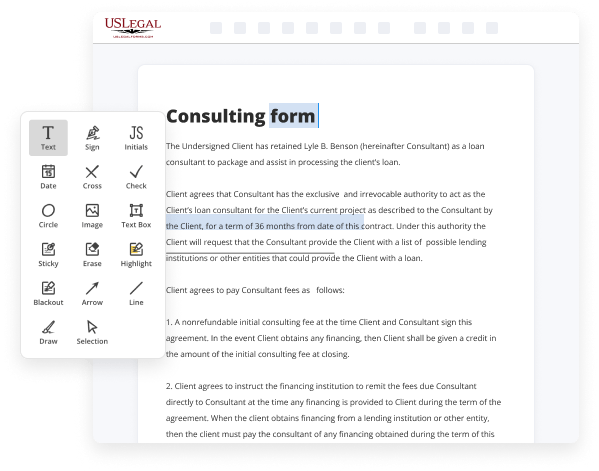

Import your North Dakota Loans Lending Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your North Dakota Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Reorder Legal North Dakota Loans Lending Forms For Free

Online PDF editors have proved their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Reorder Legal North Dakota Loans Lending Forms For Free your documents whenever you need them, with minimum effort and greatest accuracy.

Make these simple steps to Reorder Legal North Dakota Loans Lending Forms For Free online:

- Import a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary modifications. Update the form with inserted images, draw lines and symbols, highlight important elements, or remove any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if required. Use the right-side tool pane for this, drop each field where you want other participants to provide their details, and make the remaining areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones utilizing the appropriate button, rotate them, or alter their order.

- Create eSignatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any personal or business legal paperwork in minutes. Give it a try today!

Benefits of Editing North Dakota Loans Lending Forms Online

Top Questions and Answers

The grace period is a set period of time after you graduate, leave school, or drop below half-time enrollment before you must begin repayment on your loan. To determine the length of your grace period, check your promissory note. Learn more about beginning loan repayment.

Video Guide to Reorder Legal North Dakota Loans Lending Forms For Free

Love what you do um i was just curious how banks look at properties for non-resource out of state i'm in new york um i was just wondering how what they do for the building who builds us all right thank you bye okay i think it sound like you had some hammering going on you on a construction site

John um so john's question is about non-recourse financing and how do banks look at that out of state well first of all again at morris invest at our company we work with a number of banks that do non-recourse financing but we've built relationships with those banks over the years okay so these banks have like they look at

Tips to Reorder Legal North Dakota Loans Lending Forms For Free

- Review all existing lending forms to identify which ones need to be reordered.

- Create a master list of all lending forms outlining the desired order.

- Use a document management system to easily rearrange the forms electronically.

- Ensure the final order of lending forms complies with legal guidelines and regulations.

- Communicate any changes in the order of lending forms to relevant stakeholders.

Reordering Legal North Dakota Loans Lending Forms is crucial to maintain compliance and efficiency in the lending process. This editing feature may be needed when new forms are added, regulations change, or when revising the workflow of the lending process.

Related Searches

Beginning and Established Farmer Real Estate Loan Forms Beginning/Established Farmer Loan Application (PDF) Balance Sheet (PDF) The Department also licenses and regulates Money Brokers, Mortgage Loan ... The party listed in this Order has been provided the opportunity to request a hearing ... Here are the steps you should take to Add Tables To Legal North Dakota Loans Lending Forms quickly and effortlessly: Upload or import a file to the editor. Drag ... 35-03-05. Form of real estate mortgage. A mortgage of real property may be made in substantially the following form: NORTH DAKOTA STANDARD FORM. Forms. Return completed forms and required documentation via: Email: attach PDF copies of the documents and email to ndus.slsc@ndus.edu. NDCC 13-13-05 ? Every application for a residential mortgage loan servicer license or branch registration, or a renewal, must be made upon forms designated and ... Legal Forms and Guides. Need help filling out a form? Contact a lawyer and ask if the lawyer provides limited legal representation. Lawyers licensed to practice ... ... Form for any mortgage loan originated in that district after that time. The ... North Dakota (3035). Instructions · Standard form · Master form · Short form. Ohio ... Forms. Laws and Rules. List of Current Licensees. Forms. The following forms are ... Laws and Rules. South Dakota Codified Law (SDCL) 54-4 on Money Lending ... This program offers loan guarantees to lenders for their loans to rural businesses. What lenders may apply for this program? Lenders need the legal authority, ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.