Request Legal Vermont Equipment Lease Forms For Free

JUL 17TH, 2023

0

forms filled out

0

forms signed

0

forms sent

How it works

-

Import your Vermont Equipment Lease Forms from your device or the cloud, or use other available upload options.

-

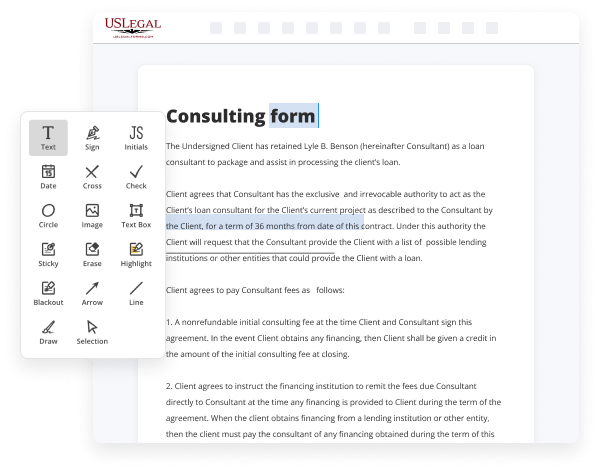

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Vermont Equipment Lease Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Request Legal Vermont Equipment Lease Forms For Free

Online document editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our safe, fast, and intuitive service to Request Legal Vermont Equipment Lease Forms For Free your documents any time you need them, with minimum effort and maximum accuracy.

Make these quick steps to Request Legal Vermont Equipment Lease Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Complete the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check features.

- Make your necessary edits. Update the form with inserted images, draw lines and symbols, highlight significant components, or erase any unnecessary ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if required. Utilize the right-side tool pane for this, place each field where you want other participants to provide their data, and make the rest of the fields required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need any longer or create new ones while using appropriate key, rotate them, or change their order.

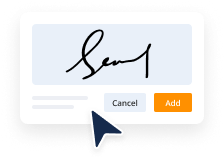

- Generate eSignatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or utilizing a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal paperwork in minutes. Give it a try today!

Benefits of Editing Vermont Equipment Lease Forms Online

Bank-level data security

Edit, sign, and keep your Vermont Equipment Lease Forms and other personal or business legal paperwork in the cloud without worries for your data safety. Entrust your documentation to a service that guarantees compliance to the highest data protection standards.

Extended editing opportunities

Manage your Vermont Equipment Lease Forms and any other legal paperwork easily and quickly like never before. Enjoy a user-friendly and feature-rich online document editor with all the tools you need right at hand. Make any adjustments in a few simple clicks.

Remote notarization

Authorize your legal forms with witnesses from anywhere, even on the go. Make a one-click request for a video call with an available notary, and once they verify your identity, eSign your form in real-time. Get an appropriate notary mark on your document within minutes.

Industry-compliant eSignatures

Sign your Vermont Equipment Lease Forms online instead of wasting time on printing and physical paperwork delivery. Create legally-binding and court-admissible electronic signatures in the way you prefer with a single click.

24/7 customer support

Our service is straightforward to work with and doesn't require you to read through multiple instructions to complete your tasks. Check our Help page and contact our support team whenever you need to resolve an issue and get your qualified assistance immediately.

Effective document collaboration

Work on your legal forms with your colleagues or other involved parties quickly and efficiently. Leave comments and annotations on changes you’ve made in a document, share it with others, and get their feedback immediately.

Top Questions and Answers

HOW IS THE TAX COMPUTED? The tax is imposed at the rate of 5% of the taxable net income. The tax shall not be less than $250. Only an unincorporated business with gross income in excess of $50,000 and adjusted net income in excess of $15,000 shall be subject to the Unincorporated Business Tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.