Rotate Legal California Independent Contractors Forms For Free

How it works

-

Import your California Independent Contractors Forms from your device or the cloud, or use other available upload options.

-

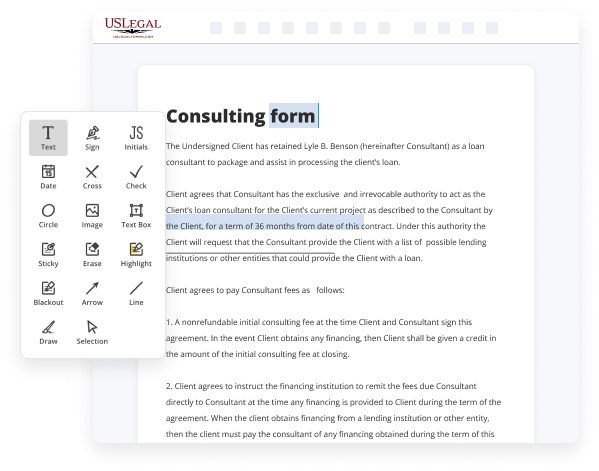

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your California Independent Contractors Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Rotate Legal California Independent Contractors Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the easiest way to Rotate Legal California Independent Contractors Forms For Free and make any other critical changes to your forms is by managing them online. Choose our quick and trustworthy online editor to complete, adjust, and execute your legal documentation with highest effectiveness.

Here are the steps you should take to Rotate Legal California Independent Contractors Forms For Free quickly and effortlessly:

- Upload or import a file to the service. Drag and drop the template to the upload pane, import it from the cloud, or use another option (extensive PDF catalog, emails, URLs, or direct form requests).

- Provide the required information. Fill out blank fields utilizing the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to make certain you’ve completed everything. Accentuate the most important facts with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to update your content, drop additional fillable fields for various data types, re-order sheets, add new ones, or delete unnecessary ones.

- Sign and request signatures. No matter which method you choose, your eSignature will be legally binding and court-admissible. Send your form to other people for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the file format you need, print it out if you require a hard copy, and choose the most suitable file-sharing method (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as quickly and more effectively. Give it a try now!

Benefits of Editing California Independent Contractors Forms Online

Top Questions and Answers

WHO MUST REPORT: Any business or government entity (defined as a ?Service-Recipient?) that is required to file a federal Form 1099-MISC for service performed by an independent contractor (defined as a ?Service-Provider?) must report.

Video Guide to Rotate Legal California Independent Contractors Forms For Free

Employee versus independent contractor a 21st century showdown in today's ever-shifting economy many job seekers are hesitant to ask too many questions during the interview process as they don't want to risk losing an employment opportunity however job seekers may be doing themselves a disservice by not clarifying whether the position is an employee or independent contractor position whether the

Prospect will be considered an employee or independent contractor has numerous impacts on various important employment characteristics such as wages taxes and withholdings fringe benefits behavior and relationships schedules and record-keeping first we need to define employee an independent contractor then we can examine the important differences between the classifications and the ramifications that incorrect classifications can have on both

Tips to Rotate Legal California Independent Contractors Forms For Free

- Ensure you have the most current version of the form before making any changes.

- Familiarize yourself with the specific clauses that need rotation and their implications.

- Use a reliable editing tool that supports PDF or document modification.

- Consider consulting with a legal expert to ensure compliance with California laws.

- Keep a backup of the original form for reference before making any edits.

This editing feature for Rotate Legal California Independent Contractors Forms may be needed during contract renewals or when there are significant changes in the terms of the agreement.

Related Searches

Free seminar for the Trucking/Motor Carrier Industry. Learn about AB 5 and how to determine if a worker is an independent contractor or employee. The "Application for Original Contractor License" is for new applicants for all business entity types, including limited liability companies, when experience ... Fill Independent Contractor Agreement California, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ? Instantly. Try Now! How do you define Independent Contractor in California? (California Labor Code). · The Assembly Bill 5 and the ABC Test · The Borello Test · AB5 Exemptions ? 2020 ... Click this link, then choose to search forms online at the Franchise Tax Board website. Enter ?587? in the forms menu: . What are the consequences of being misclassified as an independent contractor in CA? Call Ottinger Employment Lawyers for a case review. Forms and Associated Taxes for Independent Contractors · Form W-9 · Form 1099-NEC · Backup Withholding and Nonresident Alien Withholding · E-File ... The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions ... State requirements for independent contractor tax forms · Taxpayer identification number · Employer account number (if applicable in California) ... This automation replaces the paper Worker Status Evaluation Forms, Worker Information Request Worksheets, and Independent Contractor Agreements ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.