Send Via USPS PDF Fair Debt Credit Templates For Free

How it works

-

Import your Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

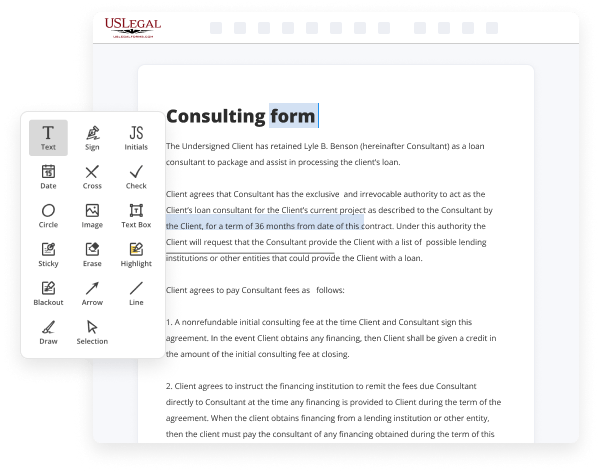

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

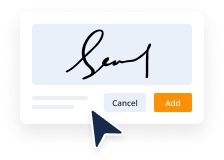

Sign your Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Send Via USPS PDF Fair Debt Credit Templates For Free

Are you tired of endless document printing, scanning, postal delivery, and spending precious time and resources with manual fill-out? The times have moved on, and the best way to Send Via USPS PDF Fair Debt Credit Templates For Free and make any other critical changes to your forms is by managing them online. Take advantage of our quick and trustworthy online editor to fill out, modify, and execute your legal documentation with highest efficiency.

Here are the steps you should take to Send Via USPS PDF Fair Debt Credit Templates For Free easily and quickly:

- Upload or import a file to the service. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Fill out empty fields using the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to make certain you’ve filled in everything. Accentuate the most significant details with the Highlight option and erase or blackout fields with no value.

- Adjust and rearrange the template. Use our upper and side toolbars to update your content, place extra fillable fields for different data types, re-order pages, add new ones, or delete unnecessary ones.

- Sign and request signatures. Whatever method you choose, your electronic signature will be legally binding and court-admissible. Send your form to other people for approval using email or signing links. Notarize the document right in our editor if it needs witnessing.

- Share and save the copy. Download or export your completed documentation to the cloud in the format you need, print it out if you require a hard copy, and select the most suitable file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as quickly and more properly. Give it a try now!

Benefits of Editing Fair Debt Credit Forms Online

Top Questions and Answers

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Video Guide to Send Via USPS PDF Fair Debt Credit Templates For Free

Under the Fair Debt Collection Practices Act, debt collectors are required to send you a written debt validation notice with information about the debt they are trying to collect. If a debt collector is trying to collect a debt, don’t ignore it. Time is of the utmost importance, so don’t ignore any letter from a debt collector. If you fail

To dispute it within thirty days, the debt collector has the right to assume the debt is valid and continue collection attempts. Do you want to start dispute the debt? Here is how to write a first dispute letter to a collection agency. Please, follow the link in the description to open the document form. Now, you can start to

Tips to Send Via USPS PDF Fair Debt Credit Templates For Free

- Ensure the PDF Fair Debt Credit template is correctly formatted and contains all necessary information.

- Save the PDF document to your computer before sending via USPS.

- Make sure the PDF file is less than 25MB in size to avoid any issues with delivery.

- Double-check the recipient's address and contact information before mailing.

- Consider using certified mail or return receipt services for added security and tracking.

- Include a cover letter or note explaining the purpose of the document to the recipient.

You may need to use the editing feature for Send Via USPS PDF Fair Debt Credit Templates when you need to update or customize the content of the document before sending it out. This can be useful for making changes to contact information, adding new details, or personalizing the message for the recipient.

Related Searches

Send this letter as soon as you can -- if at all possible, within 30 days of when a debt collector contacts you the first time about a debt. This is important ... A debt verification letter is a form used to confirm whether or not a debt is genuine. It is sent to a creditor or collection agency after ... A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. The right to know how the debt was incurred is guaranteed ... Unfair practices §809. Validation of debts §810. Multiple debts §811. Legal actions by debt collectors §812. Furnishing certain deceptive forms It is the purpose of this subchapter to eliminate abusive debt collection practices by debt collectors, to insure that those debt collectors who ... This letter tells the debt collector to stop contacting you unless they can show evidence that you are responsible for this debt. Stopping contact does not ... You should know that in either situation, the Fair Debt Collection ... A debt collector may contact you in person, by mail, telephone, telegram, or fax. Under the FDCPA and Regulation F, a ?debt collector? is defined as: ? Any person7 who uses any instrumentality of interstate commerce or mail in any business. The Fair Debt Collection Practices Act requires that debt collectors treat you fairly by prohibiting certain methods of debt collection. What debts are covered? All the debtor must do is send the collector a letter, or other written communication (such as an e-mail message), that includes the statement, ?I dispute the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.