Split Legal Debt Relief Templates For Free

How it works

-

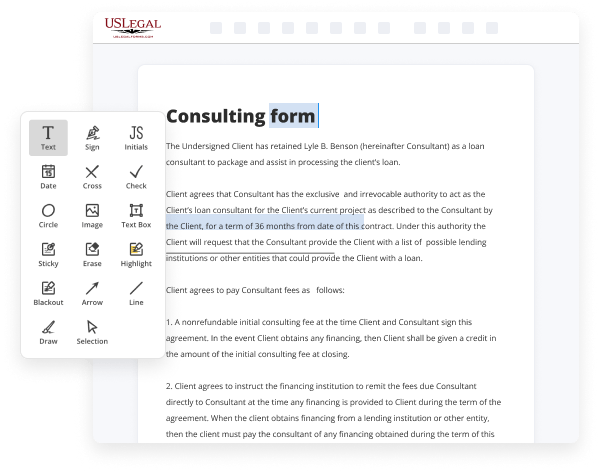

Import your Debt Relief Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Debt Relief Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal Debt Relief Templates For Free

Legal paperwork requires greatest precision and timely execution. While printing and filling forms out usually takes plenty of time, online document editors demonstrate their practicality and effectiveness. Our service is at your disposal if you’re looking for a trustworthy and straightforward-to-use tool to Split Legal Debt Relief Templates For Free quickly and securely. Once you try it, you will be surprised how effortless dealing with official paperwork can be.

Follow the guidelines below to Split Legal Debt Relief Templates For Free:

- Upload your template through one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or using a request from another person.

- Utilize the upper toolbar to fill out your document: start typing in text fields and click on the box fields to choose appropriate options.

- Make other necessary adjustments: insert pictures, lines, or icons, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, alter their order, delete unnecessary ones, add page numbers if missing, etc.

- Add more fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if things are correct and sign your paperwork - generate a legally-binding electronic signature the way you prefer and place the current date next to it.

- Click Done once you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with others or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and get your form promptly witnessed.

Imagine doing all the above manually in writing when even one error forces you to reprint and refill all the data from the beginning! With online solutions like ours, things become considerably easier. Try it now!

Benefits of Editing Debt Relief Forms Online

Top Questions and Answers

While debt settlement can eliminate outstanding obligations, it can negatively impact your credit score. Stronger credit scores may be more significantly impacted by a debt settlement. The best type of debt to settle is a single large obligation that is one to three years past due.

Video Guide to Split Legal Debt Relief Templates For Free

So if you're about to start missing payments or having late payments because you feel like the insurmountable debt that you owe to the credit card company can't possibly be paid watch this video so it dawned on me a few days ago that I've pretty much taught you guys everything I possibly can about how to pay your credit

Card bills the right way but those videos for me and people like me in this space typically revolve around people who don't have much debt on those credit cards so what about those of you who are maxed out on your credit cards and have no extra money each month to start paying those down you're pretty much on

Tips to Split Legal Debt Relief Templates For Free

- Break down the template into sections based on different types of legal debt relief strategies (e.g. bankruptcy, debt settlement, debt consolidation)

- Create separate templates for each type of legal debt relief strategy, including a brief overview, requirements, benefits, and risks

- Include placeholders for specific client information that may vary from case to case, such as debt amounts, creditors, and financial information

- Use headers, subheadings, and bullet points to clearly organize and categorize information within the templates

- Consider adding a table of contents or a navigation bar for easy access to different sections of the template

Editing features for Split Legal Debt Relief Templates may be needed when you want to customize the information for a specific client or case, or when you need to update the template with new laws or regulations related to debt relief. By breaking down the template into smaller, more manageable sections, you can easily make changes or additions without having to rewrite the entire document.

Related Searches

Below is a sample template letter to your creditors requesting that they accept reduced ... Learn how to get some debt relief from your credit cards. If you've got debts you can use our sample letter generator to write to your creditors. You can use the letter templates to tell your non-priority creditors ... You can also find useful samples and resources relating to debt on the Legal Aid NSW | Law Access website. 17.1 Sample budget. Tracking your income and spending ... Are you certain of your legal obligations? This Guide tells you how to comply with the new Rule and is designed to supplement the FTC's publication, Complying ... The sample letter below will help you to get details on the following: ... A debt collector may not have a legal obligation to provide some or all of the ... If you're struggling to resolve outstanding debts, consider writing a hardship letter. Examples of hardship letters will include an explanation of financial ... This fact sheet tells you how to offer your creditors a reduced sum to pay off your debt, rather than the full amount you owe. If the creditor agrees to ... Credgenics is India's leading Debt Collections platform. ... Legal workflow management ... Break down your borrowers by category and get a PTP. By P Borresen · Cited by 5 ? The role of a debt office depends on its debt management functions, such as the duties that laws and regulations assign to it, on ... You can also find useful samples and resources relating to debt on the Legal Aid NSW | Law Access website. 17.1 Sample budget. Tracking your income and spending ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.