Split Legal Illinois Fair Debt Credit Forms For Free

How it works

-

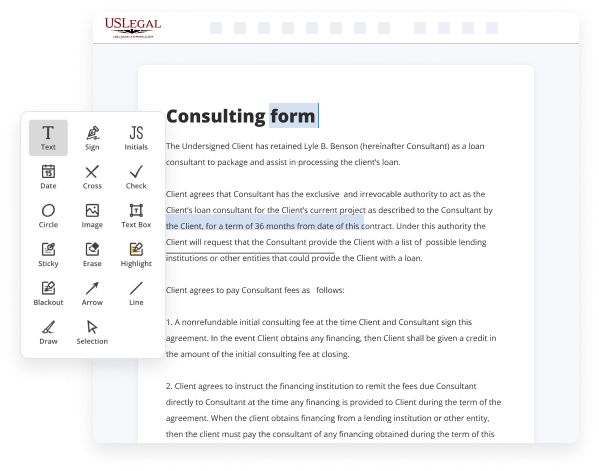

Import your Illinois Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Illinois Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal Illinois Fair Debt Credit Forms For Free

Are you tired of constant document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the simplest way to Split Legal Illinois Fair Debt Credit Forms For Free and make any other critical adjustments to your forms is by managing them online. Choose our quick and reliable online editor to fill out, edit, and execute your legal paperwork with greatest efficiency.

Here are the steps you should take to Split Legal Illinois Fair Debt Credit Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload pane, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide the required information. Fill out blank fields utilizing the Text, Check, and Cross tools from our top pane. Use our editor’s navigation to ensure you’ve filled in everything. Point out the most important details with the Highlight option and erase or blackout fields with no value.

- Adjust and rearrange the form. Use our upper and side toolbars to update your content, drop extra fillable fields for various data types, re-order pages, add new ones, or delete unnecessary ones.

- Sign and collect signatures. Whatever method you choose, your electronic signature will be legally binding and court-admissible. Send your form to others for signing using email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished paperwork to the cloud in the format you need, print it out if you prefer a hard copy, and select the most appropriate file-sharing method (email, fax, SMS, or sent by snail mail using the USPS).

With our service, you don’t have any more excuses to accomplish legal documents manually. Save time and effort executing them online twice as fast and more properly. Give it a try now!

Benefits of Editing Illinois Fair Debt Credit Forms Online

Top Questions and Answers

Briefly explain the situation that caused the error. Explain the steps you took to correct the issue and ensure it wouldn't happen again. Mention how it's negatively affecting you, like if it's hindering your ability to qualify for a mortgage. Ask for a ?goodwill adjustment? to have it removed.

Video Guide to Split Legal Illinois Fair Debt Credit Forms For Free

Foreign if you've been sued for a debt do you know how to get the court to dismiss the case I'm going to teach you how what you need to know is how to file a motion now a motion is just a formal request for the court to order something in this case you want to file a motion

To dismiss asking the court to dismiss the case if you check out .debtbrief.com we have four motions that you can use in your debt collection case and when you're drafting a motion you want to include four things number one the request the thing that you want the court to do number two the facts of your case number

Tips to Split Legal Illinois Fair Debt Credit Forms For Free

- Review the form carefully to identify sections that can be split into separate documents

- Use a PDF editing tool to split the form into smaller, more manageable sections

- Save each split section as a separate file for easy reference

- Ensure that each split section contains all necessary information and is clearly labeled

Editing features for splitting Legal Illinois Fair Debt Credit Forms may be needed when you want to separate different sections of the form for easier access or when certain sections need to be sent to different parties for review or processing.

Related Searches

People who owe money, or "debtors," are protected by a federal law called the Fair Debt Collection Practices Act (FDCPA). The law says what ... (225 ILCS 429/5) Sec. 5. Purpose and construction. The purpose of this Act is to protect consumers who enter into agreements with debt settlement providers ... Send this letter as soon as you can -- if at all possible, within 30 days of when a debt collector contacts you the first time about a debt. This is important ... Personal, family and household debts are covered under the Federal Fair Debt Collection Act. This includes money owed for medical care, charge accounts or car ... The City of Chicago is divided ... and regulations including, but not limited to, the Fair Debt Collection Act, the Illinois Collection Agency Act ... Specifically, this report examines (1) the protections provided consumers under federal and state laws related to credit card debt collection, ... Joint debt or marital debt are typically items such as auto loans, mortgage(s) and credit cards that which both parties are jointly responsible for. What an Illinois Debt Collector May Not Do When Collecting Debts · 10 years for written contracts, including mortgages. · Five years for oral ... By DA Edelman · 1996 · Cited by 2 ? The FDCPA is based on the premise. "[t]hat every individual, whether or not he owes the debt, has a right to be treated in a reasonable and civil manner."2 ... 320 provides that a collection agency cannot use forms of demand or notice or other documents drawn to resemble court process in collecting ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.