Split Legal Illinois Organizing Personal Assets Forms For Free

How it works

-

Import your Illinois Organizing Personal Assets Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Illinois Organizing Personal Assets Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal Illinois Organizing Personal Assets Forms For Free

Online PDF editors have demonstrated their trustworthiness and effectiveness for legal paperwork execution. Use our secure, fast, and user-friendly service to Split Legal Illinois Organizing Personal Assets Forms For Free your documents whenever you need them, with minimum effort and highest accuracy.

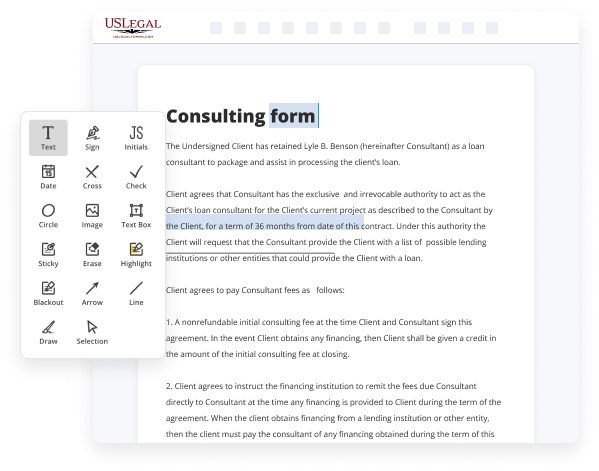

Make these quick steps to Split Legal Illinois Organizing Personal Assets Forms For Free online:

- Upload a file to the editor. You can select from a couple of options - upload it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

- Complete the blank fields. Place the cursor on the first empty field and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and symbols, highlight significant elements, or remove any pointless ones.

- Add more fillable fields. Modify the template with a new area for fill-out if required. Make use of the right-side toolbar for this, drop each field where you want others to leave their details, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need any longer or create new ones utilizing the appropriate key, rotate them, or change their order.

- Generate eSignatures. Click on the Sign option and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or transform it as you need.

And that’s how you can prepare and share any individual or business legal paperwork in clicks. Give it a try today!

Benefits of Editing Illinois Organizing Personal Assets Forms Online

Top Questions and Answers

Generally, an organization filing Form 990-T must make installment payments of estimated tax if its estimated tax (tax minus allowable credits) is expected to be $500 or more. Don't include the proxy tax when computing your estimated tax liability for 2022.

Video Guide to Split Legal Illinois Organizing Personal Assets Forms For Free

Hi my name is Chris Jackson I'm a business law attorney I've been one for over 25 years today we're going to go over how to create your own llc's operating agreement online I'm going to take you through the process step by step I'm going to answer the questions along the way so you can make a decision about

What to include and what not to include in the operating agreement at the end of this video you're going to be able to download that operating agreement right onto your computer for free and you're going to have an operating agreement ready to go for your LLC as you can see my dog Jax is sitting behind me on

Tips to Split Legal Illinois Organizing Personal Assets Forms For Free

- Gather all necessary financial documents such as bank statements, investment account statements, real estate deeds, and insurance policies.

- Create a separate folder or digital file for each asset category (e.g. bank accounts, retirement accounts, real estate).

- Label each form clearly with the type of asset it represents and update them regularly as needed.

- Consider using a spreadsheet or financial management software to track all assets and debts in one place.

- Consult with a legal professional or financial advisor for guidance on how to properly organize and categorize your assets.

Editing feature for Split Legal Illinois Organizing Personal Assets Forms may be needed when significant life changes occur, such as marriage or divorce, buying or selling property, or creating a will or trust. Keeping these forms updated and organized can help ensure your financial affairs are in order and easily accessible when needed.

Related Searches

Illinois is an equitable distribution state. So, when spouses are splitting assets in a divorce, marital property is not divided evenly between spouses. My office provides this booklet to assist you in the process of forming your own corporation, a procedure that sometimes can be complicated. My office provides this booklet to assist you in the process of forming your own Not-for-Profit Corporation, a procedure that sometimes can be complicated. Question #1 · any single block of stock, public bonds, or commodity futures worth $10,000 or more in one company (name only - NOT THE AMOUNT) · investment real ... You must file Form IL-1065, Partnership Replacement Tax Return, if you are a partnership (see ?Definitions to help you complete your. Form IL-1065?) and you ... Often it seems that protecting the owner's assets against the claims of personal creditors and against the claims of business creditors are competing interests. Tangible personal property ? Rents and royalties from tangible personal property are allocable to Illinois by multiplying the rents and royalties derived from ... The article discusses Series LLCs' definition, laws, benefits, drawbacks, and steps to form one in Illinois. ... divide the organization's control ... In short, yes. Household items do have to go through the probate process as they are considered probate assets with no explicit or individual title. Splitting Your Title To Your Home: With individual, single trusts for a married couple, your joint interest in your personal residence can be split into two ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.