Split Legal Ohio Corporations And LLC Forms For Free

How it works

-

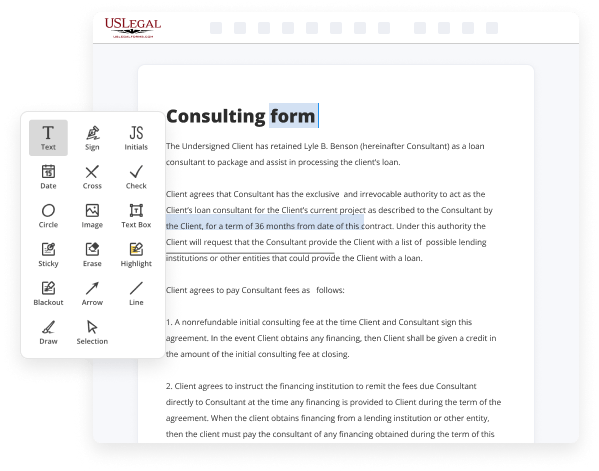

Import your Ohio Corporations And LLC Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Ohio Corporations And LLC Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal Ohio Corporations And LLC Forms For Free

Legal documentation requires greatest accuracy and prompt execution. While printing and completing forms normally takes plenty of time, online document editors demonstrate their practicality and effectiveness. Our service is at your disposal if you’re searching for a reputable and simple-to-use tool to Split Legal Ohio Corporations And LLC Forms For Free rapidly and securely. Once you try it, you will be surprised how simple dealing with formal paperwork can be.

Follow the guidelines below to Split Legal Ohio Corporations And LLC Forms For Free:

- Upload your template through one of the available options - from your device, cloud, or PDF catalog. You can also import it from an email or direct URL or using a request from another person.

- Make use of the top toolbar to fill out your document: start typing in text areas and click on the box fields to mark appropriate options.

- Make other required changes: add pictures, lines, or signs, highlight or remove some details, etc.

- Use our side tools to make page arrangements - add new sheets, change their order, remove unnecessary ones, add page numbers if missing, etc.

- Add extra fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Verify if everything is correct and sign your paperwork - create a legally-binding eSignature the way you prefer and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with others or send it to them for approval through email, a signing link, SMS, or fax. Request online notarization and get your form rapidly witnessed.

Imagine doing all the above manually on paper when even a single error forces you to reprint and refill all the details from the beginning! With online solutions like ours, things become considerably easier. Give it a try now!

Benefits of Editing Ohio Corporations And LLC Forms Online

Top Questions and Answers

As an LLC owner, you're required to pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes are complicated, so speak to your accountant or tax professional to make sure your Ohio LLC pays the correct amount to avoid fines and penalties.

Video Guide to Split Legal Ohio Corporations And LLC Forms For Free

Do you have an idea for a product or service or just want to be your own boss doing something you love starting your business is both an exciting and overwhelming time but i'm here to help you with the first few steps the ohio secretary of state's office and our ohio business central website also serve to help ohioans

Navigate the process and start you on the right path to becoming successful business owners let's get started one of the first and most important decisions you must make as an entrepreneur is selecting the legal structure of your business this decision determines how you pay taxes how you operate your business and your level of risk for personal liability

Tips to Split Legal Ohio Corporations And LLC Forms For Free

- Obtain a copy of the original legal documents for the corporation or LLC.

- Consult with a legal professional to ensure proper steps are followed.

- Create a new set of documents for the split entity, including articles of incorporation or organization.

- Update any necessary filings with the Ohio Secretary of State.

- Notify all relevant parties of the split, including clients, vendors, and employees.

Editing features for Split Legal Ohio Corporations And LLC Forms may be needed when a corporation or LLC is undergoing restructuring, merger, acquisition, or division. It is important to ensure all legal requirements and documentation are properly updated to reflect the changes.

Related Searches

Through Ohio Business Central, you can file a number of forms online, obtain and request publications, search existing businesses, and sign up for our. Filing ... Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. By A WECKER · Cited by 3 ? Once formed, the Ohio LLC has full authority to deal in any interest in property, contract, sue and be sued, form other business associations, indemnify its ... 25-Jan-2023 ? An Ohio Operating Agreement creates the policies and procedures for your LLC. Our free, attorney-drafted templates can get you started. THIS AMENDED AND RESTATED OPERATING AGREEMENT (the ?Agreement?) is made and entered into effective as of the 31 st day of December, 2008, by and among ... 20-Dec-2021 ? The policy behind it bans lay organizations from practicing medicine, exercising undue influence over physicians' medical decision-making, and ... (A) Any person, singly or jointly with others, and without regard to residence, domicile, or state of incorporation, may form a corporation by signing and ... 20-Jul-2022 ? Ohio's LLC loophole is a tax provision that exempts the first $250,000 ($125,000 for those married and filing separately) of Ohio business ... 10-Jul-2023 ? In this guide, we'll walk you through how to start an LLC in just seven simple steps. You'll learn about the pros and cons of LLCs and how ... (f) A nonprofit corporation. (H) "Foreign entity" means an entity formed under the laws of another state. (I) "Foreign limited liability partnership" means a ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.