Split Legal Oregon Startup For S-Corporation Forms For Free

How it works

-

Import your Oregon Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

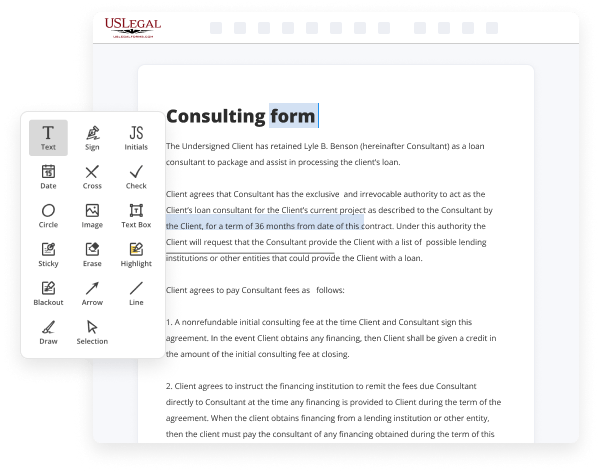

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

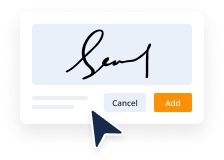

Sign your Oregon Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal Oregon Startup For S-Corporation Forms For Free

Are you tired of endless document printing, scanning, postal delivery, and wasting precious time and resources with manual fill-out? The times have moved on, and the best way to Split Legal Oregon Startup For S-Corporation Forms For Free and make any other essential adjustments to your forms is by managing them online. Choose our quick and secure online editor to fill out, modify, and execute your legal paperwork with maximum effectiveness.

Here are the steps you should take to Split Legal Oregon Startup For S-Corporation Forms For Free easily and quickly:

- Upload or import a file to the editor. Drag and drop the template to the upload area, import it from the cloud, or use another option (extensive PDF library, emails, URLs, or direct form requests).

- Provide details you need. Fill out empty fields using the Text, Check, and Cross tools from our upper pane. Use our editor’s navigation to ensure you’ve filled in everything. Accentuate the most important facts with the Highlight option and erase or blackout areas with no value.

- Adjust and rearrange the form. Use our upper and side toolbars to update your content, place additional fillable fields for different data types, re-order sheets, add new ones, or delete unnecessary ones.

- Sign and request signatures. No matter which method you select, your electronic signature will be legally binding and court-admissible. Send your form to other people for signing through email or signing links. Notarize the paperwork right in our editor if it needs witnessing.

- Share and save the copy. Download or export your accomplished paperwork to the cloud in the format you need, print it out if you require a physical copy, and choose the most appropriate file-sharing option (email, fax, SMS, or delivered by snail mail using the USPS).

With our service, you don’t have any more excuses to complete legal documents manually. Save time and effort executing them online twice as fast and more efficiently. Give it a try now!

Benefits of Editing Oregon Startup For S-Corporation Forms Online

Top Questions and Answers

An S corporation carrying on or doing business in Oregon must also pay $150 minimum excise tax.

Video Guide to Split Legal Oregon Startup For S-Corporation Forms For Free

Okay for this video i wanted to go over the newly added irs form 7203 which is used to report the s corporation shareholders stock and debt basis so why has the irs added this form well if you're a shareholder in an s corporation you have always been required to adequately track your stock and debt basis because when

You prepare your 1040 if you have allocations of losses or if you have cash distributions and you don't have sufficient amount of basis then you can't take the losses on your tax return right you can only take losses to the extent you have basis well they've added this form because they found that taxpayers have done a really

Tips to Split Legal Oregon Startup For S-Corporation Forms For Free

- Consult with a business attorney to understand the legal requirements for forming an S-Corporation in Oregon

- Decide on the structure of your S-Corporation and how many shares of stock will be issued

- Draft and file the Articles of Incorporation with the Oregon Secretary of State

- Create a corporate bylaws document outlining the rules and procedures for running the S-Corporation

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes

- Hold an initial board of directors meeting to elect officers and approve important company decisions

- Issue stock certificates to shareholders and keep accurate records of ownership

Editing features for splitting legal Oregon startup for S-Corporation forms may be needed when there are changes in ownership, structure or business operations that require updates to the company's legal documents.

Related Searches

Purpose of Form OR-20-S?? Use Form OR-20-S, Oregon S Corporation Tax Return to calculate and report the Oregon corporate excise or income tax liability of a ... Create an Oregon S-Corp with an S-Corp Formation Package that Includes Federal EIN, Oregon State Filing & Legal Documents. LLCs and corporations are separate legal entities created by a state filing. (Once formed, a corporation that wishes to be taxed as an S corp can file IRS Form ... Generally, an S corporation must file Form 1120-S by the 15th day of the 3rd month after the end of its tax year. For calendar year corporations ... Articles of organization are essentially legal forms that outline basic information about the company, and each state may have specific requirements. Generally, an S corporation must file Form 1120-S by the 15th day of the 3rd ... We ask for the information on these forms to carry out the Internal Revenue laws ... A commonly touted strategy to set your S Corp salary is to split ... Instead of a W-2, your S Corp files IRS Form 1120S, U.S. Income Tax Return for an S ... An S corp or S corporation is a business structure that is permitted under the tax code to pass its taxable income, credits, deductions, and losses directly ... Start a Business Start a Business · E-File My Taxes · Find ... Form 60 - S Corp Income Tax Return (2022). Form 60 - S Corporation Income Tax - Booklet (2022). Yes, you can switch between an LLC and an S corp. In fact, your business can be both at once; the two are not mutually exclusive. Filing for S ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.