Split Legal Pennsylvania Sale Of Business Forms For Free

How it works

-

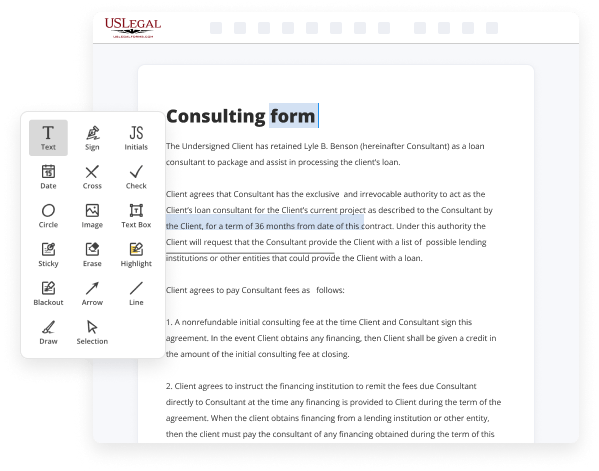

Import your Pennsylvania Sale Of Business Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Pennsylvania Sale Of Business Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal Pennsylvania Sale Of Business Forms For Free

Legal paperwork requires highest precision and timely execution. While printing and filling forms out normally takes considerable time, online PDF editors demonstrate their practicality and efficiency. Our service is at your disposal if you’re looking for a reliable and straightforward-to-use tool to Split Legal Pennsylvania Sale Of Business Forms For Free rapidly and securely. Once you try it, you will be amazed at how simple dealing with formal paperwork can be.

Follow the instructions below to Split Legal Pennsylvania Sale Of Business Forms For Free:

- Add your template via one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or through a request from another person.

- Make use of the top toolbar to fill out your document: start typing in text areas and click on the box fields to select appropriate options.

- Make other required modifications: insert images, lines, or symbols, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, change their order, delete unnecessary ones, add page numbers if missing, etc.

- Add additional fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if everything is correct and sign your paperwork - create a legally-binding eSignature the way you prefer and place the current date next to it.

- Click Done once you are ready and decide where to save your form - download it to your device or export it to the cloud in any file format you need.

- Share a copy with other people or send it to them for signature via email, a signing link, SMS, or fax. Request online notarization and get your form rapidly witnessed.

Imagine doing all the above manually on paper when even one error forces you to reprint and refill all the details from the beginning! With online services like ours, things become much more manageable. Give it a try now!

Benefits of Editing Pennsylvania Sale Of Business Forms Online

Top Questions and Answers

Thankfully, many states do make them easy to find. But some make it incredibly hazy. For example, Pennsylvania regulations state that sales tax exemption certificates ?should? be renewed every four years.

Video Guide to Split Legal Pennsylvania Sale Of Business Forms For Free

Good afternoon I'm Cindy Nellis and I'd like to welcome you to our webinar called getting started with my path I'm with them the director of the pen West Clarion Small Business Development Center and we're very happy that you have decided to join us today the Small Business Development Center here in Pennsylvania established a partnership with the Pennsylvania

Department of Revenue to deliver monthly webinars that provide key information for business owners we have four webinars that we're offering now in 2023 so we're excited to launch this year with a new one called getting started with my path you'll see our flyer here overviews our webinars for the year so we hope that you plan to join

Tips to Split Legal Pennsylvania Sale Of Business Forms For Free

- Carefully review the content of the legal form to identify sections that can be split.

- Use a PDF editor or word processing software to separate the form into smaller sections.

- Save each split section as a separate file to ensure organization.

- Consider labeling the split sections clearly for easy reference.

- Keep a master copy of the original form to track changes and updates.

The editing feature for Split Legal Pennsylvania Sale Of Business Forms may be needed when there are multiple parties involved in the business transaction and certain sections of the form need to be completed separately by each party.

Related Searches

Enter the taxable gain from each PA Schedule D-1, Form. REV-1689, Computation of Installment Sale Income. CAUTION: The installment sales method may not be. The Department of Revenue has created this guide to help business owners understand their filing obligations. The guide outlines the procedures to follow ... Liability of shareholders (Repealed). ARTICLE C. DOMESTIC BUSINESS CORPORATION. ANCILLARIES. Chapter 21. Nonstock Corporations. Subchapter A. Preliminary ... TITLE 20. DECEDENTS, ESTATES AND FIDUCIARIES. Chapter. 1. Short Title and Definitions. 3. Ownership of Property; Legal Title and Equitable Estate. Start your LLC (Limited Liability Company) in 8 easy steps with our guide, including choosing a state & registered agent, foreign qualification, & more. See Business or Rental Use of Home. Separated or divorced taxpayers. If you were separa- ted or divorced prior to the sale of the home, you can ... You can only claim the credit for income tax that you paid to another state on qualifying income which is: earned income; business income; gain from the sale of ... Resident -- A person who lives in Virginia, or maintains a place of abode here, for more than 183 days during the year, or who is a legal (domiciliary) resident ... Real estate subject to the Pennsylvania Sales, Use, and Hotel Occupancy Tax. The portion of real estate used for nonprofit business purposes. Ready to start your business? Plans start at $0 + filing fees. ... This article is for informational purposes. This content is not legal advice, it is the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.