Split Legal South Carolina Fair Debt Credit Forms For Free

How it works

-

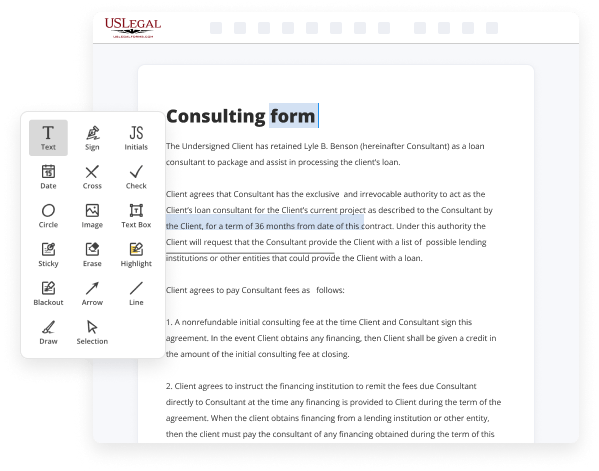

Import your South Carolina Fair Debt Credit Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your South Carolina Fair Debt Credit Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Split Legal South Carolina Fair Debt Credit Forms For Free

Online document editors have demonstrated their trustworthiness and efficiency for legal paperwork execution. Use our secure, fast, and straightforward service to Split Legal South Carolina Fair Debt Credit Forms For Free your documents whenever you need them, with minimum effort and greatest precision.

Make these quick steps to Split Legal South Carolina Fair Debt Credit Forms For Free online:

- Import a file to the editor. You can choose from a couple of options - upload it from your device or the cloud or import it from a template library, external URL, or email attachment.

- Fill out the blank fields. Place the cursor on the first empty area and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary modifications. Update the form with inserted images, draw lines and icons, highlight significant parts, or remove any unnecessary ones.

- Create additional fillable fields. Adjust the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, place each field where you want other participants to provide their details, and make the rest of the areas required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones while using appropriate button, rotate them, or alter their order.

- Create electronic signatures. Click on the Sign option and choose how you’d insert your signature to the form - by typing your name, drawing it, uploading its image, or using a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for approval via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if required.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any personal or business legal documentation in minutes. Try it today!

Benefits of Editing South Carolina Fair Debt Credit Forms Online

Top Questions and Answers

You'll need to dispute it with any credit reporting agency that's showing it on your credit report. The collections account information is correct, but you've made steps to remedy the situation. In this case, you can write a goodwill letter or pay for delete letter to ask for the account to be removed.

Video Guide to Split Legal South Carolina Fair Debt Credit Forms For Free

Hi I'm family law attorney Kyle scoresby in a previous video we talked about preparing to divide up assets and debts in and the process that we talked about in that video was identifying all the marital assets categorizing them as either community property or separate property and valuing them once those three steps are done identifying the assets categorizing

Them as marital property and valuing them then you're ready to go on to the actual division of assets itself and remember it's only the community property that gets divided that's why we have to categorize things as separate or community the community property is supposed to be divided yeah equitably which does not necessarily mean that each individual asset

Tips to Split Legal South Carolina Fair Debt Credit Forms For Free

- Always make a backup copy of the original form before splitting it.

- Use a reliable PDF editing software to easily split the form into individual pages.

- Carefully review each split page to ensure no important information is missed or cut off.

- Save each split page with a clear and descriptive file name for easy reference.

Editing feature for Split Legal South Carolina Fair Debt Credit Forms may be needed when you want to extract specific sections of the form for reference or analysis, or when you need to separate individual pages for distribution or filing purposes.

Related Searches

What is the Fair Debt Collection Practices Act? The Fair Debt Collection Practices Act requires that debt collectors treat you fairly by prohibiting certain ... (2) A loan, refinancing, or consolidation is "precomputed" if the debt is expressed as a sum comprising the principal and the amount of the loan finance charge ... Unsecured debt is divided so that you and your ex-spouse each receive an equitable or fair share of the balance of the marital estate. South Carolina is an ... Does your firm have a debt collection license from my state? If not, say why not. If so, provide the date of the license, the name on the license, the license ... Dividing debt in divorce almost seems easy to determine, but factors that like credit cards, student loans, and other debts can create problems. Our Charleston divorce lawyers explain in detail how to fill out a Financial Declaration Form for a South Carolina Family Court. We represent victims of debt collection abuse. If a creditor or collector is harassing you, contact us. We will pursue your remedies aggressively. This Legal Guide covers the federal and California fair debt collection practices statutes. ... 115 Companies that compose and sell debt collection forms and ... SCLS often has clients who are sued for collection by a debt buyer like Sunshine Finance. A debt buyer is an entity that is in the business of buying a debt for ... 16-Oct-2022 ? The statute of limitations on debt collection varies by state. Here's a breakdown of how long it lasts in each of the 50 states.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.