Type In Legal Nebraska Startup For Sole Proprietorship Forms For Free

How it works

-

Import your Nebraska Startup For Sole Proprietorship Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Nebraska Startup For Sole Proprietorship Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Type In Legal Nebraska Startup For Sole Proprietorship Forms For Free

Online document editors have proved their trustworthiness and effectiveness for legal paperwork execution. Use our secure, fast, and user-friendly service to Type In Legal Nebraska Startup For Sole Proprietorship Forms For Free your documents any time you need them, with minimum effort and highest accuracy.

Make these simple steps to Type In Legal Nebraska Startup For Sole Proprietorship Forms For Free online:

- Import a file to the editor. You can select from several options - add it from your device or the cloud or import it from a template library, external URL, or email attachment.

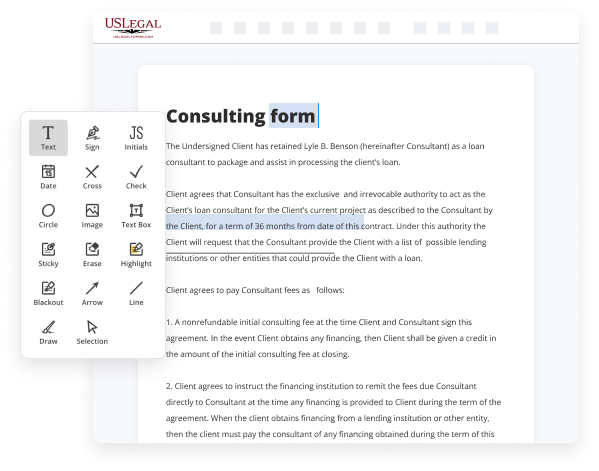

- Fill out the blank fields. Put the cursor on the first empty field and make use of our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted images, draw lines and symbols, highlight significant parts, or remove any pointless ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if required. Make use of the right-side toolbar for this, drop each field where you want other participants to leave their data, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Remove sheets you don’t need any longer or create new ones while using appropriate key, rotate them, or alter their order.

- Create electronic signatures. Click on the Sign tool and decide how you’d insert your signature to the form - by typing your name, drawing it, uploading its picture, or utilizing a QR code.

- Share and send for eSigning. Finish your editing with the Done button and send your copy to other parties for approval through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can complete and share any personal or business legal paperwork in clicks. Try it now!

Benefits of Editing Nebraska Startup For Sole Proprietorship Forms Online

Top Questions and Answers

If you qualify as a small business, you only need to register with the trade office, who will notify the tax office on your behalf. Once you have received, filled out and submitted a tax questionnaire from the tax office, your company comes into being.

Related Searches

Like every other state, in Nebraska too, you do not need to file any legal document with the state government of Nebraska to establish a one-person business also known as a sole proprietorship. Hence, a sole proprietorship is not a legal business entity like LLC (Limited Liability Company) or a corporation. 1. Choose a Business Name ... In Nebraska, a sole proprietor can use their own legal name or a trade name—also sometimes known as an "assumed business name" or " ... ... form of business in which an individual owns the business with no other owners. A sole proprietorship is not a separate legal entity apart from the owner. Apr 17, 2023 — Go to Nebraska's Corporate Document eDelivery page. Under “Select Filing Type,” choose “registering a trade name.”. Complete the online form, ... 1. Choose your business name ... Nebraska law allows you to operate a sole proprietorship under a name other than your own. While you can use your name, most ... When it comes to being a sole proprietor in the state of Nebraska, there is no formal setup process. There are also no fees involved with forming or maintaining ... Oct 27, 2022 — There are four primary types available to business owners in Nebraska: sole proprietorships, general partnerships, LLCs, and corporations. Sole Proprietorship: Sole owners of Nebraska-based businesses could opt for sole proprietorship as the easiest form of business organization. · Single Member LLC ... Business Ownership Type: Sole Proprietorship. Partnership. Nonprofit Corporation ... A Sole Proprietorship is one individual or married couple owning a business. 06-Apr-2023 — ... form a limited liability company (LLC) or partnership, starting a sole proprietorship might be the best fit for you. Maybe you have a ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.